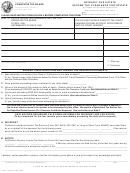

Form Ftb 1015b - Frequently Asked Questions About Your Tax Audit Page 2

ADVERTISEMENT

12. How can I request tax forms?

10. What if I do not agree with the results of the

audit?

To request forms you can do any of the following:

If we issue a Notice of Proposed Assessment

• Visit our Website at:

and you do not agree, you have the right to

• Call us at (800) 338-0505.

protest our action. You must file your written

• Write to:

protest by the date shown on the front of our

notice. We provide specific protest procedures

TAX FORMS REQUEST UNIT

FRANCHISE TAX BOARD

with the notice.

PO BOX 307

If we do not grant your claim for refund, you have

RANCHO CORDOVA CA 95741-0307

the right to appeal our action. You must file your

written appeal with the California State Board of

Equalization within 90 days of the date we

mailed our denial letter. We provide specific

appeal procedures with the denial letter.

For more information regarding your protest and

appeal rights, see the California Taxpayers' Bill

of Rights (FTB 4058).

11. Where can I get additional information?

For general tax assistance or forms and

publications please call (800) 852-5711, or visit

our Website at

For Privacy Notice , see FTB 1131.

Assistance for persons with disabilities: We

comply with the Americans with Disabilities Act.

Persons with hearing or speech impairments,

please call TTY/TDD (800) 822-6268. For all

other assistance, please contact the auditor

listed on the enclosed letter.

Page 2 FTB 1015B (REV 04-2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2