Form Npt - Net Profits Tax Return - 2004

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

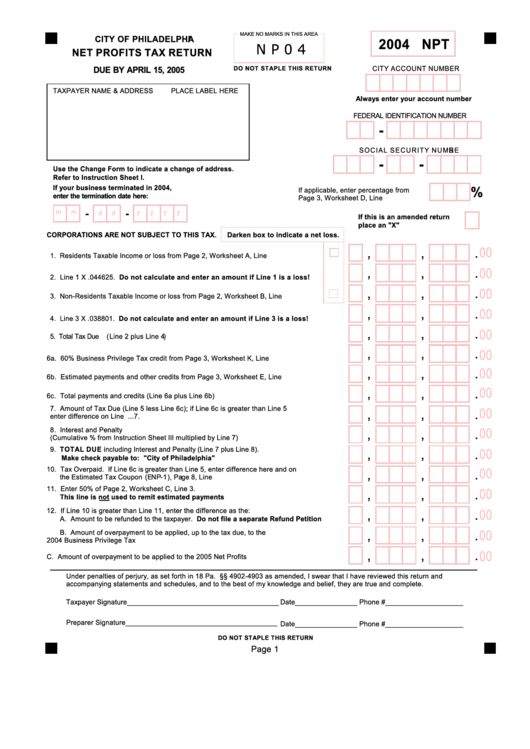

CITY OF PHILADELPHIA

2004 NPT

N P 0 4

NET PROFITS TAX RETURN

DO NOT STAP LE THIS RETURN

CITY ACCOUNT NUMBER

DUE BY APRIL 15, 2005

TA XPAY ER NA ME & A DDRESS

PLA CE LA BEL HERE

Always enter your account number

FEDERA L IDENTIFICA TION NUMB ER

-

SOCIA L SECURITY NUMBER

-

-

Us e the Change Form to indicate a change of address.

Re fer to Instruction Sheet I.

If your business terminated in 2004,

%

If applicable, enter percentage from

enter the termination date here:

Page 3, Worksheet D, Line 3............... ....

-

-

m

m

y

y

y

y

d

d

If this is an amended return

place an "X" here.......................

CORPORATIONS ARE NOT SUBJE CT TO THIS TAX.

Darken box to indicate a net loss.

00

,

,

.

1. Residents Taxable Income or loss from Page 2, Worksheet A , Line 4.....................1.

,

,

.

00

2. Line 1 X .044625. Do not calculate and enter an amount if Line 1 is a loss!.....2.

,

,

.

00

3. Non-Residents Taxable Income or loss from Page 2, Worksheet B, Line 6...... .......3.

,

,

.

00

4. Line 3 X .038801. Do not calculate and enter an amount if Line 3 is a loss!............ .......4.

,

,

.

00

5. Total Tax Due (Line 2 plus Line 4)................... ............... ............... ............... ............... ........5.

,

,

.

00

6a. 60% Business Privilege Tax credit from Page 3, W orksheet K, Line 4................. ..............6a.

00

,

,

.

6b. Estimated payments and other credits from P age 3, Worksheet E, Line 4........ ............... ..6b.

00

,

,

.

6c. Total payments and credits (Line 6a plus Line 6b)........................... ............... ............... ....6c.

7. A mount of Tax Due (Line 5 less Line 6c); if Line 6c is greater than Line 5

00

,

,

.

enter dif ference on Line 10............. ............... ............... ............... ............... ............... ..........7.

00

8. Interest and Penalty

,

,

.

(Cumulative % from Instruction Sheet III multiplied by Line 7)................. ............... ..............8.

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

00

,

,

.

M ake check payable to: "City of Philadelphia".................... ............... ............... ............9.

00

10. Tax Overpaid. If Line 6c is greater than Line 5, enter dif ference here and on

,

,

.

the Estimated Tax Coupon (ENP-1), Page 8, Line 2... ............... ............... ............... ..........10.

11. Enter 50% of Page 2, W orksheet C, Line 3.

00

,

,

.

This line is not used to remit estimated payments................. ............... ............... .........11.

12. If Line 10 is greater than Line 11, enter the dif ference as the:

00

,

,

.

A. A mount to be refunded to the taxpayer. Do not file a separate Re fund Petition.....12A.

,

,

.

00

B. A mount of overpayment to be applied, up to the tax due, to the

2004 Business Privilege Tax Return.......................... ............... ............... ............... ....12B.

,

,

.

00

C. A mount of overpayment to be applied to the 2005 Net Prof its Tax............................. 12C.

Under penalties of perjury, as set forth in 18 Pa. C.S . §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief , they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature_______________________________________ Date________________ Phone #____________________

DO NOT STAPLE THIS RETURN

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1