Withholding Tax Information Authorization

ADVERTISEMENT

Withholding Tax

Arizona Form

Information Authorization

821

Purpose of Form

Any tax year(s) or period(s) that have ended as of the date a

withholding tax information authorization is signed may be

A taxpayer may use Form 821 to authorize any corporation,

listed. The number of future tax years or periods which will

firm, organization, or partnership to inspect and/or receive

be accepted is limited to tax years or periods which end no

confidential Arizona withholding tax information for the

later than four years after the date the withholding tax

years or periods listed on this form

information authorization is signed.

If a taxpayer wants an individual to inspect and/or receive

A general reference to "all years" or "all periods" will be

information for tax types other than withholding, or to perform

accepted as applying only to tax years (periods) ending prior

other acts on the taxpayer's behalf, the taxpayer may not use Form

to the date the withholding tax information authorization is

821.

The taxpayer must use Arizona Form 285, General

signed. A general reference to "all future years" will be

Disclosure/Representation

Authorization

Form,

or

other

subject to the four-year limitation.

comparable form. Only an individual may be designated as a

representative

under

a

General

Disclosure/Representation

Section 4 - Retention/Revocation of Prior

Authorization Form.

Withholding Tax Information Authorization

FILING INSTRUCTIONS

A new withholding tax information authorization will revoke

a prior withholding tax information authorization if it is

If the taxpayer is working with a specific section or

granted by the taxpayer to another appointee for the same

employee of the department, the taxpayer should mail Form

years or periods covered by this document.

821 to that section or employee. Otherwise, the taxpayer

should mail Form 821 to:

If there is any existing withholding tax information

authorization you do not want to revoke, check the box on

Arizona Department of Revenue

this line and attach a copy of the withholding tax information

Taxpayer Information and Assistance

authorization.

P.O. Box 29086

Phoenix AZ 85038

A taxpayer may revoke a withholding tax information

The taxpayer may file an original, a photocopy, or a

authorization without authorizing a new appointee by filing a

facsimile transmission (Fax) of the Withholding Tax

statement of revocation with the department. The statement of

Information Authorization.

revocation must indicate that the authority of the previous

withholding tax information authorization is revoked and must

SPECIFIC INSTRUCTIONS

be signed by the taxpayer. Also, the name and address of each

appointee whose authority is revoked must be listed (or a copy

Section 1 - Taxpayer Information

of the withholding tax information authorization to be revoked

must be attached and marked "revoked").

Individuals - Enter your name and address. Also enter your

SSN, FEIN, and Arizona withholding number.

The filing of a Form 821 will not revoke any Arizona

Corporations, partnerships or associations - Enter the

Form 285 or other power of attorney that is in effect.

name and business address. Also enter the FEIN and the

Arizona withholding number.

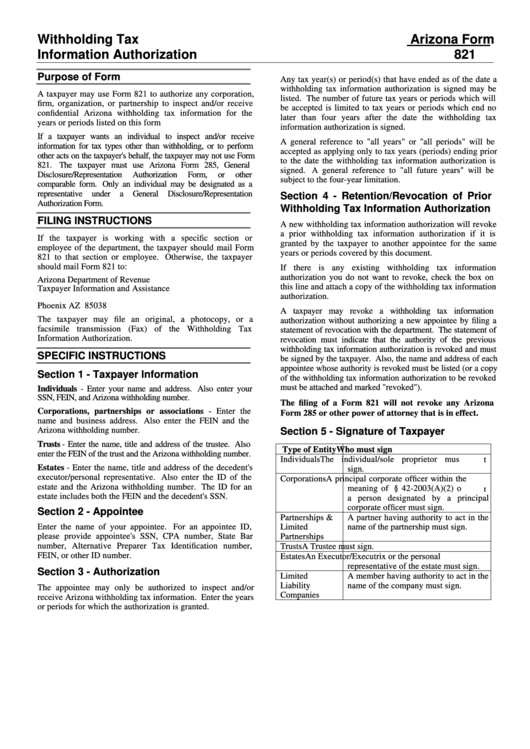

Section 5 - Signature of Taxpayer

Trusts - Enter the name, title and address of the trustee. Also

Type of Entity

Who must sign

enter the FEIN of the trust and the Arizona withholding number.

Individuals

The individual/sole proprietor must

Estates - Enter the name, title and address of the decedent's

sign.

executor/personal representative. Also enter the ID of the

Corporations

A principal corporate officer within the

estate and the Arizona withholding number. The ID for an

meaning of A.R.S. § 42-2003(A)(2) or

estate includes both the FEIN and the decedent's SSN.

a person designated by a principal

corporate officer must sign.

Section 2 - Appointee

Partnerships &

A partner having authority to act in the

Enter the name of your appointee. For an appointee ID,

Limited

name of the partnership must sign.

please provide appointee's SSN, CPA number, State Bar

Partnerships

number, Alternative Preparer Tax Identification number,

Trusts

A Trustee must sign.

FEIN, or other ID number.

Estates

An Executor/Executrix or the personal

representative of the estate must sign.

Section 3 - Authorization

Limited

A member having authority to act in the

Liability

name of the company must sign.

The appointee may only be authorized to inspect and/or

Companies

receive Arizona withholding tax information. Enter the years

or periods for which the authorization is granted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1