Income Tax Exemption Certificate Form - City Of Amherst

ADVERTISEMENT

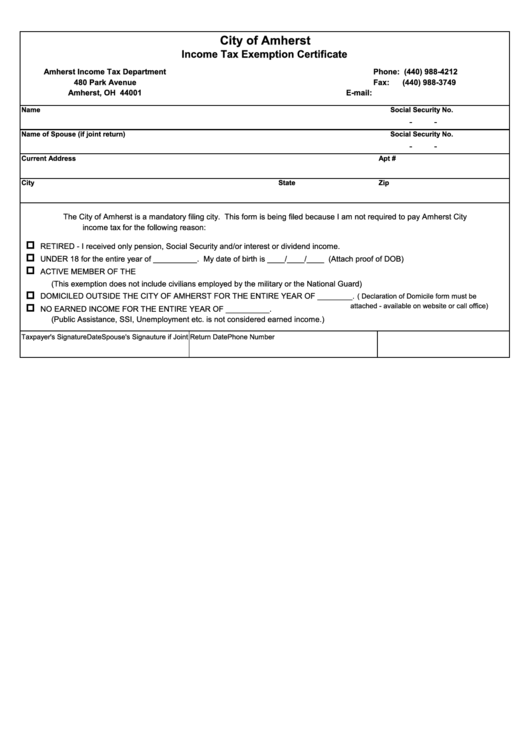

City of Amherst

Income Tax Exemption Certificate

Amherst Income Tax Department

Phone: (440) 988-4212

480 Park Avenue

Fax:

(440) 988-3749

Amherst, OH 44001

E-mail:

Name

Social Security No.

-

-

Name of Spouse (if joint return)

Social Security No.

-

-

Current Address

Apt #

City

State

Zip

The City of Amherst is a mandatory filing city. This form is being filed because I am not required to pay Amherst City

income tax for the following reason:

RETIRED - I received only pension, Social Security and/or interest or dividend income.

UNDER 18 for the entire year of __________. My date of birth is ____/____/____ (Attach proof of DOB)

ACTIVE MEMBER OF THE U.S. ARMED FORCES FOR THE ENTIRE YEAR OF ____________.

(This exemption does not include civilians employed by the military or the National Guard)

DOMICILED OUTSIDE THE CITY OF AMHERST FOR THE ENTIRE YEAR OF ________.

( Declaration of Domicile form must be

attached - available on website or call office)

NO EARNED INCOME FOR THE ENTIRE YEAR OF __________.

(Public Assistance, SSI, Unemployment etc. is not considered earned income.)

Taxpayer's Signature

Date

Spouse's Signauture if Joint Return

Date

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1