Form Sr2 - Report To Determine Liability - 2000

ADVERTISEMENT

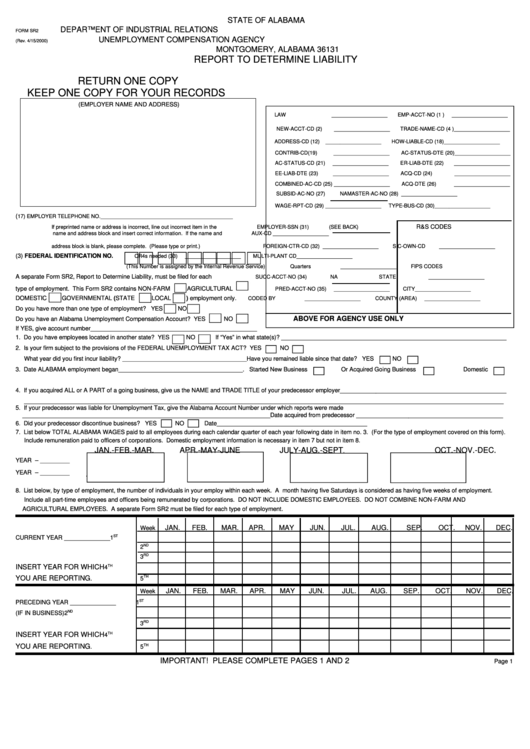

STATE OF ALABAMA

DEPARTMENT OF INDUSTRIAL RELATIONS

FORM SR2

UNEMPLOYMENT COMPENSATION AGENCY

(Rev. 4/15/2000)

MONTGOMERY, ALABAMA 36131

REPORT TO DETERMINE LIABILITY

RETURN ONE COPY

KEEP ONE COPY FOR YOUR RECORDS

(EMPLOYER NAME AND ADDRESS)

LAW

___________________

EMP-ACCT-NO (1 )

___________________

NEW-ACCT-CD (2)

___________________

TRADE-NAME-CD (4 )___________________

ADDRESS-CD (12)

___________________

HOW-LIABLE-CD (18)___________________

CONTRIB-CD(19)

___________________

AC-STATUS-DTE (20)___________________

AC-STATUS-CD (21)

___________________

ER-LIAB-DTE (22)

___________________

EE-LIAB-DTE (23)

___________________

ACQ-CD (24)

___________________

COMBINED-AC-CD (25) ___________________

ACQ-DTE (26)

___________________

SUBSID-AC-NO (27)

NA

MASTER-AC-NO (28) ___________________

WAGE-RPT-CD (29)

___________________

TYPE-BUS-CD (30)

___________________

(

17) EMPLOYER TELEPHONE NO._____________________________________________

R&S CODES

If preprinted name or address is incorrect, line out incorrect item in the

EMPLOYER-SSN (31)

(SEE BACK)

name and address block and insert correct information. If the name and

AUX-CD

___________________

address block is blank, please complete. (Please type or print.)

FOREIGN-CTR-CD (32) ___________________

SIC-OWN-CD

___________________

(3) FEDERAL IDENTIFICATION NO......

CR4s needed (33)

___________________

MULTI-PLANT CD

___________________

(This Number is assigned by the Internal Revenue Service)

Quarters

___________________

FIPS CODES

A separate Form SR2, Report to Determine Liability, must be filed for each

SUCC-ACCT-NO (34)

NA

STATE

___________________

type of employment. This Form SR2 contains NON-FARM

AGRICULTURAL

PRED-ACCT-NO (35)

___________________

CITY

___________________

DOMESTIC

GOVERNMENTAL (STATE

LOCAL

) employment only.

CODED BY

___________________

COUNTY (AREA)

___________________

Do you have more than one type of employment? YES

NO

ABOVE FOR AGENCY USE ONLY

Do you have an Alabama Unemployment Compensation Account? YES

NO

If YES, give account number___________________________________________________

1. Do you have employees located in another state? YES

NO

If “Yes” in what state(s)? _____________________________________________________________________

2. Is your firm subject to the provisions of the FEDERAL UNEMPLOYMENT TAX ACT? YES

NO

What year did you first incur liability? ______________________________________Have you remained liable since that date? YES

NO

3. Date ALABAMA employment began______________________________________. Started New Business

Or Acquired Going Business

Domestic

4. If you acquired ALL or A PART of a going business, give us the NAME and TRADE TITLE of your predecessor employer___________________________________________________

___________________________________________________________________________________________________________________________________________________

5. If your predecessor was liable for Unemployment Tax, give the Alabama Account Number under which reports were made

____________________________________________________________________________Date acquired from predecessor _____________________________________________

6. Did your predecessor discontinue business? YES

NO

Date______________________________________________

7. List below TOTAL ALABAMA WAGES paid to all employees during each calendar quarter of each year following date in item no. 3. (For the type of employment covered on this form).

Include remuneration paid to officers of corporations. Domestic employment information is necessary in item 7 but not in item 8.

JAN.-FEB.-MAR.

APR.-MAY-JUNE

JULY-AUG.-SEPT

OCT.-NOV.-DEC.

.

YEAR – _________

YEAR – _________

8. List below, by type of employment, the number of individuals in your employ within each week. A month having five Saturdays is considered as having five weeks of employment.

Include all part-time employees and officers being remunerated by corporations. DO NOT INCLUDE DOMESTIC EMPLOYEES. DO NOT COMBINE NON-FARM AND

AGRICULTURAL EMPLOYEES. A separate Form SR2 must be filed for each type of employment.

JAN.

FEB.

MAR.

APR.

MAY

JUN.

JUL.

AUG.

SEP.

OCT.

NOV.

DEC.

Week

ST

CURRENT YEAR ______________

1

ND

2

RD

3

INSERT YEAR FOR WHICH

TH

4

TH

YOU ARE REPORTING

.

5

JAN.

FEB.

MAR.

APR.

MAY

JUN.

JUL.

AUG.

SEP.

OCT.

NOV.

DEC.

Week

ST

PRECEDING YEAR ______________

1

ND

(IF IN BUSINESS)

2

RD

3

TH

INSERT YEAR FOR WHICH

4

YOU ARE REPORTING

TH

.

5

IMPORTANT! PLEASE COMPLETE PAGES 1 AND 2

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2