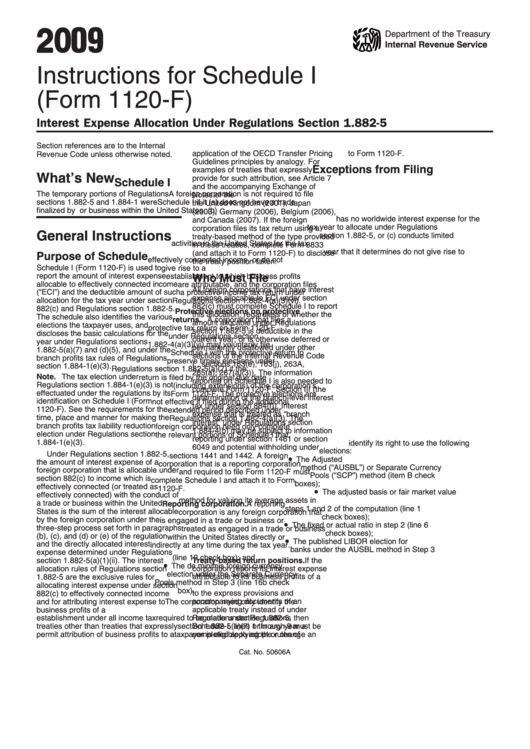

Instructions For Schedule I (Form 1120-F) - 2009

ADVERTISEMENT

2 0 09

Department of the Treasury

Internal Revenue Service

Instructions for Schedule I

(Form 1120-F)

Interest Expense Allocation Under Regulations Section 1.882-5

U.S. permanent establishment under

Regulations section 1.882-5 and attached

Section references are to the Internal

application of the OECD Transfer Pricing

to Form 1120-F.

Revenue Code unless otherwise noted.

Guidelines principles by analogy. For

Exceptions from Filing

examples of treaties that expressly

What’s New

provide for such attribution, see Article 7

Schedule I

and the accompanying Exchange of

The temporary portions of Regulations

A foreign corporation is not required to file

Notes of the U.S. income tax treaties with

sections 1.882-5 and 1.884-1 were

Schedule I if it (a) does not have a trade

the United Kingdom (2001), Japan

finalized by T.D. 9465.

or business within the United States, (b)

(2003), Germany (2006), Belgium (2006),

has no worldwide interest expense for the

and Canada (2007). If the foreign

tax year to allocate under Regulations

corporation files its tax return using a

General Instructions

section 1.882-5, or (c) conducts limited

treaty-based method of the type provided

activities in the United States for the tax

in these treaties, complete Form 8833

year that it determines do not give rise to

(and attach it to Form 1120-F) to disclose

Purpose of Schedule

effectively connected income, or do not

the treaty position taken.

Schedule I (Form 1120-F) is used to

give rise to a U.S. permanent

report the amount of interest expense

establishment to which business profits

Who Must File

allocable to effectively connected income

are attributable, and the corporation files

All foreign corporations that have interest

(“ECI”) and the deductible amount of such

a protective income tax return under

expense allocable to ECI under section

allocation for the tax year under section

Regulations section 1.882-4(a)(3)(vi).

882(c) must complete Schedule I to report

882(c) and Regulations section 1.882-5.

Protective elections on protective

this allocation, regardless of whether the

The schedule also identifies the various

returns. A corporation that files a

amount allocable under Regulations

elections the taxpayer uses, and

protective tax return on Form 1120-F

section 1.882-5 is deductible in the

discloses the basic calculations for the

under Regulations section

current year, or is otherwise deferred or

year under Regulations sections

1.882-4(a)(3)(vi) may voluntarily file

permanently disallowed under other

1.882-5(a)(7) and (d)(5), and under the

Schedule I with the protective return to

sections of the Internal Revenue Code

branch profits tax rules of Regulations

preserve timely elections under

(e.g., sections 163(e), 163(j), 263A,

section 1.884-1(e)(3).

Regulations section 1.882-5(a)(7) if the

265(a), 267(a)(3)). The information

Note. The tax election under

return is filed by the original due date

reported on Schedule I is also needed to

Regulations section 1.884-1(e)(3) is not

(including extensions) of the corporation’s

complete Form 1120-F, Section III (the

effectuated under the regulations by its

Form 1120-F. The protective elections are

determination of the branch-level interest

identification on Schedule I (Form

not effective if filed during the additional

tax under section 884(f)). Interest

1120-F). See the requirements for the

extended period described under

expense that is treated as “branch

time, place and manner for making the

Regulations section 1.882-4(a)(3). The

interest” under Regulations section

branch profits tax liability reduction

foreign corporation need only complete

1.884-4(b) may be subject to information

election under Regulations section

the relevant portions of Schedule I that

reporting under section 1461 or section

1.884-1(e)(3).

identify its right to use the following

6049 and potential withholding under

elections:

Under Regulations section 1.882-5,

sections 1441 and 1442. A foreign

•

The Adjusted U.S. Booked Liability

the amount of interest expense of a

corporation that is a reporting corporation

method (“AUSBL”) or Separate Currency

foreign corporation that is allocable under

and required to file Form 1120-F must

Pools (“SCP”) method (item B check

section 882(c) to income which is

complete Schedule I and attach it to Form

boxes);

effectively connected (or treated as

1120-F.

•

The adjusted basis or fair market value

effectively connected) with the conduct of

method for valuing its average assets in

a trade or business within the United

Reporting corporation. A reporting

steps 1 and 2 of the computation (line 1

States is the sum of the interest allocable

corporation is any foreign corporation that

check boxes);

by the foreign corporation under the

is engaged in a trade or business or

•

The fixed or actual ratio in step 2 (line 6

three-step process set forth in paragraphs

treated as engaged in a trade or business

check boxes);

(b), (c), and (d) or (e) of the regulation

within the United States directly or

•

The published LIBOR election for

and the directly allocated interest

indirectly at any time during the tax year.

banks under the AUSBL method in Step 3

expense determined under Regulations

(line 10 check box); and

Treaty-based return positions. If the

section 1.882-5(a)(1)(ii). The interest

•

The de minimis foreign currency

corporation reports its interest expense

allocation rules of Regulations section

election under the Separate Currency

attributable to its business profits of a

1.882-5 are the exclusive rules for

Pools method in Step 3 (line 16b check

U.S. permanent establishment pursuant

allocating interest expense under section

box).

to the express provisions and

882(c) to effectively connected income

accompanying documents of an

and for attributing interest expense to

The corporation need only identify the

applicable treaty instead of under

business profits of a U.S. permanent

protective election in the first year it is

establishment under all income tax

Regulations section 1.882-5, then

required to be made under Regulations

treaties other than treaties that expressly

Schedule I, lines 1 through 9 must be

section 1.882-5(a)(7) or in any year a

permit attribution of business profits to a

completed applying the rules of

taxpayer is eligible to adopt or change an

Cat. No. 50606A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8