Instructions For Form 2374 - Michigan Tobacco Products Inventory Tax Return

ADVERTISEMENT

Instructions for Michigan Tobacco Products

Inventory Tax Return (Form 2374)

In accordance with House Bill 5248 - Bill to amend P.A. 327

know or cannot identify the wholesale price of the OTP,

of 1993 (the "Tobacco Products Tax Act") every licensed

you may use 50% of the OTP retail price (excluding sales

wholesaler, unclassified acquirer, secondary wholesaler,

tax) as the wholesale price.

cigarette vending machine operator and retailer must submit

an inventory of all cigarettes on hand as of the close of

Attention vending machine operators

business on July 31, 2002. Inventory will also need to be

Each vending machine operator should take a physical

submitted on all Other Tobacco Products (OTP) on hand as

inventory of as many machines as possible with available

of the close of business on July 31, 2002. The tax due on

personnel. If it is impossible to take a physical inventory of

your July 31 cigarette inventory will be $.025 per cigarette,

each vending machine, the vending machine operator may

or $.50 on a 20-cigarette pack, and $.625 on a 25-cigarette

pay a tobacco products floor tax based on one-half of the

pack. The tax due on your July 31 OTP will be $.04 on the

normal fill capacity for those machines that cannot be

wholesale price of the OTP. This form must be filed with the

physically inventoried on July 31, 2002.

Department of Treasury and the tax paid by September 3,

2002.

Normal fill capacity means the inventory as indicated on the

individual inventory record maintained for each vending

The amount of tax due on your July 31, 2002 inventory is

machine on location. For example, if the normal fill capacity

equal to the increase in the cigarette tax rate as follows:

of a machine is 200 cigars and the wholesale price of each

from 37.5 mills to 62.5 mills per cigarette, or from $.75 to

cigar is $2.50, the Department will permit the vending

$1.25 on a 20-cigarette pack and from $.9375 to $1.56 on a

machine operator to report a tax based on one-half of 200,

25-cigarette pack. All cigarettes sold as of August 1, 2002

or 100 cigars, at 4% of their wholesale price of $250 (100

are subject to the new tax rate.

cigars x $2.50) for a tobacco products floor tax due of $10.00

(4% x $250) for that machine.

The amount of tax due on your July 31, 2002 inventory is

equal to the increase in the other tobacco products tax rate

NOTE: That the alternative method outlined above only

as follows from 16% to 20% of the wholesale price. All other

applies to vending machines on location. A physical

tobacco products sold as of August 1, 2002 are subject to

inventory must be taken of all tobacco products stored

the new tax.

elsewhere.

Line 8 Special Instructions for Retailers, Secondary

Failure to file Form 2374 and/or remit the tax due may

Wholesalers and Vending Machine Operators:

result in the issuance of a computed intent to assess

for tax, penalty and interest in accordance with P.A. 122

The wholesale price of OTP is the established price for which

of 1941, as amended.

a manufacturer sells tobacco products to a distributor before

the allowance of any discount, trade allowance, rebate or

Forms and payments that are not timely filed may be

other reduction. In the absence of the established price, the

subject to assessment of penalty and interest for late

wholesale price is the manufacturer’s invoice price.

filing in accordance with P.A. 122 of 1941, as amended,

Generally, if the manufacturer’s established price or the

the Revenue Act.

manufacturer’s invoice price are not known, the tax would

be computed on the price at which the tobacco products

This form is subject to an audit. In the event of an audit you

were purchased, without allowance of any discount, trade

will be required to substantiate your return with the above

allowance, rebate or other reduction. However, for

information and the appropriate books and records.

purposes of this one-time floor tax only, if you do not

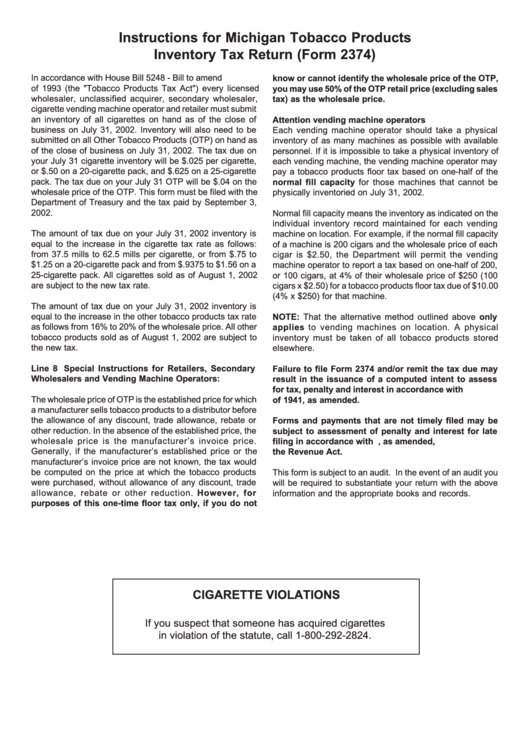

CIGARETTE VIOLATIONS

If you suspect that someone has acquired cigarettes

in violation of the statute, call 1-800-292-2824.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1