Business Extension Request Form - 2011

ADVERTISEMENT

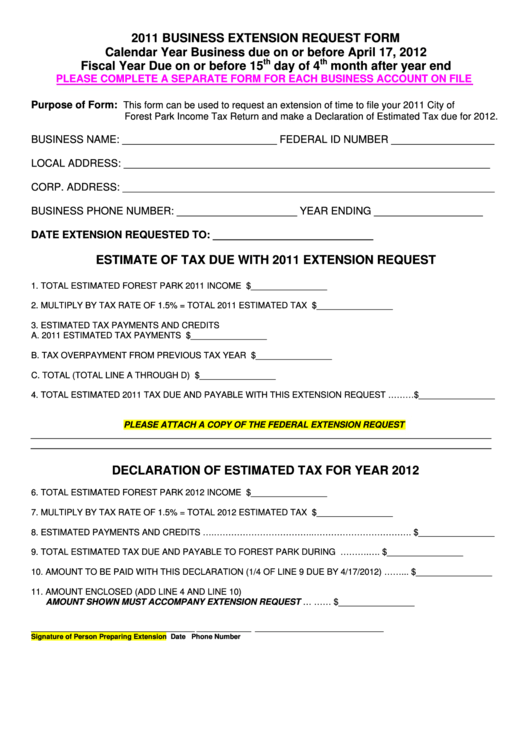

2011 BUSINESS EXTENSION REQUEST FORM

Calendar Year Business due on or before April 17, 2012

th

th

Fiscal Year Due on or before 15

day of 4

month after year end

PLEASE COMPLETE A SEPARATE FORM FOR EACH BUSINESS ACCOUNT ON FILE

Purpose of Form:

This form can be used to request an extension of time to file your 2011 City of

Forest Park Income Tax Return and make a Declaration of Estimated Tax due for 2012.

BUSINESS NAME: ___________________________ FEDERAL ID NUMBER __________________

LOCAL ADDRESS: ________________________________________________________________

CORP. ADDRESS: _________________________________________________________________

BUSINESS PHONE NUMBER: _____________________

YEAR ENDING ___________________

DATE EXTENSION REQUESTED TO: ____________________________

ESTIMATE OF TAX DUE WITH 2011 EXTENSION REQUEST

1. TOTAL ESTIMATED FOREST PARK 2011 INCOME ...................................................................... $________________

2. MULTIPLY BY TAX RATE OF 1.5% = TOTAL 2011 ESTIMATED TAX ....................................... $________________

3. ESTIMATED TAX PAYMENTS AND CREDITS

A. 2011 ESTIMATED TAX PAYMENTS ......................................................... $________________

B. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR .............................. $________________

C. TOTAL (TOTAL LINE A THROUGH D) ........................................................................................$________________

4. TOTAL ESTIMATED 2011 TAX DUE AND PAYABLE WITH THIS EXTENSION REQUEST ………$________________

PLEASE ATTACH A COPY OF THE FEDERAL EXTENSION REQUEST

_________________________________________________________________________________________________

_________________________________________________________________________________________________

DECLARATION OF ESTIMATED TAX FOR YEAR 2012

6. TOTAL ESTIMATED FOREST PARK 2012 INCOME ...................................................................... $________________

7. MULTIPLY BY TAX RATE OF 1.5% = TOTAL 2012 ESTIMATED TAX .......................................... $________________

8. ESTIMATED PAYMENTS AND CREDITS ….……………………………..……………………………. $________________

9. TOTAL ESTIMATED TAX DUE AND PAYABLE TO FOREST PARK DURING 2012.....……….…. $________________

10. AMOUNT TO BE PAID WITH THIS DECLARATION (1/4 OF LINE 9 DUE BY 4/17/2012) ……... $________________

11. AMOUNT ENCLOSED (ADD LINE 4 AND LINE 10)

AMOUNT SHOWN MUST ACCOMPANY EXTENSION REQUEST .........…............……............. $________________

__________________________________________

______________

_________________________________

Signature of Person Preparing Extension

Date

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1