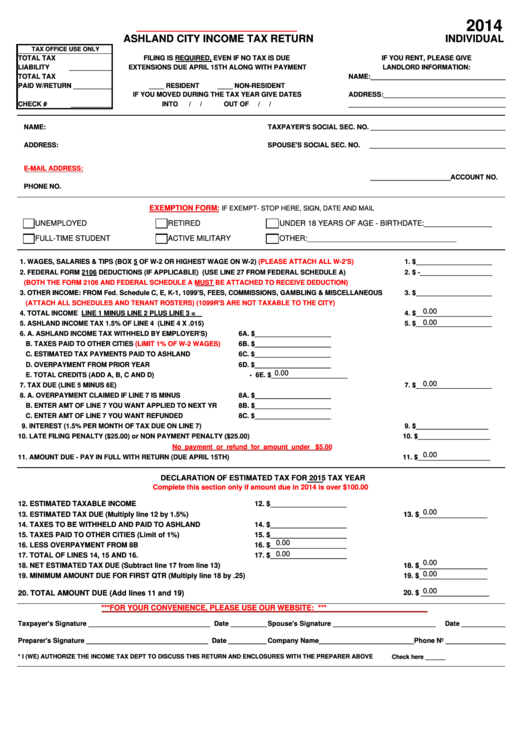

2014

ASHLAND CITY INCOME TAX RETURN

INDIVIDUAL

TAX OFFICE USE ONLY

TOTAL TAX

FILING IS REQUIRED, EVEN IF NO TAX IS DUE

IF YOU RENT, PLEASE GIVE

LIABILITY

____________

EXTENSIONS DUE APRIL 15TH ALONG WITH PAYMENT

LANDLORD INFORMATION:

TOTAL TAX

NAME:_____________________________________

PAID W/RETURN _____________

____ RESIDENT

____ NON-RESIDENT

IF YOU MOVED DURING THE TAX YEAR GIVE DATES

ADDRESS:_________________________________

CHECK #

______________

INTO

/

/

OUT OF

/

/

___________________________________________

___________________________________

NAME:

TAXPAYER'S SOCIAL SEC. NO. _____________________________________

ADDRESS:

SPOUSE'S SOCIAL SEC. NO.

_____________________________________

E-MAIL ADDRESS:

_____________________ACCOUNT NO.

PHONE NO.

EXEMPTION FORM:

IF EXEMPT- STOP HERE, SIGN, DATE AND MAIL

UNEMPLOYED

RETIRED

UNDER 18 YEARS OF AGE - BIRTHDATE:________________

FULL-TIME STUDENT

ACTIVE MILITARY

OTHER:___________________________________

1. WAGES, SALARIES & TIPS (BOX 5 OF W-2 OR HIGHEST WAGE ON W-2)

(PLEASE ATTACH ALL W-2'S)

1. $____________________

2. FEDERAL FORM 2106 DEDUCTIONS (IF APPLICABLE) (USE LINE 27 FROM FEDERAL SCHEDULE A)

2. $ -___________________

(BOTH THE FORM 2106 AND FEDERAL SCHEDULE A MUST BE ATTACHED TO RECEIVE DEDUCTION)

3. OTHER INCOME: FROM Fed. Schedule C, E, K-1, 1099'S, FEES, COMMISSIONS, GAMBLING & MISCELLANEOUS

3. $____________________

(ATTACH ALL SCHEDULES AND TENANT ROSTERS) (1099R'S ARE NOT TAXABLE TO THE CITY)

0.00

4. TOTAL INCOME LINE 1 MINUS LINE 2 PLUS LINE 3 =

4. $____________________

0.00

5. ASHLAND INCOME TAX 1.5% OF LINE 4 (LINE 4 X .015)

5. $____________________

6. A. ASHLAND INCOME TAX WITHHELD BY EMPLOYER'S)

6A. $____________________

B. TAXES PAID TO OTHER CITIES

(Limit 1% of W-2 Wages)

B. TAXES PAID TO OTHER CITIES

(LIMIT 1% OF W-2 WAGES)

6B. $____________________

C. ESTIMATED TAX PAYMENTS PAID TO ASHLAND

C. ESTIMATED TAX PAYMENTS PAID TO ASHLAND

6C. $____________________

D. OVERPAYMENT FROM PRIOR YEAR

D. OVERPAYMENT FROM PRIOR YEAR

6D. $____________________

0.00

E. TOTAL CREDITS (ADD A, B, C AND D)

E. TOTAL CREDITS (ADD A, B, C AND D)

- 6E. $____________________

0.00

7. TAX DUE (LINE 5 MINUS 6E)

7. $____________________

8. A. OVERPAYMENT CLAIMED IF LINE 7 IS MINUS

8A. $____________________

B. ENTER AMT OF LINE 7 YOU WANT APPLIED TO NEXT YR

B. ENTER AMT OF LINE 7 YOU WANT APPLIED TO NEXT YR.

8B. $____________________

C. ENTER AMT OF LINE 7 YOU WANT REFUNDED

C. ENTER AMT OF LINE 7 YOU WANT TO BE REFUNDED

8C. $____________________

9. INTEREST (1.5% PER MONTH OF TAX DUE ON LINE 7)

9. $___________________

10. LATE FILING PENALTY ($25.00) or NON PAYMENT PENALTY ($25.00)

10. $___________________

No payment or refund for amount under $5.00

0.00

11. AMOUNT DUE - PAY IN FULL WITH RETURN (DUE APRIL 15TH)

11. $___________________

DECLARATION OF ESTIMATED TAX FOR 2015 TAX YEAR

Complete this section only if amount due in 2014 is over $100.00

12. ESTIMATED TAXABLE INCOME

12. $___________________

0.00

13. ESTIMATED TAX DUE (Multiply line 12 by 1.5%)

13. $_________________

14. TAXES TO BE WITHHELD AND PAID TO ASHLAND

14. $___________________

15. TAXES PAID TO OTHER CITIES (Limit of 1%)

15. $___________________

0.00

16. LESS OVERPAYMENT FROM 8B

16. $___________________

0.00

17. TOTAL OF LINES 14, 15 AND 16.

17. $___________________

0.00

18. NET ESTIMATED TAX DUE (Subtract line 17 from line 13)

18. $_________________

0.00

19. MINIMUM AMOUNT DUE FOR FIRST QTR (Multiply line 18 by .25)

19. $_________________

0.00

20. TOTAL AMOUNT DUE (Add lines 11 and 19)

20. $ _________________

***FOR YOUR CONVENIENCE, PLEASE USE OUR WEBSITE: ***

Taxpayer's Signature ________________________________ Date __________

Spouse's Signature ___________________________

Date _____________

Preparer's Signature ________________________________ Date __________

Company Name_________________________Phone No _____________________

* I (WE) AUTHORIZE THE INCOME TAX DEPT TO DISCUSS THIS RETURN AND ENCLOSURES WITH THE PREPARER ABOVE

Check here ______

1

1 2

2