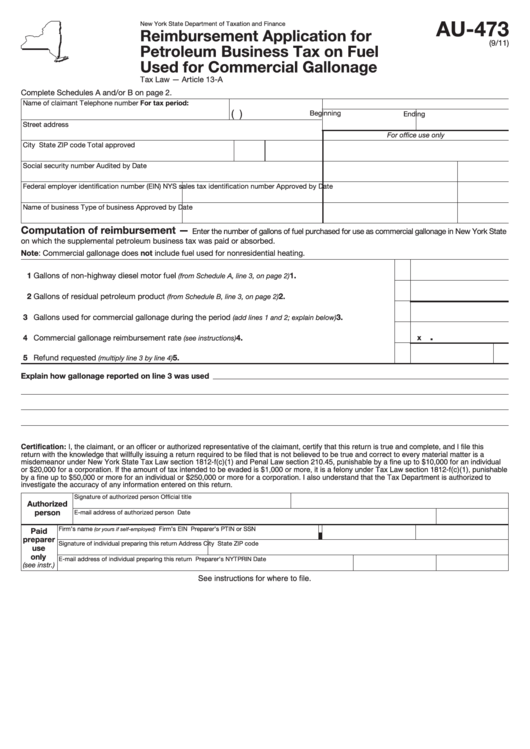

Form Au-473 - Reimbursement Application For Petroleum Business Tax On Fuel Used For Commercial Gallonage - 2011

ADVERTISEMENT

AU-473

New York State Department of Taxation and Finance

Reimbursement Application for

(9/11)

Petroleum Business Tax on Fuel

Used for Commercial Gallonage

Tax Law — Article 13-A

Complete Schedules A and/or B on page 2.

Name of claimant

Telephone number

For tax period:

(

)

Beginning

Ending

Street address

For office use only

City

State

ZIP code

Total approved

Social security number

Audited by

Date

Federal employer identification number (EIN)

NYS sales tax identification number

Approved by

Date

Name of business

Type of business

Approved by

Date

Computation of reimbursement —

Enter the number of gallons of fuel purchased for use as commercial gallonage in New York State

on which the supplemental petroleum business tax was paid or absorbed.

Note: Commercial gallonage does not include fuel used for nonresidential heating.

1 Gallons of non-highway diesel motor fuel

.............................................

1.

(from Schedule A, line 3, on page 2)

2 Gallons of residual petroleum product

2.

..................................................

(from Schedule B, line 3, on page 2)

3 Gallons used for commercial gallonage during the period

.......................

3.

(add lines 1 and 2; explain below)

.

x

4 Commercial gallonage reimbursement rate

.....................................................................

4.

(see instructions)

5 Refund requested

...................................................................................................

5.

(multiply line 3 by line 4)

Explain how gallonage reported on line 3 was used

Certification: I, the claimant, or an officer or authorized representative of the claimant, certify that this return is true and complete, and I file this

return with the knowledge that willfully issuing a return required to be filed that is not believed to be true and correct to every material matter is a

misdemeanor under New York State Tax Law section 1812-f(c)(1) and Penal Law section 210.45, punishable by a fine up to $10,000 for an individual

or $20,000 for a corporation. If the amount of tax intended to be evaded is $1,000 or more, it is a felony under Tax Law section 1812-f(c)(1), punishable

by a fine up to $50,000 or more for an individual or $250,000 or more for a corporation. I also understand that the Tax Department is authorized to

investigate the accuracy of any information entered on this return.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Date

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2