Reset Form

Print Form

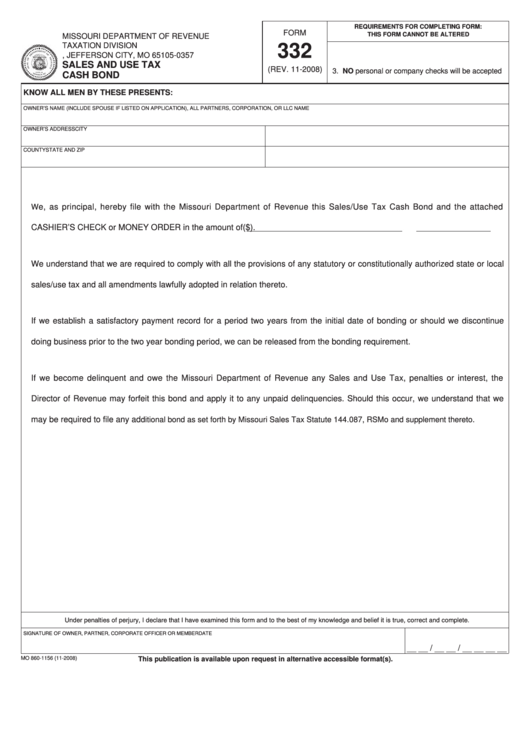

REQUIREMENTS FOR COMPLETING FORM:

FORM

THIS FORM CANNOT BE ALTERED

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

332

1. Form must be properly completed

P.O. BOX 357, JEFFERSON CITY, MO 65105-0357

2. Signed by applicant

SALES AND USE TAX

(REV. 11-2008)

3. NO personal or company checks will be accepted

CASH BOND

KNOW ALL MEN BY THESE PRESENTS:

OWNER’S NAME (INCLUDE SPOUSE IF LISTED ON APPLICATION), ALL PARTNERS, CORPORATION, OR LLC NAME

OWNER’S ADDRESS

CITY

COUNTY

STATE AND ZIP

e, as principal, hereby file with the Missouri Department of Revenue this Sales/Use Tax Cash Bond and the attached

W

CASHIER’S CHECK or MONEY ORDER in the amount of

($

).

We understand that we are required to comply with all the provisions of any statutory or constitutionally authorized state or local

sales/use tax and all amendments lawfully adopted in relation thereto.

If we establish a satisfactory payment record for a period two years from the initial date of bonding or should we discontinue

doing business prior to the two year bonding period, we can be released from the bonding requirement.

If we become delinquent and owe the Missouri Department of Revenue any Sales and Use Tax, penalties or interest, the

Director of Revenue may forfeit this bond and apply it to any unpaid delinquencies. Should this occur, we understand that we

may be required to file any ad

ditional bond as set forth by Missouri Sales Tax Statute 144.087, RSMo and supplement thereto.

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief it is true, correct and complete.

SIGNATURE OF OWNER, PARTNER, CORPORATE OFFICER OR MEMBER

DATE

__ __ / __ __ / __ __ __ __

MO 860-1156 (11-2008)

This publication is available upon request in alternative accessible format(s).

1

1