Business Extension Request Form - 2006

ADVERTISEMENT

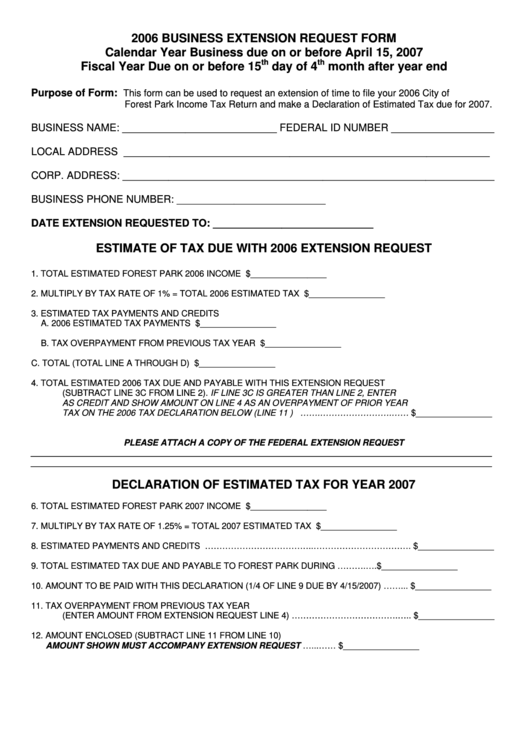

2006 BUSINESS EXTENSION REQUEST FORM

Calendar Year Business due on or before April 15, 2007

th

th

Fiscal Year Due on or before 15

day of 4

month after year end

Purpose of Form:

This form can be used to request an extension of time to file your 2006 City of

Forest Park Income Tax Return and make a Declaration of Estimated Tax due for 2007.

BUSINESS NAME: ___________________________ FEDERAL ID NUMBER __________________

LOCAL ADDRESS ________________________________________________________________

CORP. ADDRESS: _________________________________________________________________

BUSINESS PHONE NUMBER: __________________________

DATE EXTENSION REQUESTED TO: ____________________________

ESTIMATE OF TAX DUE WITH 2006 EXTENSION REQUEST

1. TOTAL ESTIMATED FOREST PARK 2006 INCOME ...................................................................... $________________

2. MULTIPLY BY TAX RATE OF 1% = TOTAL 2006 ESTIMATED TAX ............................................. $________________

3. ESTIMATED TAX PAYMENTS AND CREDITS

A. 2006 ESTIMATED TAX PAYMENTS ......................................................... $________________

B. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR .............................. $________________

C. TOTAL (TOTAL LINE A THROUGH D) ........................................................................................$________________

4. TOTAL ESTIMATED 2006 TAX DUE AND PAYABLE WITH THIS EXTENSION REQUEST

(SUBTRACT LINE 3C FROM LINE 2). IF LINE 3C IS GREATER THAN LINE 2, ENTER

AS CREDIT AND SHOW AMOUNT ON LINE 4 AS AN OVERPAYMENT OF PRIOR YEAR

TAX ON THE 2006 TAX DECLARATION BELOW (LINE 11 ) …….…………………….…… $________________

PLEASE ATTACH A COPY OF THE FEDERAL EXTENSION REQUEST

_________________________________________________________________________________________________

_________________________________________________________________________________________________

DECLARATION OF ESTIMATED TAX FOR YEAR 2007

6. TOTAL ESTIMATED FOREST PARK 2007 INCOME ...................................................................... $________________

7. MULTIPLY BY TAX RATE OF 1.25% = TOTAL 2007 ESTIMATED TAX ........................................ $________________

8. ESTIMATED PAYMENTS AND CREDITS ………………………………..……………………………. $________________

9. TOTAL ESTIMATED TAX DUE AND PAYABLE TO FOREST PARK DURING 2007.....……….…. $________________

10. AMOUNT TO BE PAID WITH THIS DECLARATION (1/4 OF LINE 9 DUE BY 4/15/2007) ……... $________________

11. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR

(ENTER AMOUNT FROM EXTENSION REQUEST LINE 4) ……………………………….….. $________________

12. AMOUNT ENCLOSED (SUBTRACT LINE 11 FROM LINE 10)

AMOUNT SHOWN MUST ACCOMPANY EXTENSION REQUEST .........…............……............. $________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1