Print

Clear

501

M

a

l i

n i

g

A

d

d

e r

s

s:

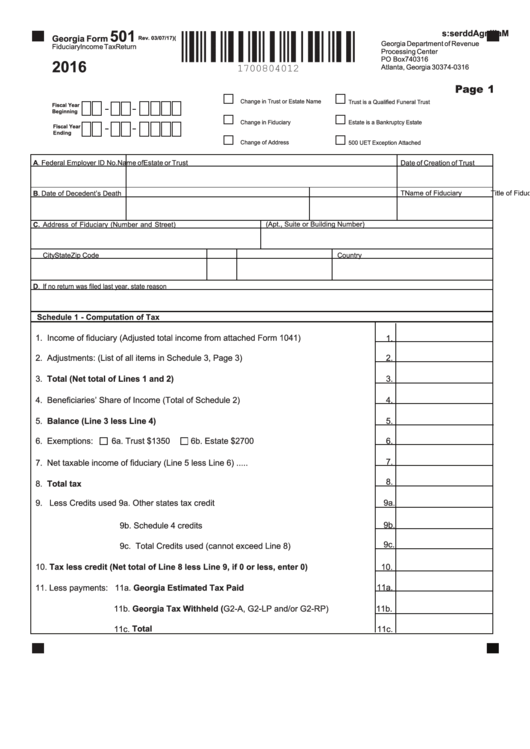

Georgia Form

(

Rev. 03/07/17)

Georgia Department of Revenue

Fiduciary Income Tax Return

Processing Center

PO Box 740316

2016

Atlanta, Georgia 30374-0316

Page 1

Change in Trust or Estate Name

Trust is a Qualified Funeral Trust

Fiscal Year

Beginning

Change in Fiduciary

Estate is a Bankruptcy Estate

Fiscal Year

ersion)

Ending

Change of Address

500 UET Exception Attached

A. Federal Employer ID No.

Name of Estate or Trust

Date of Creation of Trust

Name of Fiduciary

Title of Fiduciary

T

elephone No.

B.

Date of Decedent’s Death

(Apt., Suite or Building Number)

C.

Address of Fiduciary (Number and Street)

City

State

Zip Code

Country

D.

If no return was filed last year, state reason

Schedule 1 - Computation of Tax

1. Income of fiduciary (Adjusted total income from attached Form 1041)..............................

1.

2. Adjustments: (List of all items in Schedule 3, Page 3).......................................................

2.

3. Total (Net total of Lines 1 and 2)....................................................................................

3.

4. Beneficiaries’ Share of Income (Total of Schedule 2)........................................................

4.

5. Balance (Line 3 less Line 4) .......................................................................... ....................

5.

6. Exemptions:

6a. Trust $1350

6b. Estate $2700 ................................................

6.

7.

7. Net taxable income of fiduciary (Line 5 less Line 6)..........................................................

8.

8. Total tax

.

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . .

. . . .

. . .

. . .

. . .

9a.

9. Less Credits used 9a. Other states tax credit used.........................................................

9b. Schedule 4 credits used...............................................................

9b.

9c.

9c. Total Credits used (cannot exceed Line 8).................................

10. Tax less credit (Net total of Line 8 less Line 9, if 0 or less, enter 0)..........................

10.

11. Less payments: 11a. Georgia Estimated Tax Paid.....................................................

11a.

11b. Georgia Tax Withheld (G2-A, G2-LP and/or G2-RP) ................

11b.

11c. Total...........................................................................................

11c.

1

1 2

2 3

3 4

4 5

5