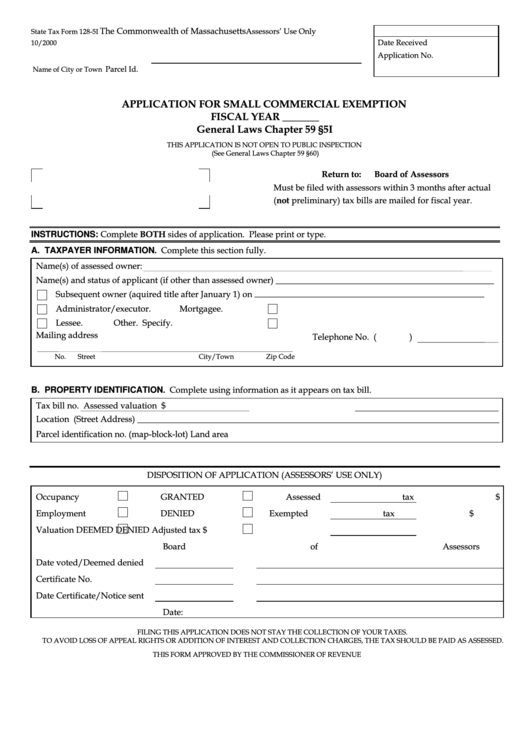

The Commonwealth of Massachusetts

Assessors’ Use Only

State Tax Form 128-5I

Date Received

10/2000

Application No.

Parcel Id.

Name of City or Town

APPLICATION FOR SMALL COMMERCIAL EXEMPTION

FISCAL YEAR _______

General Laws Chapter 59 §5I

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION

(See General Laws Chapter 59 §60)

Return to:

Board of Assessors

Must be filed with assessors within 3 months after actual

(not preliminary) tax bills are mailed for fiscal year.

INSTRUCTIONS: Complete BOTH sides of application. Please print or type.

A. TAXPAYER INFORMATION. Complete this section fully.

Name(s) of assessed owner:

Name(s) and status of applicant (if other than assessed owner) __________________________________________________

Subsequent owner (aquired title after January 1) on

___________________________________________________________

Administrator/executor.

Mortgagee.

Lessee.

Other. Specify.

Mailing address

Telephone No. (

)

No.

Street

City/Town

Zip Code

B. PROPERTY IDENTIFICATION. Complete using information as it appears on tax bill.

Tax bill no.

Assessed valuation $

Location (Street Address) ___________________________________________________________________________________

Parcel identification no. (map-block-lot)

Land area

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Occupancy

GRANTED

Assessed tax

$

Employment

DENIED

Exempted tax $

Valuation

DEEMED DENIED

Adjusted tax

$

Board of Assessors

Date voted/Deemed denied

Certificate No.

Date Certificate/Notice sent

Date:

FILING THIS APPLICATION DOES NOT STAY THE COLLECTION OF YOUR TAXES.

TO AVOID LOSS OF APPEAL RIGHTS OR ADDITION OF INTEREST AND COLLECTION CHARGES, THE TAX SHOULD BE PAID AS ASSESSED.

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

1

1 2

2