Form Rv-3 - Annual Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - Instructions - 2008 Page 3

ADVERTISEMENT

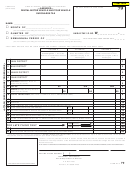

COMPUTING THE TAXES (fig. 3.1)

STEP 5 — Complete Lines 1 through 4, Columns A

STEP 6 — Enter the totals for Lines 1 through 4 of

through C, just as you did on your periodic tax returns.

Columns A through C in these spaces.

The difference between the periodic and annual tax

In Column A, Line 5, BTK has entered 10,140, the

returns is that the numbers reported on the annual tax

total number of rental motor vehicle-days. In Column

return represent the total rental days, tour vehicle (8-25

B, Line 5, BTK has entered 22, the total number of

passengers)-months, and tour vehicle (26 or more

tour vehicle (8-25 passengers)-months. In Column C,

passengers)-months in the applicable districts for the

Line 5, BTK has entered 12, the total number of tour

entire year.

vehicle (40 passenger)-months.

BTK had 6,900 net rental days for Oahu and has

STEP 7a — In Column A, multiply the number entered on

entered that figure in Column A, Line 1. BTK also had

Line 5 by the tax rate of $3 (Line 6) and enter the result on

3,240 rental days on Maui, and has entered that figure

Column A, Line 7.

in Column A, Line 2. BTK had 22 tour vehicle (8-25

BTK

has

multiplied

10,140

(the

number

of

passengers)-months on Oahu, and has entered that

vehicle-days) entered on Line 5 by $3 (the tax rate

figure in Column B, Line 1. In Column C, Line 1, BTK

listed on Line 6) to get $30,420, which is entered in

had 12 tour vehicle (40 passenger)-months on Oahu,

Column A, Line 7 (10,140 x $3 = $30,420).

and has entered that figure in Column C, Line 1.

STEP 7b — In Column B, multiply the number entered on

The annual return is a reconciliation of the number of rental

Line 5 by the tax rate of $15 (Line 6), and enter the result

motor vehicle days, the number of tour vehicle (8-25

on Line 7.

passengers)-months, and the number of tour vehicle (26 or

more passengers)-months, in the applicable districts, with the

BTK has multiplied 22 (the number of tour vehicle

numbers reported on the periodic tax returns. If an error was

(8-25 passenger)-months) entered on Line 5 by $15

made on one or more of the periodic tax returns in reporting

(the tax rate listed on Line 6) to get $330, which is

the number of rental days, the number of tour vehicle (8-25

entered in Column B, Line 7 (22 x $15 = $330).

passengers)-months, or the number of tour vehicle (26 or

STEP 7c — In Column C, multiply the number entered on

more passengers)-months, in the applicable districts, the

Line 5 by the tax rate of $65 (Line 6), and enter the result

annual tax return will correct the amounts reported on your

on Line 7.

periodic returns for the taxable year and show the amount of

any additional taxes payable or refund due.

BTK has multiplied 12 (the number of tour vehicle (26

or more passengers)-months) entered on Line 5 by $65

(the tax rate listed on Line 6) to get $780, which is

entered in Column C, Line 7 (12 x $65 = $780).

10 INTEREST

10

10

11 TOTAL AMOUNT DUE (Add lines 8, 9, and 10; Enter amount here)

11

31,530 00

11

12

12

Total taxes paid on monthly, quarterly, or semiannual returns for the period.

12

31,530 00

13

13

Additional assessments paid for the period, if included above.

13

12

15

13

14

14

14

Penalties $ ___________ Interest $ ___________ paid during the period.

14

16

15 TOTAL PAYMENTS MADE (Add lines 12, 13, and 14)

15

31,530 00

17

16 CREDIT TO BE REFUNDED (Line 15 minus line 11)

16

18

TOTAL TAXES DUE (Line 11 minus

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER “0" ON

17

17

line 15)

LINES 8 AND 17 . THIS RETURN MUST BE FILED.

00

19

18a

PENALTY

FOR LATE FILING ONLY

18

18b

INTEREST

20

19 TOTAL AMOUNT NOW DUE AND PAYABLE (Add lines 17 and 18)

19

21

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO

PLEASE ENTER AMOUNT OF

20

20

“HAWAII STATE TAX COLLECTOR” IN U.S. DOLLARS DRAWN ON ANY U.S.

YOUR PAYMENT

00

BANK AND FORM VP-1 TO FORM RV-3. WRITE “RV”, THE FILING PERIOD, AND

YOUR HAWAII TAX I.D. NO. ON YOUR CHECK OR MONEY ORDER.

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in

accordance with the provisions of the Rental Motor Vehicle and Tour Vehicle Surcharge Tax Law and the rules

issued thereunder.

fig. 3.2

FINISHING THE TAX RETURN (fig. 3.2)

STEP 8 — Add Columns A through C, Line 7, and enter

rental motor vehicle or tour vehicle activity and therefore

the total on Line 8. This is the total tax due. CAUTION:

have no tax due, enter a zero (0) on Lines 8 and 17.

LINE 8 MUST BE FILLED IN. If you do not have any

BTK has added $30,420, $330, and $780 for a total

of $31,530 which is entered on Line 8.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5