FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-149

WEB IMPORT REGISTRATION FOR e-FILE

NEW HAMPSHIRE TAX PAYMENTS

981

GENERAL INSTRUCTIONS

FOR DRA USE ONLY

WHO MUST REGISTER

WHEN TO REGISTER

Anyone wishing to make payments for clients. If at any time you

This form must be fi led prior to your fi rst fi le import. Any changes in

change your Tax Identification Number you must re-register with

the registration information must be provided to the Department. A

the Department and redefi ne your fi le layout under your new Tax

notifi cation letter will be sent confi rming your Tax Identifi cation Number.

Identifi cation Number.

Please allow up to 30 days for processing time, prior to using

e-File New Hampshire.

WHAT TO REGISTER

If you wish to participate in the Web Import e-File New Hampshire

WHERE TO REGISTER

program, you must submit this form to register with the Department.

New Hampshire Department of Revenue Administration, Document

The information provided on this form should include the name,

Processing Division, 109 Pleasant Street, PO Box 1004, Concord, NH

address, e-mail address, telephone number, and fax number of the

03302-1004.

contact person(s) for Web Import e-File New Hampshire purposes.

In addition, this form should be used to report any changes in your

NEED HELP?

registration information (i.e. a change to the contact person, telephone

Call the New Hampshire Department of Revenue Administration, Central

number, etc.).

Taxpayer Services at (603) 271-2191. Hearing or speech impaired

individuals may call TDD Access: Relay NH 1-800-735-2964. Access

TAX IDENTIFICATION NUMBER

our website at to try out the on-line demonstration

Please list your Practitioner Tax Identifi cation Number (PTIN). If you

of the NH e-fi le process prior to registering and to access the NH e-fi le

do not have a PTIN, please list your Federal Employer Identifi cation

system after the Department has processed your registration request.

Number (FEIN). If you do not have either a PTIN or FEIN, please list

your Department Identifi cation Number (DIN). If you do not have either

a PTIN, FEIN, or DIN please list your Social Security Number (SSN).

You will need to use one of these numbers when you make payments

for clients.

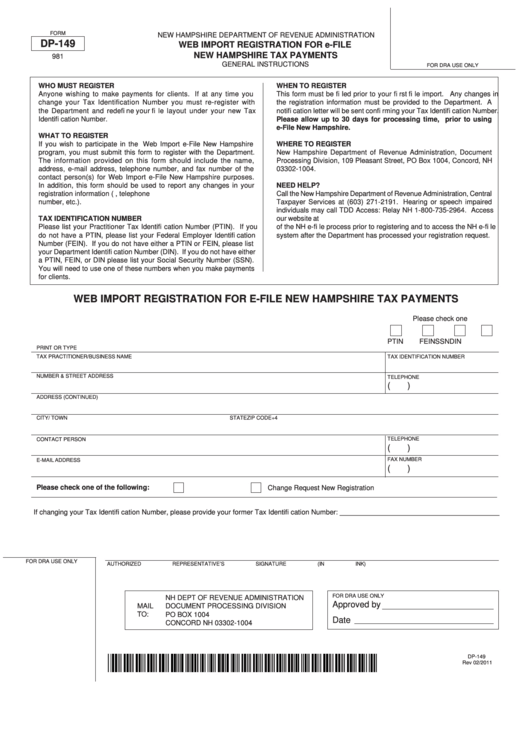

WEB IMPORT REGISTRATION FOR E-FILE NEW HAMPSHIRE TAX PAYMENTS

Please check one

PTIN

FEIN

DIN

SSN

PRINT OR TYPE

TAX PRACTITIONER/BUSINESS NAME

TAX IDENTIFICATION NUMBER

NUMBER & STREET ADDRESS

TELEPHONE

(

)

ADDRESS (CONTINUED)

CITY/ TOWN

STATE

ZIP CODE+4

TELEPHONE

CONTACT PERSON

(

)

FAX NUMBER

E-MAIL ADDRESS

(

)

Please check one of the following:

New Registration

Change Request

If changing your Tax Identifi cation Number, please provide your former Tax Identifi cation Number: _________________________________________

FOR DRA USE ONLY

AUTHORIZED REPRESENTATIVE’S SIGNATURE (IN INK)

DATE

FOR DRA USE ONLY

NH DEPT OF REVENUE ADMINISTRATION

Approved by

MAIL

DOCUMENT PROCESSING DIVISION

TO:

PO BOX 1004

Date

CONCORD NH 03302-1004

DP-149

Rev 02/2011

1

1