Frequently Asked Questions - Filing Frequency Changes (Instructions)- Kansas Department Of Revenue

ADVERTISEMENT

Frequently Asked Questions

Filing Frequency Changes

Why is my filing frequency being changed?

The Kansas Department of Revenue annually reviews the reporting history of each Kansas business tax

customer to ensure their filing frequency is within statutory guidelines. This filing frequency determination

applies to both sales tax (K.S.A. 79-3607) and withholding tax (K.S.A. 79-3298). A notice of proposed

filing frequency changes is mailed to the affected customers prior to January 1st.

Filing frequency is based on the amount of tax liability incurred during the preceding calendar year. If

there is no previous filing history the filing frequency is based on estimated filing. The department is

authorized to modify the filing schedule for any business when the current schedule is inaccurate.

What are the filing frequency statutory guidelines for sales tax and withholding tax?

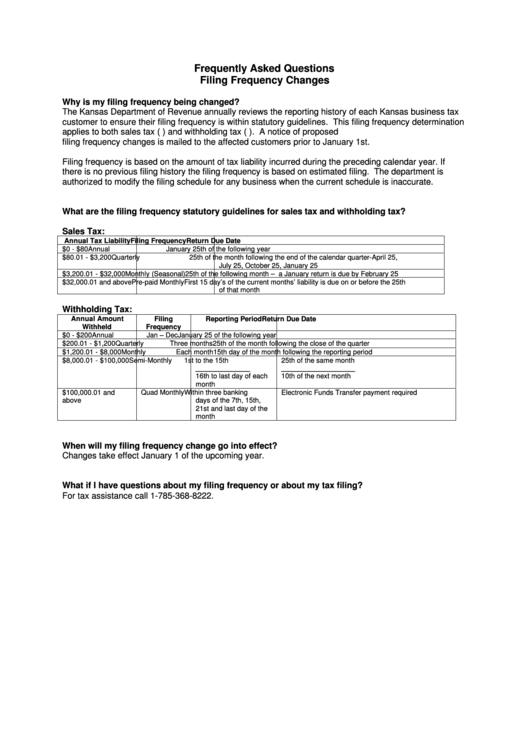

Sales Tax:

Annual Tax Liability

Filing Frequency

Return Due Date

$0 - $80

Annual

January 25th of the following year

$80.01 - $3,200

Quarterly

25th of the month following the end of the calendar quarter-April 25,

July 25, October 25, January 25

$3,200.01 - $32,000

Monthly (Seasonal)

25th of the following month – a January return is due by February 25

$32,000.01 and above

Pre-paid Monthly

First 15 day’s of the current months’ liability is due on or before the 25th

of that month

Withholding Tax:

Annual Amount

Filing

Reporting Period

Return Due Date

Withheld

Frequency

$0 - $200

Annual

Jan – Dec

January 25 of the following year

$200.01 - $1,200

Quarterly

Three months

25th of the month following the close of the quarter

$1,200.01 - $8,000

Monthly

Each month

15th day of the month following the reporting period

$8,000.01 - $100,000

Semi-Monthly

1st to the 15th

25th of the same month

______________

___________________

16th to last day of each

10th of the next month

month

$100,000.01 and

Quad Monthly

Within three banking

Electronic Funds Transfer payment required

above

days of the 7th, 15th,

21st and last day of the

month

When will my filing frequency change go into effect?

Changes take effect January 1 of the upcoming year.

What if I have questions about my filing frequency or about my tax filing?

For tax assistance call 1-785-368-8222.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1