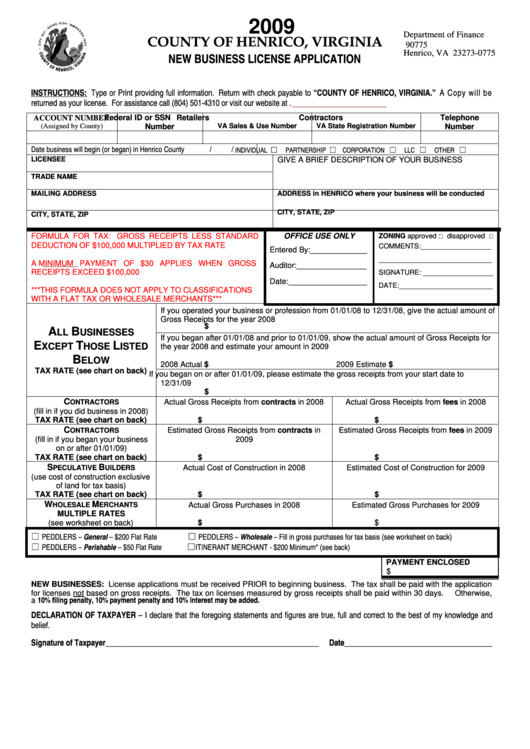

New Business License Application - County Of Henrico, Virginia - 2009

ADVERTISEMENT

2009

Department of Finance

COUNTY OF HENRICO, VIRGINIA

P.O. Box 90775

Henrico, VA 23273-0775

NEW BUSINESS LICENSE APPLICATION

INSTRUCTIONS: Type or Print providing full information. Return with check payable to “COUNTY OF HENRICO, VIRGINIA.” A Copy will be

returned as your license. For assistance call (804) 501-4310 or visit our website at

ACCOUNT NUMBER

Federal ID or SSN

Retailers

Contractors

Telephone

VA Sales & Use Number

VA State Registration Number

(Assigned by County)

Number

Number

Date business will begin (or began) in Henrico County

/

/

INDIVIDUAL

PARTNERSHIP

CORPORATION

LLC

OTHER

LICENSEE

GIVE A BRIEF DESCRIPTION OF YOUR BUSINESS

TRADE NAME

MAILING ADDRESS

ADDRESS in HENRICO where your business will be conducted

CITY, STATE, ZIP

CITY, STATE, ZIP

FORMULA FOR TAX: GROSS RECEIPTS LESS STANDARD

OFFICE USE ONLY

ZONING approved

disapproved

DEDUCTION OF $100,000 MULTIPLIED BY TAX RATE

COMMENTS:__________________

Entered By:_____________

_____________________________

A MINIMUM PAYMENT OF $30 APPLIES WHEN GROSS

Auditor:________________

RECEIPTS EXCEED $100,000

SIGNATURE: __________________

Date:__________________

DATE:________________________

***THIS FORMULA DOES NOT APPLY TO CLASSIFICATIONS

WITH A FLAT TAX OR WHOLESALE MERCHANTS***

If you operated your business or profession from 01/01/08 to 12/31/08, give the actual amount of

Gross Receipts for the year 2008

$

A

B

LL

USINESSES

If you began after 01/01/08 and prior to 01/01/09, show the actual amount of Gross Receipts for

E

T

L

XCEPT

HOSE

ISTED

the year 2008 and estimate your amount in 2009

B

ELOW

2008 Actual $

2009 Estimate $

TAX RATE (see chart on back)

If you began on or after 01/01/09, please estimate the gross receipts from your start date to

12/31/09

$

C

Actual Gross Receipts from contracts in 2008

Actual Gross Receipts from fees in 2008

ONTRACTORS

(fill in if you did business in 2008)

TAX RATE (see chart on back)

$

$

C

Estimated Gross Receipts from contracts in

Estimated Gross Receipts from fees in 2009

ONTRACTORS

(fill in if you began your business

2009

on or after 01/01/09)

TAX RATE (see chart on back)

$

$

S

B

Actual Cost of Construction in 2008

Estimated Cost of Construction for 2009

PECULATIVE

UILDERS

(use cost of construction exclusive

of land for tax basis)

TAX RATE (see chart on back)

$

$

W

M

Actual Gross Purchases in 2008

Estimated Gross Purchases for 2009

HOLESALE

ERCHANTS

MULTIPLE RATES

$

$

(see worksheet on back)

PEDDLERS – General – $200 Flat Rate

PEDDLERS – Wholesale – Fill in gross purchases for tax basis (see worksheet on back)

PEDDLERS – Perishable – $50 Flat Rate

ITINERANT MERCHANT - $200 Minimum* (see back)

PAYMENT ENCLOSED

$

NEW BUSINESSES: License applications must be received PRIOR to beginning business. The tax shall be paid with the application

for licenses not based on gross receipts. The tax on licenses measured by gross receipts shall be paid within 30 days.

Otherwise,

a 10% filing penalty, 10% payment penalty and 10% interest may be added.

DECLARATION OF TAXPAYER – I declare that the foregoing statements and figures are true, full and correct to the best of my knowledge and

belief.

Signature of Taxpayer_________________________________________________

Date__________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4