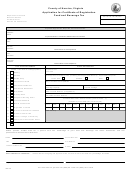

New Business License Application - County Of Henrico, Virginia - 2009 Page 2

ADVERTISEMENT

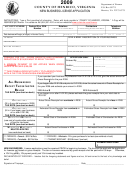

COUNTY LICENSE RATES ONLY WHEN TAX BASE EXCEEDS $100,000

(Exception: Most businesses subject to the flat tax are located on the front of this form.)

Amusement Promoter

$.20 per $100 of gross receipts or $30, whichever

Itinerant Merchant*

$200 flat tax or $.20 per $100 of gross

is greater.

(see front)

receipts, whichever is greater.

$.20 per $100 of gross receipts or $30, whichever

$30 flat tax.

Business & Misc. Service

Peddler – Ice, Wood, Coal

is greater.

$200 plus $.20 per $100 of gross receipts from

$15 flat tax.

Coin Machine Operator

Peddler – Seafood (Catch)

machines (Amusement, Music, etc.).

Commission Merchant

$.20 per $100 of gross receipts or $30, whichever

Personal Service

$.20 per $100 of gross receipts or $30,

is greater.

(includes Taxi)

whichever is greater.

Contractor

$.15 per $100 of gross receipts or $30, whichever

Professional Service

$.20 per $100 of gross receipts or $30,

(see notice below)

is greater.

whichever is greater.

Contractor (Fee Basis)

$1.50 per $100 of gross fees or $30, whichever is

Retail Merchant

$.20 per $100 of gross receipts or $30,

(see notice below)

greater.

whichever is greater.

$.15 per $100 of cost of construction (excluding

$250 per week.

Speculative Builder

Sales Promotion Show

(see notice below)

cost of land) or $30, whichever is greater.

$.20 per $100 of gross receipts (excluding

See Worksheet Below.

First Mortgage Loan &

Wholesale Merchant

Money Lender

principal) or $30, whichever is greater.

$.20 per $100 of gross receipts or $30, whichever

$.50 per $100 of gross receipts.

Hotel & Motel

Utility-Water, Telephone, Heat,

is greater.

Light and Gas

Sec. 20-358. Levy of Tax.

There shall be levied and collected for each license tax year, or for such other period of time as may be specifically provided in this article, the

license taxes as set forth in this article. The taxes imposed by the provisions of this article are in all cases imposed upon the privilege of doing

business in the county, including all phases and activities of the business, trade, or occupation conducted in the county.

Sec. 20-351. Definitions.

Gross receipts of the business means the gross sales of merchandise and the gross receipts of the business, occupation, or profession from all

earnings, fees, commissions, brokerage charges and rentals, and from all income whatsoever arising from or growing out of the conduct of the

business, occupation, or profession licensed in this article during the license year immediately preceding the license year for which the tax is being

computed, without any deductions whatsoever, unless otherwise expressly provided by the State or County Code.

NOTICE TO CONTRACTORS:

Extract of Chapter 11, Title 54.1 of the Virginia State Code – Any contractor who undertakes to bid upon, accept, or offers to accept a

single contract or project of $1,000 or more, must register with the State Board of Contractors.

Contractors must provide certificates of compliance with Worker’s Compensation Regulations. (This amendment requires that no

business license be issued-or reissued-to a contractor without proof of compliance with Chapter 8 of Title 65.2 of the Code of

Virginia.)

Contractor Affirmation: (To be signed by all contractors not required to register with the State Board of Contractors.)

I do affirm that I have read the extract of Chapter 11, Title 54.1 of the Virginia State Code above and that I do not meet

the requirements for registration.

SIGNATURE OF TAXPAYER (CONTRACTOR)

DATE

WHOLESALE MERCHANTS WORKSHEET

WHOLESALE MERCHANTS AND DISTRIBUTORS, WHOLESALE PEDDLERS, AND

JUNK/PAPER DEALERS WORKSHEET

$29,035,076

TOTAL GROSS PURCHASES

__________________________2008

TOTAL GROSS PURCHASES (Less $100,000 Standard Deduction)

(Less $100,000 Standard Deduction)

(Multiply rates below X purchases to determine TAX DUE)

(Multiply rates below X purchases to determine TAX DUE)

PURCHASES

TAX

PURCHASES

TAX

(Breakdown)

(Breakdown)

$1 to $10,000 purchases ($25 min. tax)

=

$25.00

$1 to $10,000 purchases ($25 min. tax)

$

10,000

=

$

25.00

$10,001 to $5,000,000 ($.20 per $100)

=

$10,001 to $5,000,000 ($.20 per $100)

$4,989,999

=

$ 9,980.00

$5,000,001 to $15,000,000 ($.15 per $100)

=

$5,000,001 to $15,000,000 ($.15 per $100)

$9,999,999

=

$15,000.00

$15,000,001 to $25,000,000 ($.10 per $100)

=

$15,000,001 to $25,000,000 ($.10 per $100)

$9,999,999

=

$10,000.00

$25,000,001 to $50,000,000 ($.05 per $100)

=

$25,000,001 to $50,000,000 ($.05 per $100)

$4,035,079

=

$ 2,018.00

$50,000,001 to $100,000,000 ($.025 per $100)

=

$50,000,001 to $100,000,000 ($.025 per $100)

=

$100,000,001 and over ($.0125 per $100)

=

$100,000,001 and over ($.0125 per $100)

=

TOTALS

$29,035,076

TOTALS

$37,023.00

Wholesale Tax Base

Tax Amount

Wholesale Tax Base

Tax Amount

After Standard Deduction

After Standard Deduction

Enter this total on the

Enter this total on the

License Application

License Application

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4