Instruction Sheet - Atf Form 5630.7, Special Tax Registration And Return - Firearms

ADVERTISEMENT

Instruction Sheet

ATF Form 5630.7, Special Tax Registration and Return

Firearms

General Instructions

Section III - Business Registration

If you are engaged in one or more of the National Firearms Act (NFA)

Please complete the ownership information in Section III. Supply the

activities listed on this form (see definition), you are required to file this form

information specified in item 14 for each individual owner, partner or

and pay special occupational tax before beginning business. This form is for

responsible person. For a corporation, partnership or association, a

NFA taxpayers only. You may file one return to cover several locations or

responsible person is anyone with the power to control the management

several types of activity. However, you must submit a separate return for each

policies or buying or selling practices pertaining to firearms. For a

tax period. The special occupational tax period runs from July 1 through June

corporation, association or similar organization, it also means any person

30 and payment is due annually by July 1. If you do not pay on a timely basis,

owning 10 percent or more of the outstanding stock in the business.

interest will be charged and penalties may be incurred.

Changes in Operations

If you engage in a taxable activity at more than one location, attach to your

return a sheet showing your name, trade name, address and employer iden-

For a change of address, location or trade name, an amended ATF Form

tification number, the complete street addresses, and the Federal Firearms

5630.7 must be filed and approved before the change is made. Return your

License (FFL) number of all additional locations.

Special Tax Stamp, ATF Form 5630.6A, along with the completed ATF Form

5630.7 to: NFA Branch, Bureau of ATF, 244 Needy Road, Suite 1250,

As evidence of tax payment, you will be issued a Special Tax Stamp, ATF

Martinsburg, WV 25405 and an amended ATF Form 5630.6A will be issued.

Form 5630.6A, for each location and/or business. You must have an FFL

All taxpayers with such changes must return their FFL to the ATF Federal

for the location, appropriate to the type of activity conducted. The type of

Firearms Licensing Center (address listed on FFL) for amendment.

business (individual owner, partnership, corporation) must be the same for

the taxable activity and the FFL. If a trade name is used, it must be the

If special taxpayers do not register these changes within the appropriate

same on the tax stamp and the FFL.

time frames, additional tax and interest will be charged and penalties may be

incurred. For a change in ownership or control of an activity, consult the

The special tax rates listed on this form became effective January 1, 1988.

ATF Federal Firearms Licensing Center, at 866-662-2750, before begin-

If you were engaged in NFA firearms related activity prior to this date and

ning the activity. If the Federal firearms licensee discontinues business and

did not pay special occupational tax, please contact the National Firearms

retains NFA firearms, this retention may be in violation of law. The

Act Branch for assistance.

licensee should check with State or local authorities.

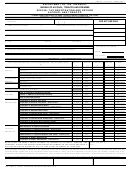

Section I - Tax Identifying Information

Definition

Complete Section I, Taxpayer Identifying Information, as specified on the

IMPORTERS, MANUFACTURERS, and DEALERS of FIREARMS

form. Enter the tax period covered by the return in the space provided.

subject to the National Firearms Act (tax class codes 61, 62, 63, 71, or 72)

Your return must contain a valid EMPLOYER IDENTIFICATION

are individuals or business entities who import, manufacture or deal in

NUMBER (EIN). The EIN is a unique number for business entities issued

machineguns, short-barreled shotguns and rifles, destructive devices, etc.

by the Inter-nal Revenue Service (IRS). You must have an EIN whether

See 26 U.S.C. 5845 for additional information on the types of weapons

you are an individual owner, partnership, corporation, or agency of

subject to the National Firearms Act. (NOTE: This tax is not required

the government. If you do not have an EIN, contact your local IRS office

from those persons or entities who deal only in conventional, sporting type

immediately to obtain one. While ATF may assign a temporary identification

fire-arms.)

number (beginning with XX) to allow initial processing of a return which

lacks an EIN, a tax stamp will not be issued until you have submitted a

Miscellaneous Instructions

valid EIN. Do not delay submission of your return and payment past the

due date pending receipt of your EIN. If you have not received a number

If you do not intend to pay the special tax for the next year, you must dis-

by the time you file this return, write “number applied for” in the space for

pose of any machineguns manufactured or imported after May 19, 1986,

the number. Submit your EIN by separate correspondence after receipt

prior to your special tax status lapsing. Title 18, United States Code,

from the IRS.

section 922(o) makes it unlawful to possess these machineguns unless you

are properly qualified. As provided in Title 27, Code of Federal Regu-

Section II - Tax Computation

lations, Part 479,105(f), the disposition must be made to a government

agency or qualified licensee or the weapon must be destroyed.

To complete Section II, enter the number of locations in Col. (11d) on the

appropriate line(s) and multiply by the tax rate, Col. (11c). Insert the tax

This form must be signed by the individual owner, a partner, or, in the case

due in Col. (11e). Compute the taxes due for each class and enter the total

of a corporation, by an individual authorized to sign for the corporation.

amount due in the block “Total Tax Due”.

Please sign and date the return, make check or money order payable to

Instructions for Reduced Rate Taxpayers

BUREAU OF ALCOHOL, TOBACCO, FIREARMS AND EXPLO-

SIVES, for the amount in the Total Tax Due block, and MAIL THE FORM

The reduced rates for certain tax classes, indicated with an asterisk (*) in

ALONG WITH THE PAYMENT TO BUREAU OF ATF, Attention:

Section II, apply only to those taxpayers whose total gross receipts for your

NFA, P.O. Box 403269, Atlanta, GA 30384-3269.

most recent income tax year are less than $500,000 (not just receipts

relating to the activity subject to special occupational tax). However, if

you are a member of a controlled group as defined in section 5061(e)(3) of

If You Need Further Assistance

the Internal Revenue Code, you are not eligible for this reduced rate unless

Contact ATF National Firearms Act Branch

the total gross receipts for the entire group are less than $500,000. If your

at

business is beginning an activity subject to special tax for the first time, you

304-616-4500

may qualify for a reduced rate in your initial tax year if gross receipts for

the business (or the entire control group, if a member of a control group)

were under $500,000 the previous year. If you are eligible for the reduced

rate, check item 15 in Section III and compute your tax using the reduced

ATF Form 5630.7

rate in Section II.

Revised April 2007

Taxpayer Reminder

This is an annual tax due before starting business and by July 1 each

year after that. After your initial payment of this tax, you should

receive a “renewal” registration and return each year in the mail,

prior to the due date. However, if you do not receive a renewal

form, you are still liable for the tax and should contact the ATF

National Firearms Act Branch noted in the instructions to obtain a

Special (Occupational) Tax Registration and Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1