0803010057

PA SCHEDULE OC

(09-08) (FI)

2008

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

START

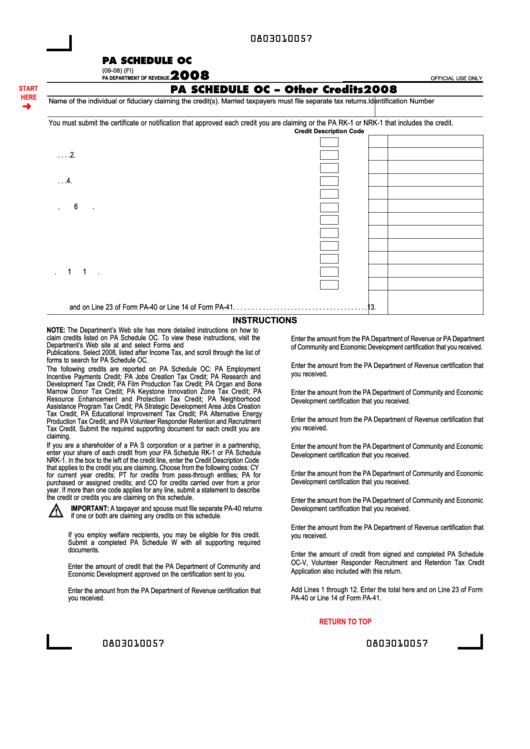

PA SCHEDULE OC – Other Credits

2008

HERE

Name of the individual or fiduciary claiming the credit(s). Married taxpayers must file separate tax returns.

Identification Number

You must submit the certificate or notification that approved each credit you are claiming or the PA RK-1 or NRK-1 that includes the credit.

Credit Description Code

1. PA Employment Incentive Payments Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

1.

2. PA Jobs Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

2.

3. PA Research and Development Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

3.

4. PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

4.

5. PA Organ and Bone Marrow Donor Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

5.

6. PA Keystone Innovation Zone Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

6.

7. PA Resource Enhancement and Protection Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

7.

8. PA Neighborhood Assistance Program Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

8.

9. PA Strategic Development Area Jobs Creation Tax Credit . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

9.

10. PA Educational Improvement Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

10.

11. PA Alternative Energy Production Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . .

11.

12. PA Volunteer Responder Retention and Recruitment Tax Credit . . . . . . . . . . . . . . . . . . .

. . . . . . .

12.

13. Total PA Other Credits. Add Lines 1 through 12. Enter the total here

and on Line 23 of Form PA-40 or Line 14 of Form PA-41. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

INSTRUCTIONS

NOTE: The Department’s Web site has more detailed instructions on how to

4.

PA Film Production Tax Credit

claim credits listed on PA Schedule OC. To view these instructions, visit the

Enter the amount from the PA Department of Revenue or PA Department

Department’s Web site at and select Forms and

of Community and Economic Development certification that you received.

Publications. Select 2008, listed after Income Tax, and scroll through the list of

5.

PA Organ and Bone Marrow Donor Tax Credit

forms to search for PA Schedule OC.

Enter the amount from the PA Department of Revenue certification that

The following credits are reported on PA Schedule OC: PA Employment

you received.

Incentive Payments Credit; PA Jobs Creation Tax Credit; PA Research and

Development Tax Credit; PA Film Production Tax Credit; PA Organ and Bone

6.

PA Keystone Innovation Zone Tax Credit

Marrow Donor Tax Credit; PA Keystone Innovation Zone Tax Credit; PA

Enter the amount from the PA Department of Community and Economic

Resource Enhancement and Protection Tax Credit; PA Neighborhood

Development certification that you received.

Assistance Program Tax Credit; PA Strategic Development Area Jobs Creation

7.

PA Resource Enhancement and Protection Tax Credit

Tax Credit; PA Educational Improvement Tax Credit; PA Alternative Energy

Enter the amount from the PA Department of Revenue certification that

Production Tax Credit; and PA Volunteer Responder Retention and Recruitment

you received.

Tax Credit. Submit the required supporting document for each credit you are

claiming.

8.

PA Neighborhood Assistance Program Tax Credit

If you are a shareholder of a PA S corporation or a partner in a partnership,

Enter the amount from the PA Department of Community and Economic

enter your share of each credit from your PA Schedule RK-1 or PA Schedule

Development certification that you received.

NRK-1. In the box to the left of the credit line, enter the Credit Description Code

9.

PA Strategic Development Area Jobs Creation Tax Credit

that applies to the credit you are claiming. Choose from the following codes: CY

Enter the amount from the PA Department of Community and Economic

for current year credits; PT for credits from pass-through entities; PA for

Development certification that you received.

purchased or assigned credits; and CO for credits carried over from a prior

year. If more than one code applies for any line, submit a statement to describe

10.

PA Educational Improvement Tax Credit

the credit or credits you are claiming on this schedule.

Enter the amount from the PA Department of Community and Economic

IMPORTANT: A taxpayer and spouse must file separate PA-40 returns

Development certification that you received.

if one or both are claiming any credits on this schedule.

11.

PA Alternative Energy Production Tax Credit

Enter the amount from the PA Department of Revenue certification that

1.

PA Employment Incentive Payments Credit

If you employ welfare recipients, you may be eligible for this credit.

you received.

Submit a completed PA Schedule W with all supporting required

12.

PA Volunteer Responder Retention and Recruitment Tax Credit

documents.

Enter the amount of credit from signed and completed PA Schedule

2.

PA Jobs Creation Tax Credit

OC-V, Volunteer Responder Recruitment and Retention Tax Credit

Enter the amount of credit that the PA Department of Community and

Application also included with this return.

Economic Development approved on the certification sent to you.

13.

Total PA Other Credits

3.

PA Research and Development Tax Credit

Add Lines 1 through 12. Enter the total here and on Line 23 of Form

Enter the amount from the PA Department of Revenue certification that

you received.

PA-40 or Line 14 of Form PA-41.

RETURN TO TOP

PRINT FORM

Reset Entire Form

0803010057

0803010057

1

1