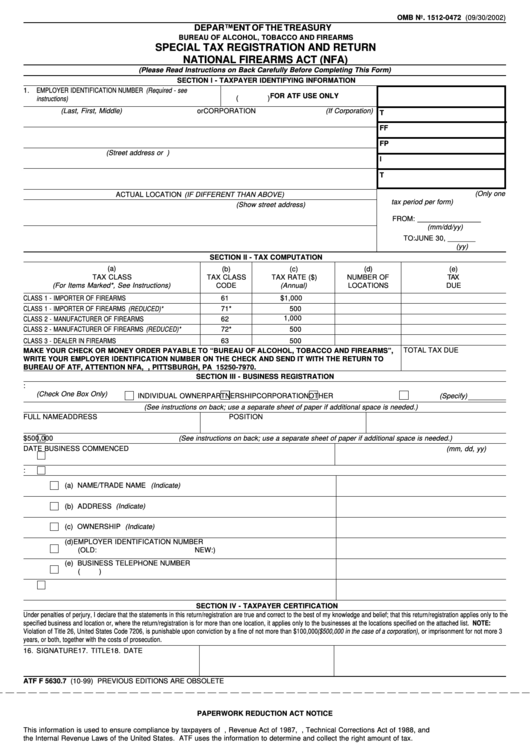

Form Atf F 5630.7 - Special Tax Registration And Return National Firearms Act (Nfa) - 1999

ADVERTISEMENT

OMB No. 1512-0472 (09/30/2002)

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

SPECIAL TAX REGISTRATION AND RETURN

NATIONAL FIREARMS ACT (NFA)

(Please Read Instructions on Back Carefully Before Completing This Form)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

2. BUSINESS TELEPHONE NUMBER

1. EMPLOYER IDENTIFICATION NUMBER (Required - see

FOR ATF USE ONLY

(

)

instructions)

3. NAME (Last, First, Middle)

or

CORPORATION (If Corporation)

T

FF

4. TRADE NAME

FP

5. MAILING ADDRESS (Street address or P.O. box number)

I

6. CITY

STATE

ZIP CODE

T

9. TAX PERIOD COVERING (Only one

ACTUAL LOCATION (IF DIFFERENT THAN ABOVE)

tax period per form)

7. PHYSICAL ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Show street address)

FROM: ________________

(mm/dd/yy)

8. CITY

STATE

ZIP CODE

TO: JUNE 30, _______

(yy)

SECTION II - TAX COMPUTATION

(a)

(b)

(c)

(d)

(e)

TAX CLASS

TAX CLASS

TAX RATE ($)

NUMBER OF

TAX

(For Items Marked*, See Instructions)

(Annual)

CODE

LOCATIONS

DUE

CLASS 1 - IMPORTER OF FIREARMS

61

$1,000

CLASS 1 - IMPORTER OF FIREARMS (REDUCED)*

71*

500

1,000

CLASS 2 - MANUFACTURER OF FIREARMS

62

CLASS 2 - MANUFACTURER OF FIREARMS (REDUCED)*

72*

500

CLASS 3 - DEALER IN FIREARMS

63

500

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO “BUREAU OF ALCOHOL, TOBACCO AND FIREARMS”,

TOTAL TAX DUE

WRITE YOUR EMPLOYER IDENTIFICATION NUMBER ON THE CHECK AND SEND IT WITH THE RETURN TO

BUREAU OF ATF, ATTENTION NFA, P.O. BOX 371970, PITTSBURGH, PA 15250-7970.

SECTION III - BUSINESS REGISTRATION

10. OWNERSHIP INFORMATION:

(Check One Box Only)

INDIVIDUAL OWNER

PARTNERSHIP

CORPORATION

OTHER (Specify)

11. OWNERSHIP RESPONSIBILITY (See instructions on back; use a separate sheet of paper if additional space is needed.)

FULL NAME

ADDRESS

POSITION

12.

GROSS RECEIPTS less than $500,000 (See instructions on back; use a separate sheet of paper if additional space is needed.)

DATE BUSINESS COMMENCED (mm, dd, yy)

13.

NEW BUSINESS

14.

EXISTING BUSINESS WITH CHANGE IN:

(a) NAME/TRADE NAME (Indicate)

(b) ADDRESS (Indicate)

(c) OWNERSHIP (Indicate)

(d) EMPLOYER IDENTIFICATION NUMBER

(OLD:

NEW:

)

(e) BUSINESS TELEPHONE NUMBER

(

)

15.

DISCONTINUED BUSINESS

SECTION IV - TAXPAYER CERTIFICATION

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; that this return/registration applies only to the

specified business and location or, where the return/registration is for more than one location, it applies only to the businesses at the locations specified on the attached list. NOTE:

Violation of Title 26, United States Code 7206, is punishable upon conviction by a fine of not more than $100,000 ($500,000 in the case of a corporation), or imprisonment for not more 3

years, or both, together with the costs of prosecution.

16. SIGNATURE

17. TITLE

18. DATE

ATF F 5630.7 (10-99) PREVIOUS EDITIONS ARE OBSOLETE

PAPERWORK REDUCTION ACT NOTICE

This information is used to ensure compliance by taxpayers of P.L. 100-203, Revenue Act of 1987, P.L. 100-647, Technical Corrections Act of 1988, and

the Internal Revenue Laws of the United States. ATF uses the information to determine and collect the right amount of tax.

The estimated average burden associated with this collection of information is .8 hours per respondent or recordkeeper, depending on individual circum-

stances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be addressed to Reports Manage-

ment Officer, Document Services Branch, Bureau of Alcohol, Tobacco and Firearms, Washington, DC 20226.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB

control number.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1