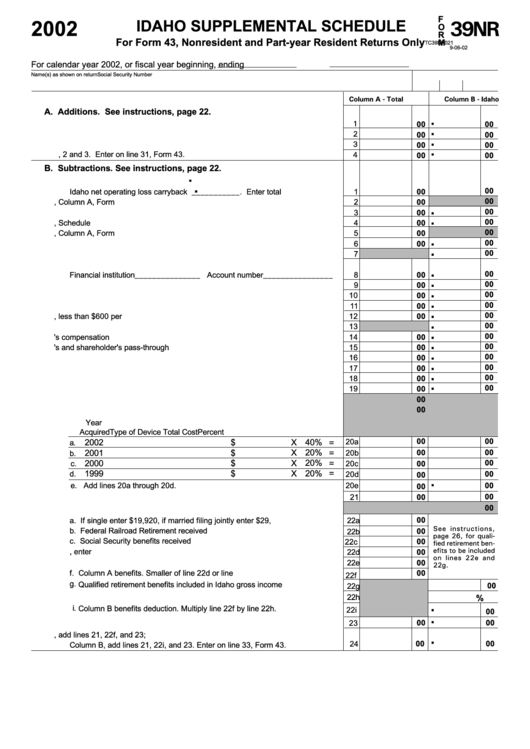

Form 39nr - Idaho Supplemental Schedule - 2002

ADVERTISEMENT

39NR

F

IDAHO SUPPLEMENTAL SCHEDULE

2002

O

R

For Form 43, Nonresident and Part-year Resident Returns Only

M

TC39NR021

9-06-02

For calendar year 2002, or fiscal year beginning

, ending

Name(s) as shown on return

Social Security Number

Column A - Total

Column B - Idaho

A. Additions. See instructions, page 22.

. .

1

1. Non-Idaho state and local bond interest and dividends ...................................

00

00

2

2. Idaho college savings account withdrawal .......................................................

. .

00

00

3

3. Other additions. Attach explanation. ...............................................................

00

00

4

4. Total additions. Add lines 1, 2 and 3. Enter on line 31, Form 43.

00

00

B. Subtractions. See instructions, page 22.

.

.

1. Idaho net operating loss carryover ___________.

00

Idaho net operating loss carryback ___________. Enter total here. ...............

1

00

00

2. State income tax refund included in line 30, Column A, Form 43 ......................

2

00

. .

00

3. Interest from U.S. Government obligations .......................................................

3

00

00

4. Child/dependent care. Attach federal Form 2441 or 1040A, Schedule 2. ........

4

00

00

5. Social security and railroad benefits included in line 30, Column A, Form 43 ....

5

00

. .

00

6. Idaho capital gains deduction. Attach Form CG. ..............................................

6

00

00

7. Idaho resident - Active duty military pay earned outside of Idaho .......................

7

8. Idaho medical savings account - contributions and interest.

. .

00

Financial institution_______________ Account number________________

8

00

00

9. Idaho college savings program .........................................................................

9

00

.

00

10. Adoption expenses ...........................................................................................

00

10

. .

00

11. Maintaining a home for the aged and/or developmentally disabled ....................

11

00

00

12. Idaho lottery winnings, less than $600 per prize ................................................

12

00

. .

00

13. Income earned on a reservation by an American Indian ...................................

13

00

14. Worker's compensation insurance ....................................................................

14

00

.

00

15. Partner's and shareholder's pass-through subtractions ....................................

15

00

. .

00

16. Insulation of Idaho residence ............................................................................

16

00

00

17. Technological equipment donation ...................................................................

17

00

. .

00

18. Health insurance premiums ..............................................................................

18

00

00

19. Long-term care insurance .................................................................................

19

00

00

20. Alternative energy device deduction.

00

Year

Acquired

Type of Device

Total Cost

Percent

00

00

40%

20a

2002

$

X

a.

=

X

20%

00

2001

$

=

20b

00

b.

$

X

20%

00

2000

=

c.

20c

00

1999

$

X

20%

=

00

d.

20d

.

00

e. Add lines 20a through 20d. .........................................................................

20e

00

00

21. Add lines 1 through 19 and 20e. .......................................................................

00

21

00

00

22. Retirement benefits deduction.

00

a. If single enter $19,920, if married filing jointly enter $29,880. .......................

22a

See instructions,

b. Federal Railroad Retirement received ..........................................................

22b

00

page 26, for quali-

c. Social Security benefits received ..................................................................

22c

00

fied retirement ben-

efits to be included

d. Balance. Line 22a minus lines 22b and 22c. If less than zero, enter zero. ....

00

22d

on lines 22e and

e. Qualified retirement benefits included in federal gross income ......................

22e

00

22g.

f. Column A benefits. Smaller of line 22d or line 22e. .......................................

00

22f

g. Qualified retirement benefits included in Idaho gross income ........................

22g

00

h. Divide line 22g by line 22e. ...........................................................................

22h

%

.

i.

Column B benefits deduction. Multiply line 22f by line 22h. ...........................

22i

.

00

23. Other subtractions. Attach explanation. ............................................................

23

00

00

.

24. Total subtractions. Column A, add lines 21, 22f, and 23;

00

00

24

Column B, add lines 21, 22i, and 23. Enter on line 33, Form 43.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2