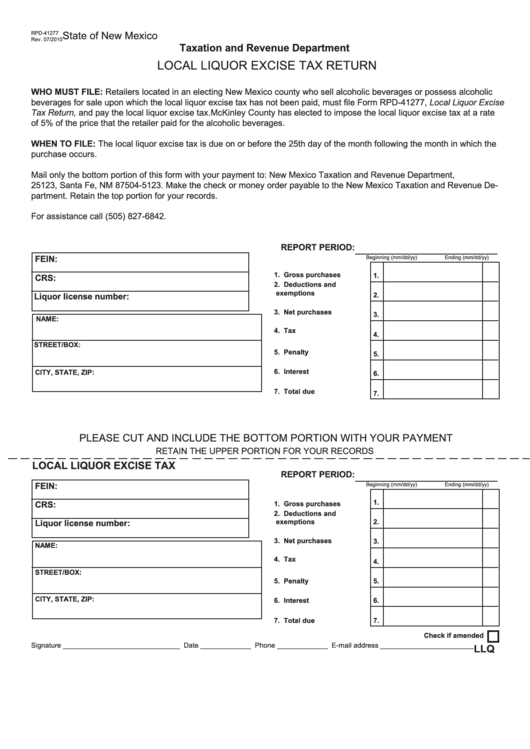

State of New Mexico

RPD-41277

Rev. 07/2010

Taxation and Revenue Department

LOCAL LIQUOR EXCISE TAX RETURN

WHO MUST FILE: Retailers located in an electing New Mexico county who sell alcoholic beverages or possess alcoholic

beverages for sale upon which the local liquor excise tax has not been paid, must file Form RPD-41277, Local Liquor Excise

Tax Return, and pay the local liquor excise tax. McKinley County has elected to impose the local liquor excise tax at a rate

of 5% of the price that the retailer paid for the alcoholic beverages.

WHEN TO FILE: The local liquor excise tax is due on or before the 25th day of the month following the month in which the

purchase occurs.

Mail only the bottom portion of this form with your payment to: New Mexico Taxation and Revenue Department, P.O. Box

25123, Santa Fe, NM 87504-5123. Make the check or money order payable to the New Mexico Taxation and Revenue De-

partment. Retain the top portion for your records.

For assistance call (505) 827-6842.

REPORT PERIOD:

FEIN:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

1. Gross purchases

1.

CRS:

2. Deductions and

exemptions

Liquor license number:

2.

3. Net purchases

3.

NAME:

4. Tax

4.

STREET/BOX:

5. Penalty

5.

6. Interest

CITY, STATE, ZIP:

6.

7. Total due

7.

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

LOCAL LIQUOR EXCISE TAX

REPORT PERIOD:

FEIN:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

1.

CRS:

1. Gross purchases

2. Deductions and

exemptions

2.

Liquor license number:

3. Net purchases

3.

NAME:

4. Tax

4.

STREET/BOX:

5. Penalty

5.

CITY, STATE, ZIP:

6. Interest

6.

7. Total due

7.

Check if amended

Signature ______________________________ Date _____________ Phone _____________ E-mail address ________________________

LLQ

1

1 2

2