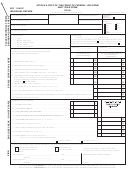

Bellwood-Antis School District And Municipality Individual Return Form - Bellwood-Antis School District Tax Office Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FILING FINAL RETURN FOR EARNED INCOME AND NET PROFITS TAX

Residents of Bellwood Borough, and Antis Township will remit 1% tax with this return-1/2% for school purposes and 1/2% for

township and borough purposes.

WHO MUST FILE - All individuals who have taxable earned income and/or net profits and resided in Antis

Township or Bellwood Borough. If you receive a form, it must be returned even if there are no earnings to

report. Failure of a taxpayer to receive a tax form shall not excuse the taxpayer from filing a return, or from

paying any tax due. Failure to file your return may subject you to a fine up to $500. Forms are available at the

tax office, or can be mailed upon request.

Note: The taxable period for this return is from January 1 through December 31, or any portion while a resident

of this district. Any individual who resided in the district for part of the year must pay based on the time

domiciled in the district.

TAXABLE INCOME (Use these items)

1. WAGES

6. FEES

2. SALARIES

7. NET PROFIT OF BUSINESS, PROFESSION

3. COMMISSIONS

AND OTHER ACTIVITY (SUBMIT SCHEDULES)

4. BONUSES

8. INCENTIVE PAYMENTS

5. TIPS-RECEIVED

9. SICK OR DISABILITY BENEFITS PAID BY EMPLOYER

NON-TAXABLE INCOME (Do Not Use)

8. DEATH BENEFITS

1. OLD AGE BENEFITS

2. RETIREMENT PAY

9. PROCEEDS OF INSURANCE POLICIES

10. GIFTS OR BEQUESTS

3. PENSION

11. INTEREST

4. SICK OR DISABILITY PAID

12. PUBLIC ASSISTANCE OR UNEMPLOYMENT COMPENSATION

THROUGH THIRD-PARTY INSURANCE

13. CLERGY HOUSING

5. CAPITAL GAINS OR LOSSES

6. ACTIVE MILITARY SERVICE PAY OR

14. QUALIFIED SECTION 125 PLAN DEDUCTIONS

BONUSES FOR ACTIVE MILITARY SERVICE

7. INCOME FROM STOCKS, TRUSTS, AND RENTAL OF DWELLINGS OWNED BY INDIVIDUALS NOT

LICENSED (OR CONDUCTING A BUSINESS) AS REALTORS BY THE COMMONWEALTH OF PENNSYLVANIA.

IMPORTANT INFORMATION

March 6, 1989 Supreme Court decision (O’Reilly vs Fox Chapel Borough and School District) now allows a taxpayer to

offset a net loss from a business (professional or farm) against earned income (as reported on a W-2). However, a

taxpayer is still not permitted to offset a net loss from one business against a net profit of another business.

If you should receive more than one tax return as a result of moving or marriage please return both forms to us, using the

correct form for filing and marking “duplicate” on the incorrect form.

A service fee of $20.00 will be assessed on all checks returned.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2