Print

Clear

M

a

l i

n i

g

A

d

d

e r

s

s

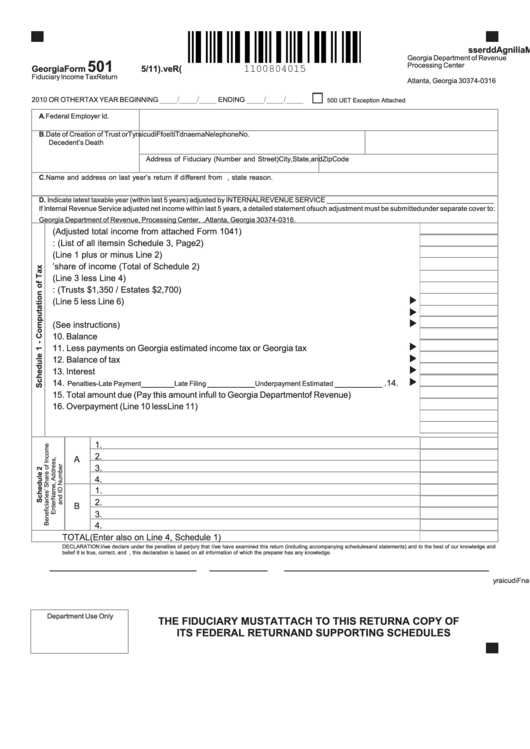

Georgia Department of Revenue

501

Processing Center

Georgia Form

(

R

e

. v

5/11)

P.O. Box 740316

Fiduciary Income Tax Return

Atlanta, Georgia 30374-0316

____/____/____

____/____/____

2010 OR OTHER TAX YEAR BEGINNING

ENDING

500 UET Exception Attached

A. Federal Employer Id. No.

Name of Estate or Trust

B. Date of Creation of Trust or

N

a

m

e

a

n

d

i T

e l t

f o

F

d i

c u

a i

y r

T

elephone No.

Decedent’s Death

Address of Fiduciary (Number and Street)

City, State, and Zip Code

C. Name and address on last year’s return if different from above. If no return was filed last year, state reason.

D. Indicate latest taxable year (within last 5 years) adjusted by INTERNAL REVENUE SERVICE ___________________________________________

If Internal Revenue Service adjusted net income within last 5 years, a detailed statement of such adjustment must be submitted under separate cover to:

Georgia Department of Revenue, Processing Center, P.O. Box 740316 , Atlanta, Georgia 30374-0316.

1. Income of fiduciary (Adjusted total income from attached Form 1041) .....................

1.

2. Adjustments: (List of all items in Schedule 3, Page 2) ...............................................

2.

3. Total (Line 1 plus or minus Line 2) .............................................................................

3.

4. Beneficiaries’ share of income (Total of Schedule 2) .................................................

4.

5. Balance (Line 3 less Line 4) .......................................................................................

5.

6. Exemptions: (Trusts $1,350 / Estates $2,700) ............................................................

6.

7. Net taxable income of fiduciary (Line 5 less Line 6) .....................................................

7.

8. Total tax ......................................................................................................................

8.

9. Less Credits (See instructions) ...................................................................................

9.

10. Balance ...................................................................................................................... 10.

11. Less payments on Georgia estimated income tax or Georgia tax withheld .................. 11.

12. Balance of tax due ..................................................................................................... 12.

13. Interest ....................................................................................................................... 13.

14.

_______

__________

__________ . 14.

Penalties-Late Payment

Late Filing

Underpayment Estimated

15. Total amount due (Pay this amount in full to Georgia Department of Revenue) ............ 15.

16. Overpayment (Line 10 less Line 11) ............................................................................ 16.

17. Amount to be refunded .............................................................................................. 17.

18. Amount of Line 16 to be credited to 2011 estimated tax ............................................. 18.

1.

2.

A

3.

.

4

1.

2.

B

3.

.

4

TOTAL (Enter also on Line 4, Schedule 1)

DECLARATION: I/we declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of our knowledge and

belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

S

g i

n

a

u t

e r

f o

F

d i

u

c

a i

y r

D

a

e t

S

g i

n

a

u t

e r

a

n

d

d I

e

n

i t

c i f

t a

o i

n

N

u

m

b

r e

f o

P

e r

p

r a

r e

o

h t

r e

h t

a

n

F

d i

u

c

a i

y r

Department Use Only

THE FIDUCIARY MUST ATTACH TO THIS RETURN A COPY OF

ITS FEDERAL RETURN AND SUPPORTING SCHEDULES

1

1 2

2