Employee Refund Request Instructions

ADVERTISEMENT

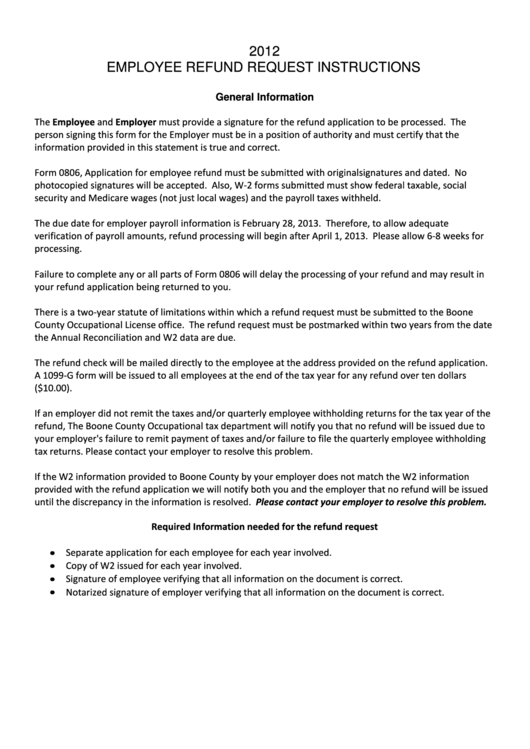

2012

EMPLOYEE REFUND REQUEST INSTRUCTIONS

General Information

The Employee and Employer must provide a signature for the refund application to be processed. The

person signing this form for the Employer must be in a position of authority and must certify that the

information provided in this statement is true and correct.

Form 0806, Application for employee refund must be submitted with original signatures and dated. No

photocopied signatures will be accepted. Also, W-2 forms submitted must show federal taxable, social

security and Medicare wages (not just local wages) and the payroll taxes withheld.

The due date for employer payroll information is February 28, 2013. Therefore, to allow adequate

verification of payroll amounts, refund processing will begin after April 1, 2013. Please allow 6-8 weeks for

processing.

Failure to complete any or all parts of Form 0806 will delay the processing of your refund and may result in

your refund application being returned to you.

There is a two-year statute of limitations within which a refund request must be submitted to the Boone

County Occupational License office. The refund request must be postmarked within two years from the date

the Annual Reconciliation and W2 data are due.

The refund check will be mailed directly to the employee at the address provided on the refund application.

A 1099-G form will be issued to all employees at the end of the tax year for any refund over ten dollars

($10.00).

If an employer did not remit the taxes and/or quarterly employee withholding returns for the tax year of the

refund, The Boone County Occupational tax department will notify you that no refund will be issued due to

your employer's failure to remit payment of taxes and/or failure to file the quarterly employee withholding

tax returns. Please contact your employer to resolve this problem.

If the W2 information provided to Boone County by your employer does not match the W2 information

provided with the refund application we will notify both you and the employer that no refund will be issued

until the discrepancy in the information is resolved. Please contact your employer to resolve this problem.

Required Information needed for the refund request

Separate application for each employee for each year involved.

Copy of W2 issued for each year involved.

Signature of employee verifying that all information on the document is correct.

Notarized signature of employer verifying that all information on the document is correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3