Instructions For Schedule Cr - Other Credits - 2009

ADVERTISEMENT

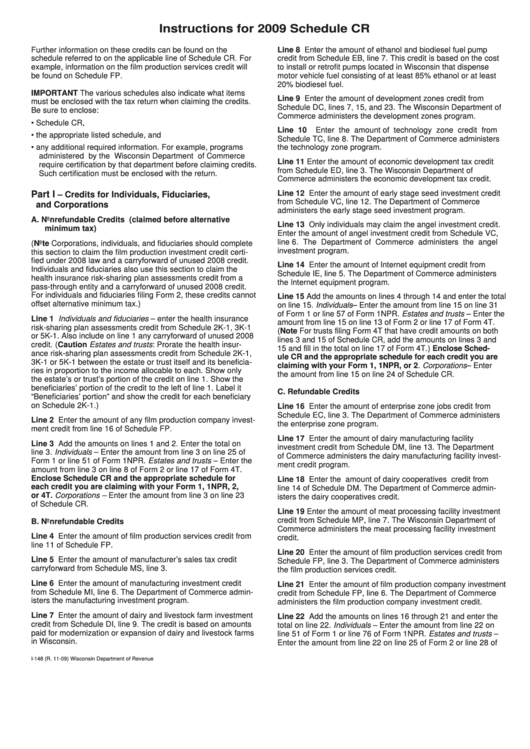

Instructions for 2009 Schedule CR

Further information on these credits can be found on the

Line 8 Enter the amount of ethanol and biodiesel fuel pump

schedule referred to on the applicable line of Schedule CR. For

credit from Schedule EB, line 7. This credit is based on the cost

example, information on the film production services credit will

to install or retrofit pumps located in Wisconsin that dispense

be found on Schedule FP.

motor vehicle fuel consisting of at least 85% ethanol or at least

20% biodiesel fuel.

IMPORTANT The various schedules also indicate what items

Line 9 Enter the amount of development zones credit from

must be enclosed with the tax return when claiming the credits.

Schedule DC, lines 7, 15, and 23. The Wisconsin Department of

Be sure to enclose:

Commerce administers the development zones program.

• Schedule CR,

Line 10

Enter the amount of technology zone credit from

• the appropriate listed schedule, and

Schedule TC, line 8. The Department of Commerce administers

• any additional required information. For example, programs

the technology zone program.

administered by the Wisconsin Department of Commerce

Line 11 Enter the amount of economic development tax credit

require certification by that department before claiming credits.

from Schedule ED, line 3. The Wisconsin Department of

Such certification must be enclosed with the return.

Commerce administers the economic development tax credit.

Line 12 Enter the amount of early stage seed investment credit

Part I

– Credits for Individuals, Fiduciaries,

from Schedule VC, line 12. The Department of Commerce

and Corporations

administers the early stage seed investment program.

A. Nonrefundable Credits (claimed before alternative

Line 13 Only individuals may claim the angel investment credit.

minimum tax)

Enter the amount of angel investment credit from Schedule VC,

line 6. The Department of Commerce administers the angel

(Note Corporations, individuals, and fiduciaries should complete

investment program.

this section to claim the film production investment credit certi-

fied under 2008 law and a carryforward of unused 2008 credit.

Line 14 Enter the amount of Internet equipment credit from

Individuals and fiduciaries also use this section to claim the

Schedule IE, line 5. The Department of Commerce administers

health insurance risk-sharing plan assessments credit from a

the Internet equipment program.

pass-through entity and a carryforward of unused 2008 credit.

For individuals and fiduciaries filing Form 2, these credits cannot

Line 15 Add the amounts on lines 4 through 14 and enter the total

offset alternative minimum tax.)

on line 15. Individuals – Enter the amount from line 15 on line 31

of Form 1 or line 57 of Form 1NPR. Estates and trusts – Enter the

Line 1 Individuals and fiduciaries – enter the health insurance

amount from line 15 on line 13 of Form 2 or line 17 of Form 4T.

risk-sharing plan assessments credit from Schedule 2K-1, 3K-1

(Note For trusts filing Form 4T that have credit amounts on both

or 5K-1. Also include on line 1 any carryforward of unused 2008

lines 3 and 15 of Schedule CR, add the amounts on lines 3 and

credit. (Caution Estates and trusts: Prorate the health insur-

15 and fill in the total on line 17 of Form 4T.) Enclose Sched-

ance risk-sharing plan assessments credit from Schedule 2K-1,

ule CR and the appropriate schedule for each credit you are

3K-1 or 5K-1 between the estate or trust itself and its beneficia-

claiming with your Form 1, 1NPR, or 2. Corporations – Enter

ries in proportion to the income allocable to each. Show only

the amount from line 15 on line 24 of Schedule CR.

the estate’s or trust’s portion of the credit on line 1. Show the

beneficiaries’ portion of the credit to the left of line 1. Label it

C. Refundable Credits

“Beneficiaries’ portion” and show the credit for each beneficiary

on Schedule 2K-1.)

Line 16 Enter the amount of enterprise zone jobs credit from

Schedule EC, line 3. The Department of Commerce administers

Line 2 Enter the amount of any film production company invest-

the enterprise zone program.

ment credit from line 16 of Schedule FP.

Line 17

Enter the amount of dairy manufacturing facility

Line 3 Add the amounts on lines 1 and 2. Enter the total on

investment credit from Schedule DM, line 13. The Department

line 3. Individuals – Enter the amount from line 3 on line 25 of

of Commerce administers the dairy manufacturing facility invest-

Form 1 or line 51 of Form 1NPR. Estates and trusts – Enter the

ment credit program.

amount from line 3 on line 8 of Form 2 or line 17 of Form 4T.

Enclose Schedule CR and the appropriate schedule for

Line 18 Enter the amount of dairy cooperatives credit from

each credit you are claiming with your Form 1, 1NPR, 2,

line 14 of Schedule DM. The Department of Commerce admin-

or 4T. Corporations – Enter the amount from line 3 on line 23

isters the dairy cooperatives credit.

of Schedule CR.

Line 19 Enter the amount of meat processing facility investment

credit from Schedule MP, line 7. The Wisconsin Department of

B. Nonrefundable Credits

Commerce administers the meat processing facility investment

Line 4 Enter the amount of film production services credit from

credit.

line 11 of Schedule FP.

Line 20 Enter the amount of film production services credit from

Line 5 Enter the amount of manufacturer’s sales tax credit

Schedule FP, line 3. The Department of Commerce administers

carryforward from Schedule MS, line 3.

the film production services credit.

Line 6 Enter the amount of manufacturing investment credit

Line 21 Enter the amount of film production company investment

from Schedule MI, line 6. The Department of Commerce admin-

credit from Schedule FP, line 6. The Department of Commerce

isters the manufacturing investment program.

administers the film production company investment credit.

Line 7 Enter the amount of dairy and livestock farm investment

Line 22 Add the amounts on lines 16 through 21 and enter the

credit from Schedule DI, line 9. The credit is based on amounts

total on line 22. Individuals – Enter the amount from line 22 on

paid for modernization or expansion of dairy and livestock farms

line 51 of Form 1 or line 76 of Form 1NPR. Estates and trusts –

in Wisconsin.

Enter the amount from line 22 on line 25 of Form 2 or line 28 of

I-148 (R. 11-09)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2