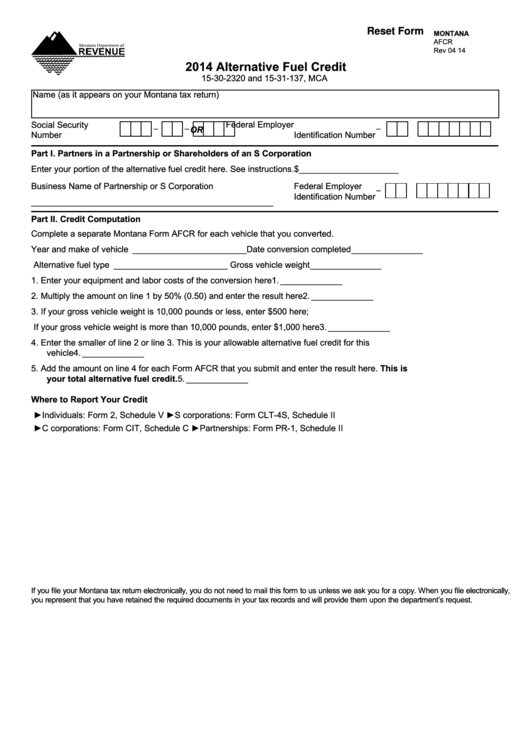

Reset Form

MONTANA

AFCR

Rev 04 14

2014 Alternative Fuel Credit

15-30-2320 and 15-31-137, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Number

Identification Number

Part I. Partners in a Partnership or Shareholders of an S Corporation

Enter your portion of the alternative fuel credit here. See instructions.

$_____________________

Business Name of Partnership or S Corporation

Federal Employer

-

Identification Number

___________________________________________________

Part II. Credit Computation

Complete a separate Montana Form AFCR for each vehicle that you converted.

Year and make of vehicle ________________________Date conversion completed _______________

Alternative fuel type ________________________

Gross vehicle weight _______________

1. Enter your equipment and labor costs of the conversion here ........................................................... 1. _____________

2. Multiply the amount on line 1 by 50% (0.50) and enter the result here .............................................. 2. _____________

3. If your gross vehicle weight is 10,000 pounds or less, enter $500 here;

If your gross vehicle weight is more than 10,000 pounds, enter $1,000 here .................................... 3. _____________

4. Enter the smaller of line 2 or line 3. This is your allowable alternative fuel credit for this

vehicle ................................................................................................................................................ 4. _____________

5. Add the amount on line 4 for each Form AFCR that you submit and enter the result here. This is

your total alternative fuel credit. .................................................................................................... 5. _____________

Where to Report Your Credit

►Individuals: Form 2, Schedule V

►S corporations: Form CLT-4S, Schedule II

►C corporations: Form CIT, Schedule C

►Partnerships: Form PR-1, Schedule II

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

1

1 2

2