Form Mo-1040 And Mo-A Instructions - Missouri Department Of Revenue - 2006

ADVERTISEMENT

2006 FORM MO-1040 &

FORM MO-A INSTRUCTIONS

IMPORTANT FILING

your Missouri return to get a refund of your

If you receive an extension of time to file

Missouri withholding. If you are not required

your federal income tax return, you will

to file a Missouri return and you do not antici-

automatically be granted an extension of

INFORMATION

pate an increase in income, you may change

time to file your Missouri income tax

your Form MO W-4 to “exempt” so your

return, provided you do not expect to owe

This information is for guidance only and

employer will not withhold Missouri tax.

any additional Missouri income tax.

does not state the complete law.

Attach a copy of your federal extension

W

T

F

HEN

O

ILE

(Federal Form 4868) with your Missouri

F

R

ILING

EQUIREMENTS

income tax return when you file.

Calendar year taxpayers must file no later

You do not have to file a Missouri return if

than April 16, 2007. Late filing will subject

you are not required to file a federal return.

If you expect to owe Missouri income tax,

taxpayers to charges for interest and addi-

file Form MO-60 with your payment by the

If you are required to file a federal return,

tions to tax. Fiscal year filers must file no

original due date of the return.

you may not have to file a Missouri return if

later than the 15th day of the fourth month

you:

Remember: An extension of time to file

following the close of their taxable year.

• are a resident and have less than

does not extend the time to pay. A 5 per-

$1,200 of Missouri adjusted gross

cent additions to tax will apply if the tax is

E

T

F

XTENSION OF

IME TO

ILE

income;

not paid by the original return’s due date,

You are not required to file an extension if

• are a nonresident with less than $600

provided your return is filed by the exten-

you do not expect to owe additional

of Missouri income; or

sion date.

income tax or if you anticipate receiving a

• have Missouri adjusted gross income

refund.

If you wish to file a Missouri

less than the amount of your standard

extension, and do not expect to owe

L

F

P

ATE

ILING AND

AYMENT

deduction plus the exemption amount

Missouri income tax, you may file an

Simple interest is charged on all delinquent

for your filing status.

extension by filing Form MO-60, Applica-

taxes. The rate will be updated annually

Note: If you are not required to file a Missouri

tion for Extension of Time to File. An auto-

and can be found on our web site at

return, but you received a Form W-2 stating

matic extension of time to file will be

you had Missouri tax withheld, you must file

granted until October 15, 2007.

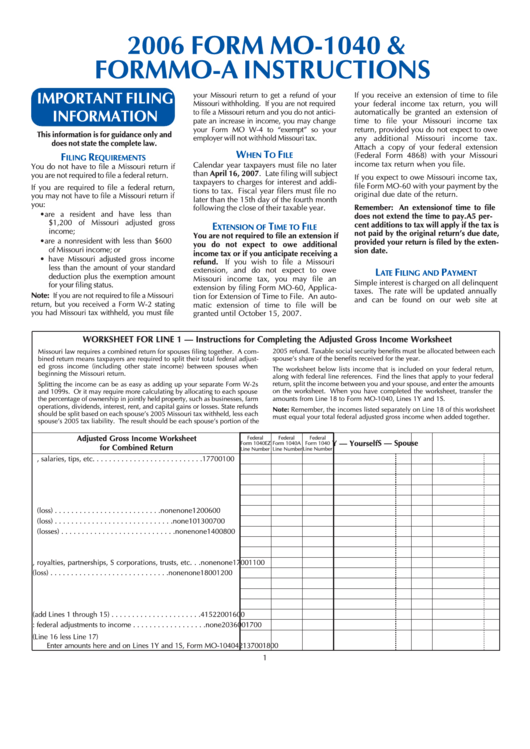

WORKSHEET FOR LINE 1 — Instructions for Completing the Adjusted Gross Income Worksheet

Missouri law requires a combined return for spouses filing together. A com-

2005 refund. Taxable social security benefits must be allocated between each

spouse's share of the benefits received for the year.

bined return means taxpayers are required to split their total federal adjust-

ed gross income (including other state income) between spouses when

The worksheet below lists income that is included on your federal return,

beginning the Missouri return.

along with federal line references. Find the lines that apply to your federal

return, split the income between you and your spouse, and enter the amounts

Splitting the income can be as easy as adding up your separate Form W-2s

on the worksheet. When you have completed the worksheet, transfer the

and 1099s. Or it may require more calculating by allocating to each spouse

amounts from Line 18 to Form MO-1040, Lines 1Y and 1S.

the percentage of ownership in jointly held property, such as businesses, farm

operations, dividends, interest, rent, and capital gains or losses. State refunds

Note: Remember, the incomes listed separately on Line 18 of this worksheet

should be split based on each spouse's 2005 Missouri tax withheld, less each

must equal your total federal adjusted gross income when added together.

spouse's 2005 tax liability. The result should be each spouse's portion of the

Adjusted Gross Income Worksheet

Federal

Federal

Federal

S — Spouse

Y — Yourself

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

1

00

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

2

00

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9a

9a

00

3

00

4. State and local income tax refunds . . . . . . . . . . . . . . . . . .

none

none

10

00

4

00

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

5

00

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

6

00

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10

13

00

7

00

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

8

00

9. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

15b

00

9

00

10. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . .

none

12b

16b

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. . .

none

none

17

00

11

00

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

12

00

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . .

3

13

19

00

13

00

14. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . .

none

14b

20b

00

14

00

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

15

00

16. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . .

4

15

22

00

16

00

17. Less: federal adjustments to income . . . . . . . . . . . . . . . . . .

none

20

36

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

Enter amounts here and on Lines 1Y and 1S, Form MO-1040

4

21

37

00

18

00

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17