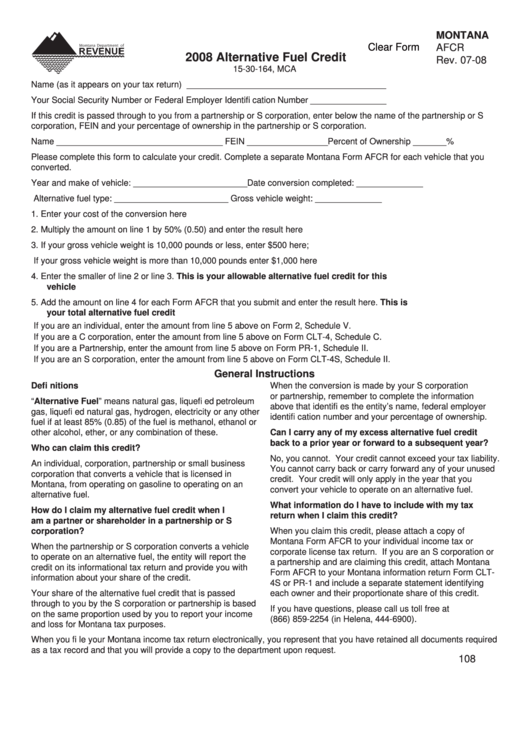

MONTANA

Clear Form

AFCR

2008 Alternative Fuel Credit

Rev. 07-08

15-30-164, MCA

Name (as it appears on your tax return) __________________________________________

Your Social Security Number or Federal Employer Identifi cation Number ________________

If this credit is passed through to you from a partnership or S corporation, enter below the name of the partnership or S

corporation, FEIN and your percentage of ownership in the partnership or S corporation.

Name ___________________________________ FEIN _________________ Percent of Ownership _______ %

Please complete this form to calculate your credit. Complete a separate Montana Form AFCR for each vehicle that you

converted.

Year and make of vehicle: ________________________Date conversion completed: ______________

Alternative fuel type: ________________________

Gross vehicle weight: ______________

1. Enter your cost of the conversion here .............................................................................................. 1. _____________

2. Multiply the amount on line 1 by 50% (0.50) and enter the result here .............................................. 2. _____________

3. If your gross vehicle weight is 10,000 pounds or less, enter $500 here;

If your gross vehicle weight is more than 10,000 pounds enter $1,000 here ..................................... 3. _____________

4. Enter the smaller of line 2 or line 3. This is your allowable alternative fuel credit for this

vehicle ............................................................................................................................................... 4. _____________

5. Add the amount on line 4 for each Form AFCR that you submit and enter the result here. This is

your total alternative fuel credit ..................................................................................................... 5. _____________

If you are an individual, enter the amount from line 5 above on Form 2, Schedule V.

If you are a C corporation, enter the amount from line 5 above on Form CLT-4, Schedule C.

If you are a Partnership, enter the amount from line 5 above on Form PR-1, Schedule II.

If you are an S corporation, enter the amount from line 5 above on Form CLT-4S, Schedule II.

General Instructions

Defi nitions

When the conversion is made by your S corporation

or partnership, remember to complete the information

“Alternative Fuel” means natural gas, liquefi ed petroleum

above that identifi es the entity’s name, federal employer

gas, liquefi ed natural gas, hydrogen, electricity or any other

identifi cation number and your percentage of ownership.

fuel if at least 85% (0.85) of the fuel is methanol, ethanol or

other alcohol, ether, or any combination of these.

Can I carry any of my excess alternative fuel credit

back to a prior year or forward to a subsequent year?

Who can claim this credit?

No, you cannot. Your credit cannot exceed your tax liability.

An individual, corporation, partnership or small business

You cannot carry back or carry forward any of your unused

corporation that converts a vehicle that is licensed in

credit. Your credit will only apply in the year that you

Montana, from operating on gasoline to operating on an

convert your vehicle to operate on an alternative fuel.

alternative fuel.

What information do I have to include with my tax

How do I claim my alternative fuel credit when I

return when I claim this credit?

am a partner or shareholder in a partnership or S

corporation?

When you claim this credit, please attach a copy of

Montana Form AFCR to your individual income tax or

When the partnership or S corporation converts a vehicle

corporate license tax return. If you are an S corporation or

to operate on an alternative fuel, the entity will report the

a partnership and are claiming this credit, attach Montana

credit on its informational tax return and provide you with

Form AFCR to your Montana information return Form CLT-

information about your share of the credit.

4S or PR-1 and include a separate statement identifying

Your share of the alternative fuel credit that is passed

each owner and their proportionate share of this credit.

through to you by the S corporation or partnership is based

If you have questions, please call us toll free at

on the same proportion used by you to report your income

(866) 859-2254 (in Helena, 444-6900).

and loss for Montana tax purposes.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

108

1

1