Instructions For Preparation Of Refund Requests

ADVERTISEMENT

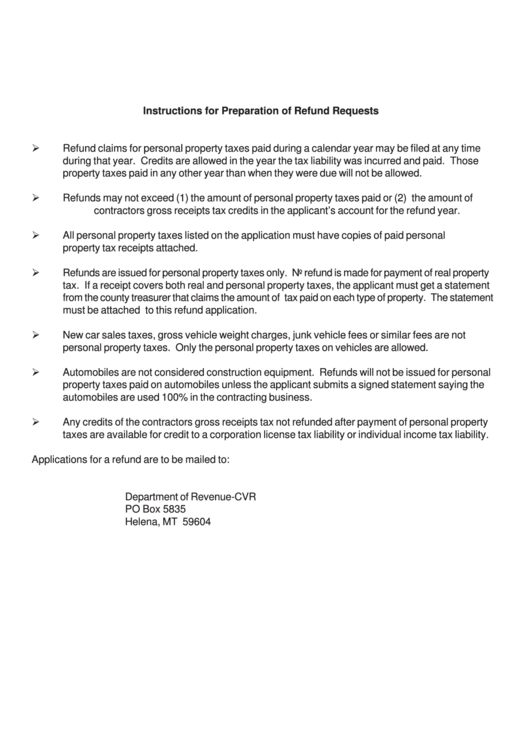

Instructions for Preparation of Refund Requests

Refund claims for personal property taxes paid during a calendar year may be filed at any time

during that year. Credits are allowed in the year the tax liability was incurred and paid. Those

property taxes paid in any other year than when they were due will not be allowed.

Refunds may not exceed (1) the amount of personal property taxes paid or (2) the amount of

contractors gross receipts tax credits in the applicant’s account for the refund year.

All personal property taxes listed on the application must have copies of paid personal

property tax receipts attached.

Refunds are issued for personal property taxes only. No refund is made for payment of real property

tax. If a receipt covers both real and personal property taxes, the applicant must get a statement

from the county treasurer that claims the amount of tax paid on each type of property. The statement

must be attached to this refund application.

New car sales taxes, gross vehicle weight charges, junk vehicle fees or similar fees are not

personal property taxes. Only the personal property taxes on vehicles are allowed.

Automobiles are not considered construction equipment. Refunds will not be issued for personal

property taxes paid on automobiles unless the applicant submits a signed statement saying the

automobiles are used 100% in the contracting business.

Any credits of the contractors gross receipts tax not refunded after payment of personal property

taxes are available for credit to a corporation license tax liability or individual income tax liability.

Applications for a refund are to be mailed to:

Department of Revenue-CVR

PO Box 5835

Helena, MT 59604

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1