1

2

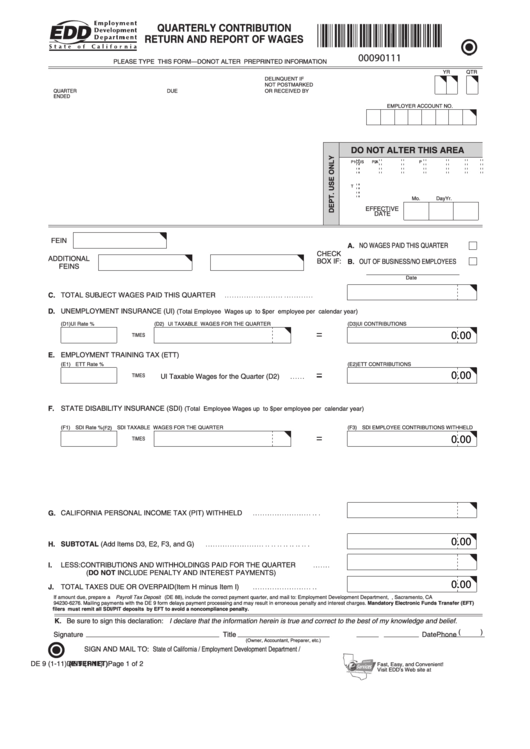

QUARTERLY CONTRIBUTION

3

RETURN AND REPORT OF WAGES

00090111

PLEASE TYPE THIS FORM—DO NOT ALTER PREPRINTED INFORMATION

YR

QTR

DELINQUENT IF

NOT POSTMARKED

QUARTER

DUE

OR RECEIVED BY

ENDED

EMPLOYER ACCOUNT NO.

11

12

13

14

DO NOT ALTER THIS AREA

15

16

P1

P2

C

P

U

S

A

17

18

T

19

Mo.

Day

Yr.

20

EFFECTIVE

21

DATE

22

23

FEIN

A.

24

NO WAGES PAID THIS QUARTER

CHECK

25

ADDITIONAL

BOX IF:

B.

OUT OF BUSINESS/NO EMPLOYEES

26

FEINS

27

Date

28

C.

TOTAL SUBJECT WAGES PAID THIS QUARTER

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30

D.

UNEMPLOYMENT INSURANCE (UI)

(Total Employee Wages up to $

per employee per calendar year)

31

(D1) UI Rate %

(D2)

UI TAXABLE WAGES FOR THE QUARTER

(D3) UI CONTRIBUTIONS

32

0.00

TIMES

33

34

E.

EMPLOYMENT TRAINING TAX (ETT)

35

(E1)

ETT Rate %

(E2) ETT CONTRIBUTIONS

36

0.00

TIMES

UI Taxable Wages for the Quarter (D2)

. . . . . .

37

38

39

F.

STATE DISABILITY INSURANCE (SDI)

(Total Employee Wages up to $

per employee per calendar year)

40

41

(F1)

SDI Rate %

(F2) SDI TAXABLE WAGES FOR THE QUARTER

(F3)

SDI EMPLOYEE CONTRIBUTIONS WITHHELD

42

0.00

TIMES

43

44

45

46

47

48

49

G.

CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD

. . . . . . . . . . . . . . . . . . . . . . . . . . .

50

51

52

0.00

H.

SUBTOTAL (Add Items D3, E2, F3, and G)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

53

54

I.

LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER

. . . . . . .

55

(DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS)

56

0.00

J.

TOTAL TAXES DUE OR OVERPAID

(Item H minus Item I)

. . . . . . . . . . . . . . . . . . . . . . . . . .

57

If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development Department, P.O. Box 826276, Sacramento, CA

58

94230-6276. Mailing payments with the DE 9 form delays payment processing and may result in erroneous penalty and interest charges. Mandatory Electronic Funds Transfer (EFT)

59

filers

must remit all SDI/PIT deposits

by EFT to avoid a noncompliance penalty.

60

K. Be sure to sign this declaration: I declare that the information herein is true and correct to the best of my knowledge and belief.

61

Phone (

)

Signature

Title

Date

62

(Owner, Accountant, Preparer, etc.)

SIGN AND MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento CA 95798-9071

63

64

DE 9 (1-11) (INTERNET)

DE 9 (1-11)

Page 1 of 2

Fast, Easy, and Convenient!

Visit EDD’s Web site at

65

66

1

1