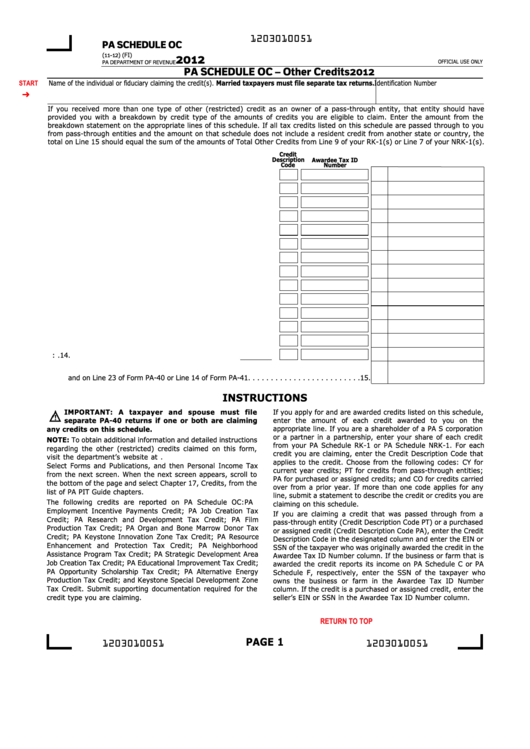

1203010051

PA SCHEDULE OC

(11-12) (FI)

2012

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

PA SCHEDULE OC – Other Credits

2012

START

Name of the individual or fiduciary claiming the credit(s). Married taxpayers must file separate tax returns. Identification Number

If you received more than one type of other (restricted) credit as an owner of a pass-through entity, that entity should have

provided you with a breakdown by credit type of the amounts of credits you are eligible to claim. Enter the amount from the

breakdown statement on the appropriate lines of this schedule. If all tax credits listed on this schedule are passed through to you

from pass-through entities and the amount on that schedule does not include a resident credit from another state or country, the

total on Line 15 should equal the sum of the amounts of Total Other Credits from Line 9 of your RK-1(s) or Line 7 of your NRK-1(s).

Credit

Description

Awardee Tax ID

Code

Number

1. PA Employment Incentive Payments Credit. . . . . . . . . . . . . . .

1.

2. PA Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. PA Research and Development Tax Credit. . . . . . . . . . . . . . . .

3.

4. PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . .

4.

5. PA Organ and Bone Marrow Donor Tax Credit. . . . . . . . . . . . .

5.

6. PA Keystone Innovation Zone Tax Credit . . . . . . . . . . . . . . . .

6.

7. PA Resource Enhancement and Protection Tax Credit . . . . . . .

7.

8. PA Neighborhood Assistance Program Tax Credit . . . . . . . . . .

8.

9. PA Strategic Development Area Job Creation Tax Credit . . . . .

9.

10. PA Educational Improvement Tax Credit . . . . . . . . . . . . . . . .

10.

11. PA Opportunity Scholarship Tax Credit . . . . . . . . . . . . . . . . . .

11.

12. PA Alternative Energy Production Tax Credit . . . . . . . . . . . . .

12.

13. Keystone Special Development Zone Tax Credit . . . . . . . . . . .

13.

14. Other restricted credits not listed above. Enter type:

.

14.

15. Total PA Other Credits. Add Lines 1 through 14. Enter the total here

and on Line 23 of Form PA-40 or Line 14 of Form PA-41. . . . . . . . . . . . . . . . . . . . . . . . .

15.

INSTRUCTIONS

IMPORTANT: A taxpayer and spouse must file

If you apply for and are awarded credits listed on this schedule,

enter the amount of each credit awarded to you on the

separate PA-40 returns if one or both are claiming

appropriate line. If you are a shareholder of a PA S corporation

any credits on this schedule.

or a partner in a partnership, enter your share of each credit

NOTE: To obtain additional information and detailed instructions

from your PA Schedule RK-1 or PA Schedule NRK-1. For each

regarding the other (restricted) credits claimed on this form,

credit you are claiming, enter the Credit Description Code that

visit the department’s website at

applies to the credit. Choose from the following codes: CY for

Select Forms and Publications, and then Personal Income Tax

current year credits; PT for credits from pass-through entities;

from the next screen. When the next screen appears, scroll to

PA for purchased or assigned credits; and CO for credits carried

the bottom of the page and select Chapter 17, Credits, from the

over from a prior year. If more than one code applies for any

list of PA PIT Guide chapters.

line, submit a statement to describe the credit or credits you are

The following credits are reported on PA Schedule OC: PA

claiming on this schedule.

Employment Incentive Payments Credit; PA Job Creation Tax

If you are claiming a credit that was passed through from a

Credit; PA Research and Development Tax Credit; PA Film

pass-through entity (Credit Description Code PT) or a purchased

Production Tax Credit; PA Organ and Bone Marrow Donor Tax

or assigned credit (Credit Description Code PA), enter the Credit

Credit; PA Keystone Innovation Zone Tax Credit; PA Resource

Description Code in the designated column and enter the EIN or

Enhancement and Protection Tax Credit; PA Neighborhood

SSN of the taxpayer who was originally awarded the credit in the

Assistance Program Tax Credit; PA Strategic Development Area

Awardee Tax ID Number column. If the business or farm that is

Job Creation Tax Credit; PA Educational Improvement Tax Credit;

awarded the credit reports its income on PA Schedule C or PA

PA Opportunity Scholarship Tax Credit; PA Alternative Energy

Schedule F, respectively, enter the SSN of the taxpayer who

Production Tax Credit; and Keystone Special Development Zone

owns the business or farm in the Awardee Tax ID Number

Tax Credit. Submit supporting documentation required for the

column. If the credit is a purchased or assigned credit, enter the

credit type you are claiming.

seller’s EIN or SSN in the Awardee Tax ID Number column.

RETURN TO TOP

Reset Entire Form

PRINT FORM

PAGE 1

1203010051

1203010051

1

1 2

2