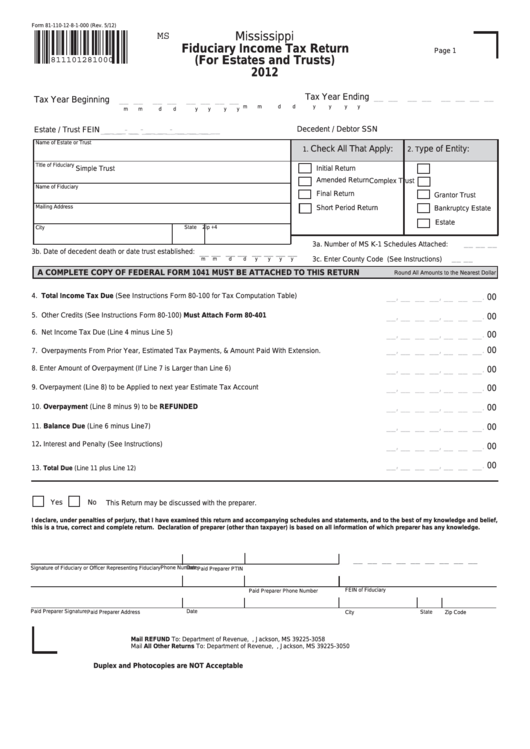

Form 81-110-12-8-1-000 (Rev. 5/12)

MS

Mississippi

Fiduciary Income Tax Return

Page 1

811101281000

(For Estates and Trusts)

2012

Tax Year Ending

__ __

__ __

__ __ __ __

Tax Year Beginning

__ __

__ __

__ __ __ __

m

m

d

d

y

y

y

y

m

m

d

d

y

y

y

y

__ __ __ - __ __ - __ __ __ __

Estate / Trust FEIN

__ __ - __ __ __ __ __ __ __

Decedent / Debtor SSN

Name of Estate or Trust

Check All That Apply:

ype of Entity:

1.

2. T

Title of Fiduciary

Initial Return

Simple Trust

Amended Return

Complex Trust

Name of Fiduciary

Final Return

Grantor Trust

Mailing Address

Short Period Return

Bankruptcy Estate

Estate

State

Zip +4

City

__ __ __

3a. Number of MS K-1 Schedules Attached:

__ __ __ __ __ __ __ __

3b. Date of decedent death or date trust established:

__ __

3c. Enter County Code (See Instructions)

m

m

d

d

y

y

y

y

A COMPLETE COPY OF FEDERAL FORM 1041 MUST BE ATTACHED TO THIS RETURN

Round All Amounts to the Nearest Dollar

4. Total Income Tax Due (See Instructions Form 80-100 for Tax Computation Table)

__, __ __ __, __ __ __.

00

5. Other Credits (See Instructions Form 80-100) Must Attach Form 80-401

__, __ __ __, __ __ __.

00

6. Net Income Tax Due (Line 4 minus Line 5)

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

7. Overpayments From Prior Year, Estimated Tax Payments, & Amount Paid With Extension.

8. Enter Amount of Overpayment (If Line 7 is Larger than Line 6)

__, __ __ __, __ __ __.

00

9. Overpayment (Line 8) to be Applied to next year Estimate Tax Account

__, __ __ __, __ __ __.

00

10. Overpayment (Line 8 minus 9) to be REFUNDED

__, __ __ __, __ __ __.

00

11. Balance Due (Line 6 minus Line7)

__, __ __ __, __ __ __.

00

12. Interest and Penalty (See Instructions)

__, __ __ __, __ __ __.

00

__, __ __ __, __ __ __.

00

13.

Total Due (Line 11 plus Line 12

)

Yes

No

This Return may be discussed with the preparer.

I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

this is a true, correct and complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

__ __ __ __ __ __ __ __ __

Date

Phone Number

Signature of Fiduciary or Officer Representing Fiduciary

Paid Preparer PTIN

FEIN of Fiduciary

Paid Preparer Phone Number

Paid Preparer Signature

Date

State

Paid Preparer Address

City

Zip Code

Mail REFUND To: Department of Revenue, P.O. Box 23058, Jackson, MS 39225-3058

Mail All Other Returns To: Department of Revenue, P.O. Box 23050, Jackson, MS 39225-3050

Duplex and Photocopies are NOT Acceptable

1

1 2

2