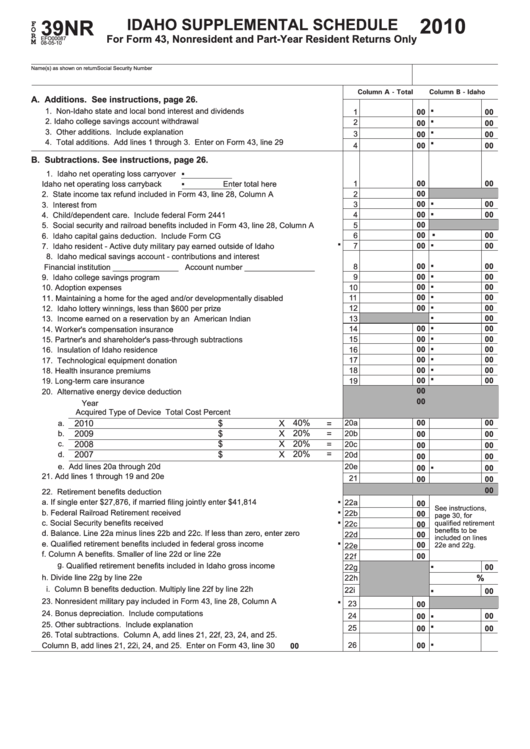

Form 39nr - Idaho Supplemental Schedule - 2010

ADVERTISEMENT

2010

39NR

IDAHO SUPPLEMENTAL SCHEDULE

F

O

R

For Form 43, Nonresident and Part-Year Resident Returns Only

M

EFO00087

08-05-10

Name(s) as shown on return

Social Security Number

Column A - Total

Column B - Idaho

.

A. Additions. See instructions, page 26.

.

1. Non-Idaho state and local bond interest and dividends ......................................

1

00

00

.

2. Idaho college savings account withdrawal ..........................................................

2

00

00

.

3. Other additions. Include explanation .................................................................

3

00

00

4. Total additions. Add lines 1 through 3. Enter on Form 43, line 29 .....................

4

00

00

B. Subtractions. See instructions, page 26.

.

.

1. Idaho net operating loss carryover

00

00

Idaho net operating loss carryback

Enter total here ................

1

. .

2

00

2. State income tax refund included in Form 43, line 28, Column A .......................

3

00

00

3. Interest from U.S. Government obligations ........................................................

00

00

4

4. Child/dependent care. Include federal Form 2441 .............................................

. .

00

5

5. Social security and railroad benefits included in Form 43, line 28, Column A ....

.

00

00

6. Idaho capital gains deduction. Include Form CG ..............................................

6

7

00

00

7. Idaho resident - Active duty military pay earned outside of Idaho ......................

. .

8. Idaho medical savings account - contributions and interest

00

00

8

Financial institution _______________ Account number ________________

.

00

00

9

9. Idaho college savings program ..........................................................................

. .

00

00

10. Adoption expenses .............................................................................................

10

11

00

00

11. Maintaining a home for the aged and/or developmentally disabled ...................

. .

12

00

00

12. Idaho lottery winnings, less than $600 per prize ................................................

13

00

13. Income earned on a reservation by an American Indian ...................................

. .

00

00

14

14. Worker's compensation insurance ......................................................................

00

00

15

15. Partner's and shareholder's pass-through subtractions .....................................

. .

00

00

16. Insulation of Idaho residence .............................................................................

16

17

00

00

17. Technological equipment donation .....................................................................

.

18

00

00

18. Health insurance premiums ................................................................................

00

00

19

19. Long-term care insurance ..................................................................................

00

20. Alternative energy device deduction

00

Year

Acquired

Type of Device

Total Cost

Percent

2010

$

X

40%

20a

00

00

a.

=

20%

2009

$

X

=

b.

20b

00

00

20%

2008

$

X

=

c.

20c

00

00

.

20%

=

d.

2007

$

X

20d

00

00

e. Add lines 20a through 20d .............................................................................

20e

00

00

21. Add lines 1 through 19 and 20e .........................................................................

21

00

00

. .

00

22. Retirement benefits deduction

a. If single enter $27,876, if married filing jointly enter $41,814 .........................

22a

00

.

See instructions,

b. Federal Railroad Retirement received ...........................................................

22b

00

page 30, for

c. Social Security benefits received ...................................................................

qualified retirement

22c

00

.

benefits to be

d. Balance. Line 22a minus lines 22b and 22c. If less than zero, enter zero .....

22d

00

included on lines

e. Qualified retirement benefits included in federal gross income .....................

00

22e

22e and 22g.

.

f. Column A benefits. Smaller of line 22d or line 22e ........................................

00

22f

g. Qualified retirement benefits included in Idaho gross income .......................

22g

00

.

h. Divide line 22g by line 22e .............................................................................

%

22h

.

i. Column B benefits deduction. Multiply line 22f by line 22h ...........................

22i

00

23. Nonresident military pay included in Form 43, line 28, Column A ......................

. .

23

00

24. Bonus depreciation. Include computations ........................................................

24

00

00

25. Other subtractions. Include explanation ............................................................

25

00

00

.

26. Total subtractions. Column A, add lines 21, 22f, 23, 24, and 25.

Column B, add lines 21, 22i, 24, and 25. Enter on Form 43, line 30 .................

26

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2