Instruction For Form Ri-6238 - Worksheet For Computing Total Household Income - 2010

ADVERTISEMENT

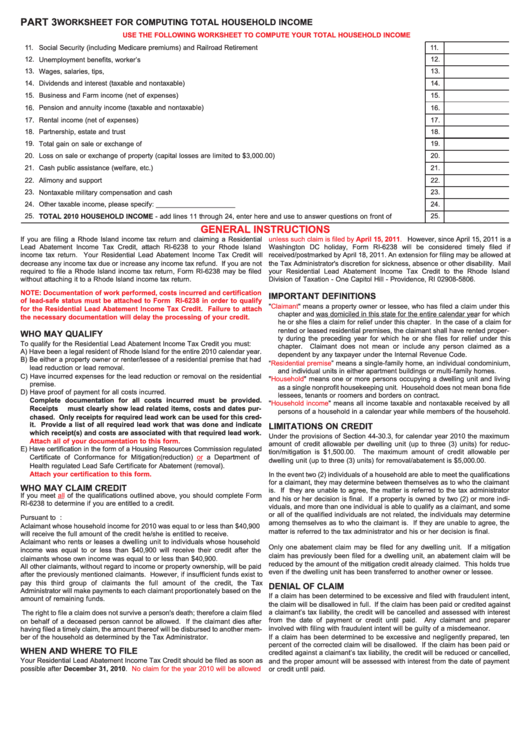

PART 3

WORKSHEET FOR COMPUTING TOTAL HOUSEHOLD INCOME

USE THE FOLLOWING WORKSHEET TO COMPUTE YOUR TOTAL HOUSEHOLD INCOME

11.

Social Security (including Medicare premiums) and Railroad Retirement benefits............................................................................

11.

12.

Unemployment benefits, worker’s compensation...............................................................................................................................

12.

13.

13.

Wages, salaries, tips, etc....................................................................................................................................................................

14.

Dividends and interest (taxable and nontaxable)................................................................................................................................

14.

15.

Business and Farm income (net of expenses)...................................................................................................................................

15.

16.

Pension and annuity income (taxable and nontaxable)......................................................................................................................

16.

17.

Rental income (net of expenses)........................................................................................................................................................

17.

18.

Partnership, estate and trust income..................................................................................................................................................

18.

19.

Total gain on sale or exchange of property.........................................................................................................................................

19.

20.

Loss on sale or exchange of property (capital losses are limited to $3,000.00)................................................................................

20.

21.

Cash public assistance (welfare, etc.)................................................................................................................................................

21.

22.

Alimony and support money................................................................................................................................................................

22.

23.

Nontaxable military compensation and cash benefits.........................................................................................................................

23.

24.

Other taxable income, please specify: _____________________ ....................................................................................................

24.

25.

25.

TOTAL 2010 HOUSEHOLD INCOME - add lines 11 through 24, enter here and use to answer questions on front of form...........

GENERAL INSTRUCTIONS

If you are filing a Rhode Island income tax return and claiming a Residential

unless such claim is filed by April 15, 2011.

However, since April 15, 2011 is a

Lead Abatement Income Tax Credit, attach RI-6238 to your Rhode Island

Washington DC holiday, Form RI-6238 will be considered timely filed if

income tax return. Your Residential Lead Abatement Income Tax Credit will

received/postmarked by April 18, 2011. An extension for filing may be allowed at

decrease any income tax due or increase any income tax refund. If you are not

the Tax Administrator's discretion for sickness, absence or other disability. Mail

required to file a Rhode Island income tax return, Form RI-6238 may be filed

your Residential Lead Abatement Income Tax Credit to the Rhode Island

without attaching it to a Rhode Island income tax return.

Division of Taxation - One Capitol Hill - Providence, RI 02908-5806.

NOTE: Documentation of work performed, costs incurred and certification

IMPORTANT DEFINITIONS

of lead-safe status must be attached to Form RI-6238 in order to qualify

"Claimant" means a property owner or lessee, who has filed a claim under this

for the Residential Lead Abatement Income Tax Credit. Failure to attach

chapter and was domiciled in this state for the entire calendar year for which

the necessary documentation will delay the processing of your credit.

he or she files a claim for relief under this chapter. In the case of a claim for

rented or leased residential premises, the claimant shall have rented proper-

WHO MAY QUALIFY

ty during the preceding year for which he or she files for relief under this

To qualify for the Residential Lead Abatement Income Tax Credit you must:

chapter.

Claimant does not mean or include any person claimed as a

A) Have been a legal resident of Rhode Island for the entire 2010 calendar year.

dependent by any taxpayer under the Internal Revenue Code.

B) Be either a property owner or renter/lessee of a residential premise that had

“Residential

premise” means a single-family home, an individual condominium,

lead reduction or lead removal.

and individual units in either apartment buildings or multi-family homes.

C) Have incurred expenses for the lead reduction or removal on the residential

"Household" means one or more persons occupying a dwelling unit and living

premise.

as a single nonprofit housekeeping unit. Household does not mean bona fide

D) Have proof of payment for all costs incurred.

lessees, tenants or roomers and borders on contract.

Complete documentation for all costs incurred must be provided.

"Household

income" means all income taxable and nontaxable received by all

Receipts

must clearly show lead related items, costs and dates pur-

persons of a household in a calendar year while members of the household.

chased. Only receipts for required lead work can be used for this cred-

it. Provide a list of all required lead work that was done and indicate

LIMITATIONS ON CREDIT

which receipt(s) and costs are associated with that required lead work.

Under the provisions of Section 44-30.3, for calendar year 2010 the maximum

Attach all of your documentation to this form.

amount of credit allowable per dwelling unit (up to three (3) units) for reduc-

E) Have certification in the form of a Housing Resources Commission regulated

tion/mitigation is $1,500.00. The maximum amount of credit allowable per

Certificate of Conformance for Mitigation (reduction)

or

a Department of

dwelling unit (up to three (3) units) for removal/abatement is $5,000.00.

Health regulated Lead Safe Certificate for Abatement (removal).

Attach your certification to this form.

In the event two (2) individuals of a household are able to meet the qualifications

for a claimant, they may determine between themselves as to who the claimant

WHO MAY CLAIM CREDIT

is. If they are unable to agree, the matter is referred to the tax administrator

If you meet

all

of the qualifications outlined above, you should complete Form

and his or her decision is final. If a property is owned by two (2) or more indi-

RI-6238 to determine if you are entitled to a credit.

viduals, and more than one individual is able to qualify as a claimant, and some

or all of the qualified individuals are not related, the individuals may determine

Pursuant to R.I.G.L. 44-30.3:

among themselves as to who the claimant is. If they are unable to agree, the

A claimant whose household income for 2010 was equal to or less than $40,900

matter is referred to the tax administrator and his or her decision is final.

will receive the full amount of the credit he/she is entitled to receive.

A claimant who rents or leases a dwelling unit to individuals whose household

Only one abatement claim may be filed for any dwelling unit. If a mitigation

income was equal to or less than $40,900 will receive their credit after the

claim has previously been filed for a dwelling unit, an abatement claim will be

claimants whose own income was equal to or less than $40,900.

reduced by the amount of the mitigation credit already claimed. This holds true

All other claimants, without regard to income or property ownership, will be paid

even if the dwelling unit has been transferred to another owner or lessee.

after the previously mentioned claimants. However, if insufficient funds exist to

pay this third group of claimants the full amount of the credit, the Tax

DENIAL OF CLAIM

Administrator will make payments to each claimant proportionately based on the

If a claim has been determined to be excessive and filed with fraudulent intent,

amount of remaining funds.

the claim will be disallowed in full. If the claim has been paid or credited against

a claimant’s tax liability, the credit will be cancelled and assessed with interest

The right to file a claim does not survive a person's death; therefore a claim filed

from the date of payment or credit until paid. Any claimant and preparer

on behalf of a deceased person cannot be allowed. If the claimant dies after

involved with filing with fraudulent intent will be guilty of a misdemeanor.

having filed a timely claim, the amount thereof will be disbursed to another mem-

If a claim has been determined to be excessive and negligently prepared, ten

ber of the household as determined by the Tax Administrator.

percent of the corrected claim will be disallowed. If the claim has been paid or

WHEN AND WHERE TO FILE

credited against a claimant’s tax liability, the credit will be reduced or cancelled,

Your Residential Lead Abatement Income Tax Credit should be filed as soon as

and the proper amount will be assessed with interest from the date of payment

possible after December 31, 2010.

No claim for the year 2010 will be allowed

or credit until paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1