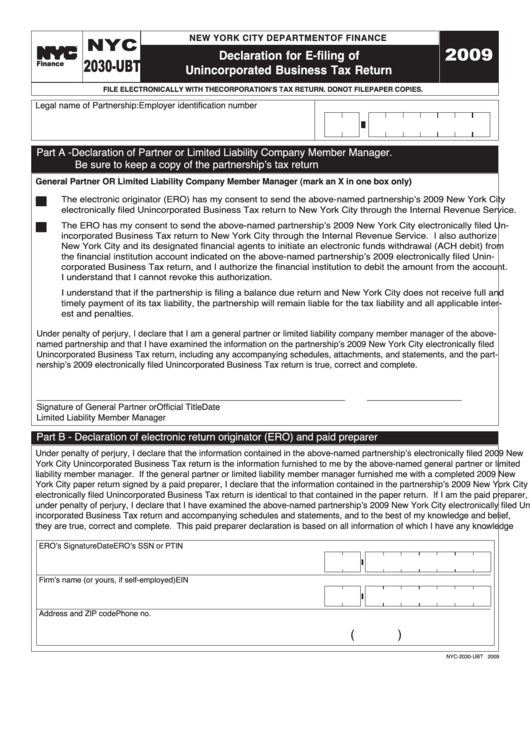

Form Nyc-2030-Ubt - Declaration For E-Filing Of Unincorporated Business Tax Return - 2009

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

NYC

Declaration for E-filing of

2009

2030-UBT

Unincorporated Business Tax Return

TM

Finance

FILE ELECTRONICALLY WITH THE CORPORATIONʼS TAX RETURN. DO NOT FILE PAPER COPIES.

Legal name of Partnership:

Employer identification number

Part A - Declaration of Partner or Limited Liability Company Member Manager.

Be sure to keep a copy of the partnershipʼs tax return

General Partner OR Limited Liability Company Member Manager (mark an X in one box only)

The electronic originator (ERO) has my consent to send the above-named partnershipʼs 2009 New York City

I I

electronically filed Unincorporated Business Tax return to New York City through the Internal Revenue Service.

The ERO has my consent to send the above-named partnershipʼs 2009 New York City electronically filed Un-

I I

incorporated Business Tax return to New York City through the Internal Revenue Service. I also authorize

New York City and its designated financial agents to initiate an electronic funds withdrawal (ACH debit) from

the financial institution account indicated on the above-named partnershipʼs 2009 electronically filed Unin-

corporated Business Tax return, and I authorize the financial institution to debit the amount from the account.

I understand that I cannot revoke this authorization.

I understand that if the partnership is filing a balance due return and New York City does not receive full and

timely payment of its tax liability, the partnership will remain liable for the tax liability and all applicable inter-

est and penalties.

Under penalty of perjury, I declare that I am a general partner or limited liability company member manager of the above-

named partnership and that I have examined the information on the partnershipʼs 2009 New York City electronically filed

Unincorporated Business Tax return, including any accompanying schedules, attachments, and statements, and the part-

nershipʼs 2009 electronically filed Unincorporated Business Tax return is true, correct and complete.

________________________________________

_________________________

____________________

Signature of General Partner or

Official Title

Date

Limited Liability Member Manager

Part B - Declaration of electronic return originator (ERO) and paid preparer

Under penalty of perjury, I declare that the information contained in the above-named partnershipʼs electronically filed 2009 New

York City Unincorporated Business Tax return is the information furnished to me by the above-named general partner or limited

liability member manager. If the general partner or limited liability member manager furnished me with a completed 2009 New

York City paper return signed by a paid preparer, I declare that the information contained in the partnershipʼs 2009 New York City

electronically filed Unincorporated Business Tax return is identical to that contained in the paper return. If I am the paid preparer,

under penalty of perjury, I declare that I have examined the above-named partnershipʼs 2009 New York City electronically filed Un-

incorporated Business Tax return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. This paid preparer declaration is based on all information of which I have any knowledge.

EROʼs Signature

Date

EROʼs SSN or PTIN

Firmʼs name (or yours, if self-employed)

EIN

Address and ZIP code

Phone no.

(

)

NYC-2030-UBT 2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1