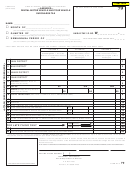

Form Rv-3 - Annual Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - Instructions - 2008

ADVERTISEMENT

HOW TO COMPLETE YOUR ANNUAL

FORM RV-3

RENTAL MOTOR VEHICLE AND TOUR VEHICLE

INSTRUCTIONS

(REV. 2008)

SURCHARGE TAX RETURN (FORM RV-3)

CHANGES TO NOTE

These instructions will assist you in filling out your annual Rental

Motor Vehicle and Tour Vehicle Surcharge Tax Return (Form

Act 223, Session Laws of Hawaii (SLH) 1999, increased the

RV-3) correctly.

surcharge tax on rental motor vehicles from $2 per day to $3 per

day during the period of September 1, 1999 to August 31, 2007.

The RV tax annual return and reconciliation (Form RV-3), is used

Act 258, SLH 2007, extended the $3 per day rate to August 31,

to summarize your rental motor vehicle and tour vehicle surcharge

2008. Act 226, SLH 2008, further extended the $3 per day rate to

tax activities for the taxable year. It may also be used to correct

August 31, 2011. On September 1, 2011, the rate reverts back to

errors on the periodic tax returns (Form RV-2). If the total number

$2 per day.

of rental vehicles days, number of months for tour vehicles, taxes

due, penalty and interest are accurately reported and paid in full on

Effective July 1, 2006, the rental motor vehicle surcharge tax does

your periodic returns, no additional tax will be due on the annual

not apply to the rental or lease of a vehicle to replace a vehicle of

return. Form RV-3 must be filed in addition to (not in lieu of) the

the lessee that is being repaired, provided:

periodic rental motor vehicle and tour vehicle surcharge tax

•

the lessor retains a record of the repair order for the

returns.

vehicle for 2 years for verification purposes, or

If you had no activity for the entire year, enter “0” on lines 8

•

the motor vehicle repair dealer retains a record of the

and 17. Please note that this return must be filed.

repair order for 2 years as provided in section 437B-16,

The annual tax return must be filed on or before the 20th day of the

Hawaii Revised Statutes (HRS).

4th month following the close of the taxable year. For example, if

For the purposes of this exclusion, a "repair order" is an invoice as

you are a calendar-year taxpayer (i.e., your tax year ends on

required under section 437B-13, HRS. Also, for the purposes of

December 31), then your annual tax return must be filed on or

the exclusion, "repair" shall have the same meaning as the

before April 20 of the following year.

definition of "repair of motor vehicles" in section 437B-1, HRS.

To properly enter the necessary information into our computer

INTRODUCTION

system, the annual tax return must be filled in completely and

The rental motor vehicle and tour vehicle surcharge tax (RV tax)

accurately.

contains two separate taxes with different tax rates. The rental

If a payment is being made with Form RV-3, make your check or

motor vehicle surcharge tax is levied at the rate of $3 per day or a

money order payable to “Hawaii State Tax Collector.” Write “RV”,

portion of a day for the period of September 1, 1999 to August 31,

the filing period, and your Hawaii Tax I.D. No. on the check. Also

2011 and $2 per day or a portion of a day after August 31, 2011 on

complete the appropriate tax payment voucher (if you are using a

the lessor of any rental motor vehicle. The tour vehicle surcharge

preprinted form from your rental motor vehicle and tour vehicle

tax is imposed on tour vehicle operators for use of a vehicle on a

surcharge tax return booklet, complete Form VP-1R for the

monthly basis, or a portion of a month at the following rates:

appropriate filing period (CAUTION: do not submit a photocopy of

•

Form VP-1R); if you are not using a preprinted form, complete

$65 - Over 25 passenger tour vehicle; and

•

Form VP-1).

Attach your check or money order and the

$15 - 8 to 25 passenger tour vehicle.

appropriate tax payment voucher where indicated on the front of

RV tax returns (Form RV-2) are filed monthly, quarterly, or

Form RV-3.

semiannual basis depending on the amount of a person’s tax

If you are unable to file the annual return by the due date, you may

liability.

An annual return and reconciliation, (Form RV-3)

request an extension to file Form RV-3 by filing Form RV-7,

summarizing activity for the past year also must be filed on or

Application for Extension of Time to File the Annual Return and

before the twentieth day of the fourth month following the close of

Reconciliation Rental Motor Vehicle and Tour Vehicle Surcharge

the taxable year.

Tax (Form RV-3). For more information, see Form RV-7.

Taxpayers whose liability for the RV tax exceeds $100,000 per year are

required to pay the tax by Electronic Funds Transfer (EFT).

If you have any questions, please contact the customer service staff of our Taxpayer Services Branch at:

Voice: 808-587-4242

Mail: Taxpayer Services Branch

Telephone for the Hearing Impaired:

1-800-222-3229 (Toll-Free)

P.O. Box 259

(808) 587-1418

Fax: (808) 587-1488

Honolulu, HI 96809-0259

1-800-887-8174 (Toll-Free)

E-mail: Taxpayer.Services@hawaii.gov

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5