Form Npt - Net Profits Tax - City Of Philadelphia - 2010

ADVERTISEMENT

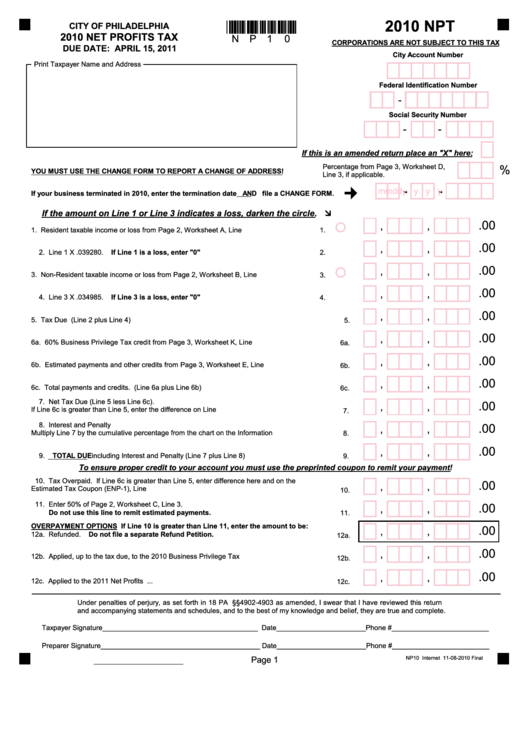

2010 NPT

CITY OF PHILADELPHIA

2010 NET PROFITS TAX

N

P

1

0

CORPORATIONS ARE NOT SUBJECT TO THIS TAX

DUE DATE: APRIL 15, 2011

City Account Number

Print Taxpayer Name and Address

Federal Identification Number

-

Social Security Number

-

-

If this is an amended return place an "X" here:

Percentage from Page 3, Worksheet D,

%

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS!

Line 3, if applicable.

-

-

m m

d d

y y y y

If your business terminated in 2010, enter the termination date AND file a CHANGE FORM.

If the amount on Line 1 or Line 3 indicates a loss, darken the circle.

.00

,

,

1. Resident taxable income or loss from Page 2, Worksheet A, Line 4..............................

1.

.00

,

,

2. Line 1 X .039280. If Line 1 is a loss, enter "0"............................................................

2.

.00

,

,

3. Non-Resident taxable income or loss from Page 2, Worksheet B, Line 6......................

3.

.00

,

,

4. Line 3 X .034985. If Line 3 is a loss, enter "0"............................................................

4.

.00

,

,

5. Tax Due (Line 2 plus Line 4)..................................................................................................

5.

.00

,

,

6a. 60% Business Privilege Tax credit from Page 3, Worksheet K, Line 4....................................

6a.

.00

,

,

6b. Estimated payments and other credits from Page 3, Worksheet E, Line 4..............................

6b.

.00

,

,

6c. Total payments and credits. (Line 6a plus Line 6b).................................................................

6c.

7. Net Tax Due (Line 5 less Line 6c).

.00

,

,

If Line 6c is greater than Line 5, enter the difference on Line 10.............................................

7.

8. Interest and Penalty

.00

,

,

Multiply Line 7 by the cumulative percentage from the chart on the Information Sheet...........

8.

.00

,

,

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).............................................

9.

To ensure proper credit to your account you must use the preprinted coupon to remit your payment!

10. Tax Overpaid. If Line 6c is greater than Line 5, enter difference here and on the

.00

,

,

Estimated Tax Coupon (ENP-1), Line 2..................................................................................

10.

11. Enter 50% of Page 2, Worksheet C, Line 3.

.00

,

,

Do not use this line to remit estimated payments...............................................................

11.

OVERPAYMENT OPTIONS If Line 10 is greater than Line 11, enter the amount to be:

.00

,

,

12a. Refunded. Do not file a separate Refund Petition...............................................................

12a.

.00

,

,

12b. Applied, up to the tax due, to the 2010 Business Privilege Tax Return....................................

12b.

.00

,

,

12c. Applied to the 2011 Net Profits Tax.........................................................................................

12c.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

Page 1

NP10 Internet 11-08-2010 Final

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1