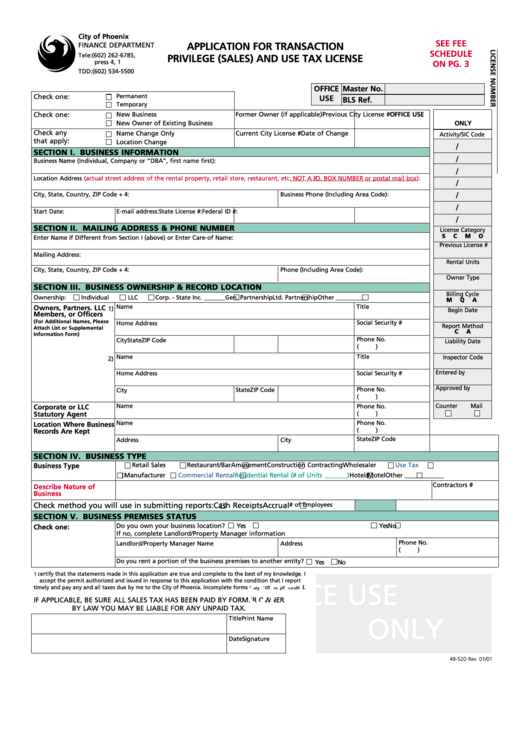

Form 49-52d - Application For Transaction Privilege (Sales) And Use Tax License - 2001

ADVERTISEMENT

City of Phoenix

SEE FEE

FINANCE DEPARTMENT

APPLICATION FOR TRANSACTION

SCHEDULE

Tele: (602) 262-6785,

PRIVILEGE (SALES) AND USE TAX LICENSE

press 4, 1

ON PG. 3

TDD: (602) 534-5500

OFFICE

Master No.

Permanent

Check one:

USE

BLS Ref.

Temporary

Check one:

New Business

Former Owner (if applicable)

Previous City License #

OFFICE USE

New Owner of Existing Business

ONLY

Check any

Name Change Only

Current City License #

Date of Change

Activity / SIC Code

that apply:

Location Change

/

SECTION I. BUSINESS INFORMATION

/

Business Name (Individual, Company or “DBA”, first name first):

/

Location Address

(actual street address of the rental property, retail store, restaurant, etc. NOT A P.O. BOX NUMBER or postal mail box):

/

City, State, Country, ZIP Code + 4:

Business Phone (Including Area Code):

/

/

Start Date:

E-mail address:

State License #:

Federal ID #:

/

SECTION II. MAILING ADDRESS & PHONE NUMBER

License Category

S

C

M

O

Enter Name if Different from Section I (above) or Enter Care-of Name:

Previous License #

Mailing Address:

Rental Units

City, State, Country, ZIP Code + 4:

Phone (Including Area Code):

Owner Type

SECTION III. BUSINESS OWNERSHIP & RECORD LOCATION

Billing Cycle

Ownership:

Individual

LLC

Corp. - State Inc. _______

Gen. Partnership

Ltd. Partnership

Other __________

M

Q

A

Name

Title

Owners, Partners. LLC

1)

Begin Date

Members, or Officers

(For Additional Names, Please

Social Security #

Home Address

Report Method

Attach List or Supplemental

C

A

Information Form)

Phone No.

City

State

ZIP Code

Liability Date

(

)

Name

Title

Inspector Code

2)

Entered by

Social Security #

Home Address

Approved by

Phone No.

City

State

ZIP Code

(

)

Name

Counter

Mail

Phone No.

Corporate or LLC

Statutory Agent

(

)

Name

Phone No.

Location Where Business

(

)

Records Are Kept

State

ZIP Code

Address

City

SECTION IV. BUSINESS TYPE

Retail Sales

Restaurant/Bar

Amusement

Construction Contracting

Use Tax

Wholesaler

Business Type

Manufacturer

Commercial Rental

Residential Rental (# of Units _______)

Hotel/Motel

Other ____________

Contractors #

Describe Nature of

Business

Check method you will use in submitting reports:

Cash Receipts

Accrual

# of Employees

SECTION V. BUSINESS PREMISES STATUS

Do you own your business location?

Yes

No

If yes, is this your residence?

Yes

No

Check one:

If no, complete Landlord/Property Manager information

Phone No.

Landlord/Property Manager Name

Address

(

)

Do you rent a portion of the business premises to another entity?

Yes

No

I certify that the statements made in this application are true and complete to the best of my knowledge. I

accept the permit authorized and issued in response to this application with the condition that I report

OFFICE USE

timely and pay any and all taxes due by me to the City of Phoenix. Incomplete forms may not be processed.

IF APPLICABLE, BE SURE ALL SALES TAX HAS BEEN PAID BY FORMER OWNER.

BY LAW YOU MAY BE LIABLE FOR ANY UNPAID TAX.

Print Name

Title

ONLY

Signature

Date

49-52D Rev. 01/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1