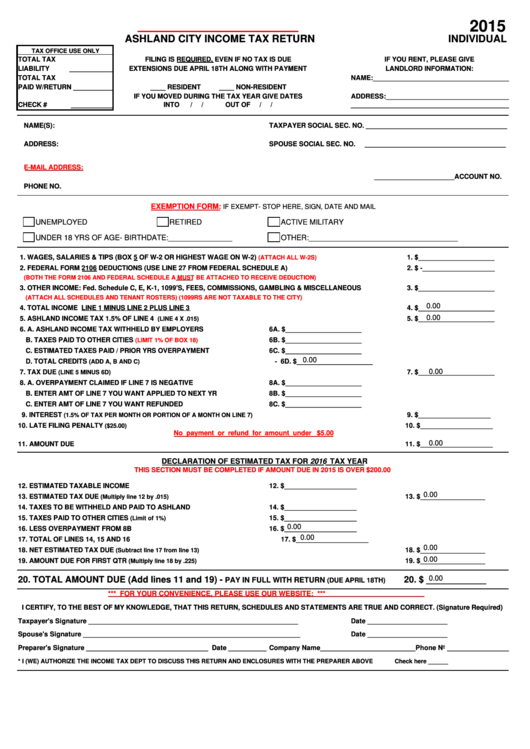

2015

ASHLAND CITY INCOME TAX RETURN

INDIVIDUAL

TAX OFFICE USE ONLY

TOTAL TAX

FILING IS REQUIRED, EVEN IF NO TAX IS DUE

IF YOU RENT, PLEASE GIVE

LIABILITY

____________

EXTENSIONS DUE APRIL 18TH ALONG WITH PAYMENT

LANDLORD INFORMATION:

TOTAL TAX

NAME:_____________________________________

PAID W/RETURN _____________

____ RESIDENT

____ NON-RESIDENT

IF YOU MOVED DURING THE TAX YEAR GIVE DATES

ADDRESS:_________________________________

CHECK #

______________

INTO

/

/

OUT OF

/

/

___________________________________________

___________________________________

NAME(S):

TAXPAYER SOCIAL SEC. NO. _____________________________________

ADDRESS:

SPOUSE SOCIAL SEC. NO.

_____________________________________

E-MAIL ADDRESS:

_____________________ACCOUNT NO.

PHONE NO.

EXEMPTION FORM:

IF EXEMPT- STOP HERE, SIGN, DATE AND MAIL

UNEMPLOYED

RETIRED

ACTIVE MILITARY

UNDER 18 YRS OF AGE- BIRTHDATE:_______________

OTHER:___________________________________

1. WAGES, SALARIES & TIPS (BOX 5 OF W-2 OR HIGHEST WAGE ON W-2)

1. $____________________

(ATTACH ALL W-2S)

2. FEDERAL FORM 2106 DEDUCTIONS (USE LINE 27 FROM FEDERAL SCHEDULE A)

2. $ -___________________

(BOTH THE FORM 2106 AND FEDERAL SCHEDULE A MUST BE ATTACHED TO RECEIVE DEDUCTION)

3. OTHER INCOME: Fed. Schedule C, E, K-1, 1099'S, FEES, COMMISSIONS, GAMBLING & MISCELLANEOUS

3. $____________________

(ATTACH ALL SCHEDULES AND TENANT ROSTERS) (1099RS ARE NOT TAXABLE TO THE CITY)

0.00

4. TOTAL INCOME LINE 1 MINUS LINE 2 PLUS LINE 3

4. $____________________

0.00

5. ASHLAND INCOME TAX 1.5% OF LINE 4

5. $____________________

(LINE 4 X .015)

6. A. ASHLAND INCOME TAX WITHHELD BY EMPLOYERS

6A. $____________________

B. TAXES PAID TO OTHER CITIES

B. TAXES PAID TO OTHER CITIES

(Limit 1% of W-2 Wages)

6B. $____________________

(LIMIT 1% OF BOX 18)

C. ESTIMATED TAXES PAID / PRIOR YRS OVERPAYMENT

C. ESTIMATED TAX PAYMENTS PAID TO ASHLAND

6C. $____________________

0.00

D. TOTAL CREDITS

E. TOTAL CREDITS (ADD A, B, C AND D)

- 6D. $____________________

(ADD A, B AND C)

0.00

7. TAX DUE

7. $____________________

(LINE 5 MINUS 6D)

8. A. OVERPAYMENT CLAIMED IF LINE 7 IS NEGATIVE

8A. $____________________

B. ENTER AMT OF LINE 7 YOU WANT APPLIED TO NEXT YR

B. ENTER AMT OF LINE 7 YOU WANT APPLIED TO NEXT YR.

8B. $____________________

C. ENTER AMT OF LINE 7 YOU WANT REFUNDED

C. ENTER AMT OF LINE 7 YOU WANT TO BE REFUNDED

8C. $____________________

9. INTEREST

9. $___________________

(1.5% OF TAX PER MONTH OR PORTION OF A MONTH ON LINE 7)

10. LATE FILING PENALTY

10. $___________________

($25.00)

No payment or refund for amount under $5.00

0.00

11. AMOUNT DUE

11. $___________________

DECLARATION OF ESTIMATED TAX FOR 2016 TAX YEAR

THIS SECTION MUST BE COMPLETED IF AMOUNT DUE IN 2015 IS OVER $200.00

12. ESTIMATED TAXABLE INCOME

12. $___________________

0.00

13. ESTIMATED TAX DUE

13. $_________________

(Multiply line 12 by .015)

14. TAXES TO BE WITHHELD AND PAID TO ASHLAND

14. $___________________

15. TAXES PAID TO OTHER CITIES

15. $___________________

(Limit of 1%)

0.00

16. LESS OVERPAYMENT FROM 8B

16. $___________________

0.00

17. TOTAL OF LINES 14, 15 AND 16

17. $___________________

0.00

18. NET ESTIMATED TAX DUE

18. $_________________

(Subtract line 17 from line 13)

0.00

19. AMOUNT DUE FOR FIRST QTR

19. $_________________

(Multiply line 18 by .225)

0.00

20. TOTAL AMOUNT DUE (Add lines 11 and 19) -

20. $ ____________

PAY IN FULL WITH RETURN

(DUE APRIL 18TH)

*** FOR YOUR CONVENIENCE, PLEASE USE OUR WEBSITE: ***

I CERTIFY, TO THE BEST OF MY KNOWLEDGE, THAT THIS RETURN, SCHEDULES AND STATEMENTS ARE TRUE AND CORRECT. (Signature Required)

Taxpayer's Signature _______________________________________________________

Date _____________________

Spouse's Signature _________________________________________________________

Date _____________________

Preparer's Signature ________________________________ Date __________

Company Name_________________________Phone No _____________________

* I (WE) AUTHORIZE THE INCOME TAX DEPT TO DISCUSS THIS RETURN AND ENCLOSURES WITH THE PREPARER ABOVE

Check here ______

1

1 2

2