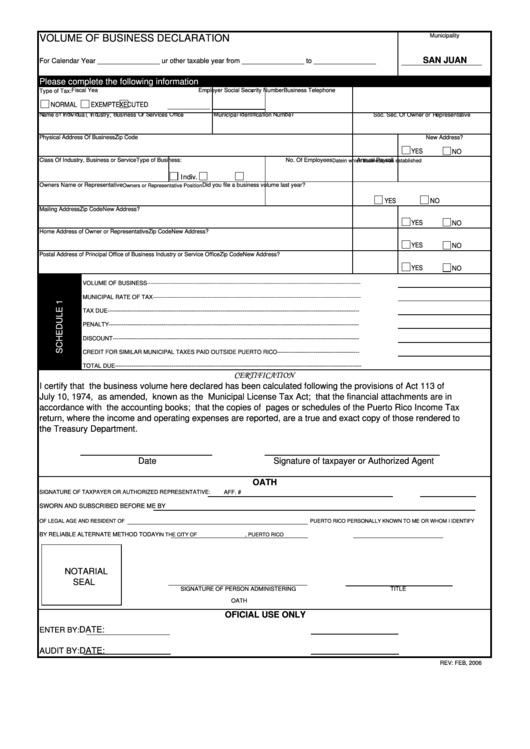

Volume Of Business Declaration Form - San Juan

ADVERTISEMENT

Municipality

VOLUME OF BUSINESS DECLARATION

SAN JUAN

For Calendar Year ________________ ur other taxable year from ________________ to ________________

Please complete the following information

Fiscal Year

Business Telephone

Employer Social Security Number

Type of Tax:

NORMAL

EXEMPT

EXECUTED

Name of Individual, Industry, Business Or Services Office

Municipal Identification Number

Soc. Sec. Of Owner or Representative

Physical Address Of Business

Zip Code

New Address?

YES

NO

Class Of Industry, Business or Service

Type of Business:

No. Of Employees

Annual Payroll

Datein which business was established

Indiv.

Soc.

Corp.

Owners Name or Representative

Did you file a business volume last year?

Owners or Representative Position

YES

NO

Mailing Address

Zip Code

New Address?

YES

NO

Home Address of Owner or Representative

Zip Code

New Address?

YES

NO

Postal Address of Principal Office of Business Industry or Service Office

Zip Code

New Address?

YES

NO

VOLUME OF BUSINESS---------------------------------------------------------------------------------------------------------------------

MUNICIPAL RATE OF TAX------------------------------------------------------------------------------------------------------------------

TAX DUE------------------------------------------------------------------------------------------------------------------------------------------

PENALTY-----------------------------------------------------------------------------------------------------------------------------------------

DISCOUNT---------------------------------------------------------------------------------------------------------------------------------------

CREDIT FOR SIMILAR MUNICIPAL TAXES PAID OUTSIDE PUERTO RICO---------------------------------------------

TOTAL DUE---------------------------------------------------------------------------------------------------------------------------------------

CERTIFICATION

I certify that the business volume here declared has been calculated following the provisions of Act 113 of

July 10, 1974, as amended, known as the Municipal License Tax Act; that the financial attachments are in

accordance with the accounting books; that the copies of pages or schedules of the Puerto Rico Income Tax

return, where the income and operating expenses are reported, are a true and exact copy of those rendered to

the Treasury Department.

Date

Signature of taxpayer or Authorized Agent

OATH

SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE:

AFF. #

SWORN AND SUBSCRIBED BEFORE ME BY

OF LEGAL AGE AND RESIDENT OF

PUERTO RICO PERSONALLY KNOWN TO ME OR WHOM I IDENTIFY

BY RELIABLE ALTERNATE METHOD TODAY

IN THE CITY OF

, PUERTO RICO

NOTARIAL

SEAL

SIGNATURE OF PERSON ADMINISTERING

TITLE

OATH

OFICIAL USE ONLY

DATE:

ENTER BY:

AUDIT BY:

DATE:

REV: FEB, 2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1