Instructions

Print

Reset

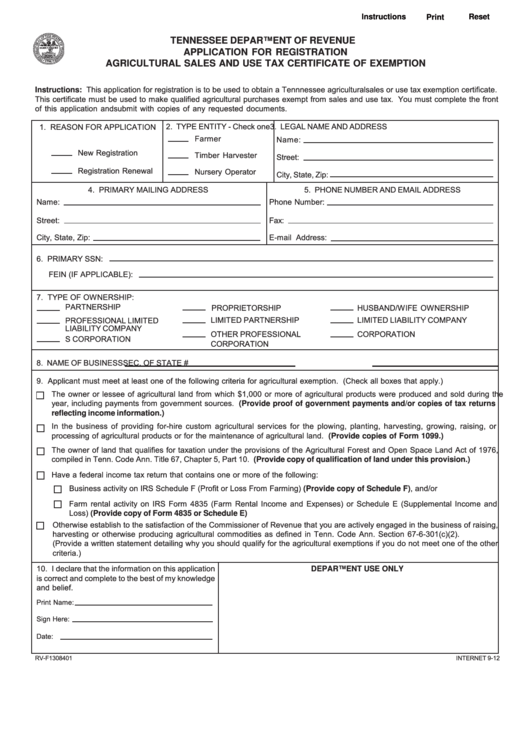

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR REGISTRATION

AGRICULTURAL SALES AND USE TAX CERTIFICATE OF EXEMPTION

Instructions: This application for registration is to be used to obtain a Tennnessee agricultural sales or use tax exemption certificate.

This certificate must be used to make qualified agricultural purchases exempt from sales and use tax. You must complete the front

of this application and submit with copies of any requested documents.

2. TYPE ENTITY - Check one

1. REASON FOR APPLICATION

3. LEGAL NAME AND ADDRESS

Farmer

Name:

New Registration

Timber Harvester

Street:

Registration Renewal

Nursery Operator

City, State, Zip:

4. PRIMARY MAILING ADDRESS

5. PHONE NUMBER AND EMAIL ADDRESS

Name:

Phone Number:

Street:

Fax:

City, State, Zip:

E-mail Address:

6. PRIMARY SSN:

FEIN (IF APPLICABLE):

7. TYPE OF OWNERSHIP:

PARTNERSHIP

PROPRIETORSHIP

HUSBAND/WIFE OWNERSHIP

LIMITED PARTNERSHIP

LIMITED LIABILITY COMPANY

PROFESSIONAL LIMITED

LIABILITY COMPANY

OTHER PROFESSIONAL

CORPORATION

S CORPORATION

CORPORATION

8. NAME OF BUSINESS

SEC. OF STATE #

9. Applicant must meet at least one of the following criteria for agricultural exemption. (Check all boxes that apply.)

The owner or lessee of agricultural land from which $1,000 or more of agricultural products were produced and sold during the

year, including payments from government sources. (Provide proof of government payments and/or copies of tax returns

reflecting income information.)

In the business of providing for-hire custom agricultural services for the plowing, planting, harvesting, growing, raising, or

processing of agricultural products or for the maintenance of agricultural land. (Provide copies of Form 1099.)

The owner of land that qualifies for taxation under the provisions of the Agricultural Forest and Open Space Land Act of 1976,

compiled in Tenn. Code Ann. Title 67, Chapter 5, Part 10. (Provide copy of qualification of land under this provision.)

Have a federal income tax return that contains one or more of the following:

Business activity on IRS Schedule F (Profit or Loss From Farming) (Provide copy of Schedule F), and/or

Farm rental activity on IRS Form 4835 (Farm Rental Income and Expenses) or Schedule E (Supplemental Income and

Loss) (Provide copy of Form 4835 or Schedule E)

Otherwise establish to the satisfaction of the Commissioner of Revenue that you are actively engaged in the business of raising,

harvesting or otherwise producing agricultural commodities as defined in Tenn. Code Ann. Section 67-6-301(c)(2).

(Provide a written statement detailing why you should qualify for the agricultural exemptions if you do not meet one of the other

criteria.)

10. I declare that the information on this application

DEPARTMENT USE ONLY

is correct and complete to the best of my knowledge

and belief.

Print Name:

Sign Here:

Date:

RV-F1308401

INTERNET 9-12

1

1 2

2