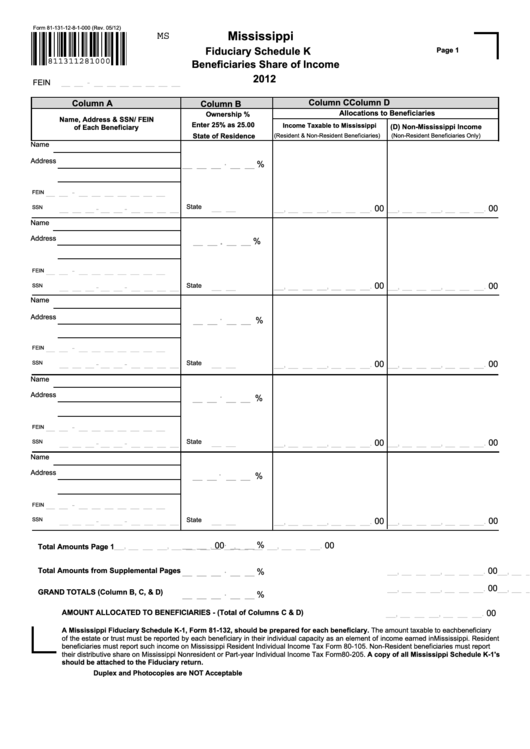

Form 81-131-12-8-1-000 - Mississippi Fiduciary Schedule K Beneficiaries Share Of Income - 2012

ADVERTISEMENT

Form 81-131-12-8-1-000 (Rev. 05/12)

MS

Mississippi

Fiduciary Schedule K

Page 1

811311281000

Beneficiaries Share of Income

2012

FEIN

__ __ - __ __ __ __ __ __ __

Column C

Column D

Column A

Column B

Allocations to Beneficiaries

Ownership %

Name, Address & SSN/ FEIN

Enter 25% as 25.00

Income Taxable to Mississippi

(D) Non-Mississippi Income

of Each Beneficiary

State of Residence

(Resident & Non-Resident Beneficiaries)

(Non-Resident Beneficiaries Only)

Name

.

Address

__ __ __

__ __

%

__ __ - __ __ __ __ __ __ __

FEIN

State

__ __

SSN

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

__ __ __ - __ __ - __ __ __ __

Name

.

Address

__ __

__ __

%

__ __ - __ __ __ __ __ __ __

FEIN

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

State

__ __

SSN

__ __ __ - __ __ - __ __ __ __

Name

.

Address

__ __

__ __

%

__ __ - __ __ __ __ __ __ __

FEIN

State

__ __

SSN

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

__ __ __ - __ __ - __ __ __ __

Name

.

Address

__ __

__ __

%

__ __ - __ __ __ __ __ __ __

FEIN

__ __

State

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

SSN

__ __ __ - __ __ - __ __ __ __

Name

.

Address

__ __

__ __

%

__ __ - __ __ __ __ __ __ __

FEIN

SSN

State

__ __

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

__ __ __ - __ __ - __ __ __ __

.

__ __ __

__ __

%

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

Total Amounts Page 1

.

Total Amounts from Supplemental Pages

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

__ __ __

__ __

%

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

.

GRAND TOTALS (Column B, C, & D)

__ __ __

__ __

%

AMOUNT ALLOCATED TO BENEFICIARIES - (Total of Columns C & D)

__, __ __ __, __ __ __.

00

A Mississippi Fiduciary Schedule K-1, Form 81-132, should be prepared for each beneficiary. The amount taxable to each beneficiary

of the estate or trust must be reported by each beneficiary in their individual capacity as an element of income earned in Mississippi. Resident

beneficiaries must report such income on Mississippi Resident Individual Income Tax Form 80-105. Non-Resident beneficiaries must report

their distributive share on Mississippi Nonresident or Part-year Individual Income Tax Form 80-205. A copy of all Mississippi Schedule K-1's

should be attached to the Fiduciary return.

Duplex and Photocopies are NOT Acceptable

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3