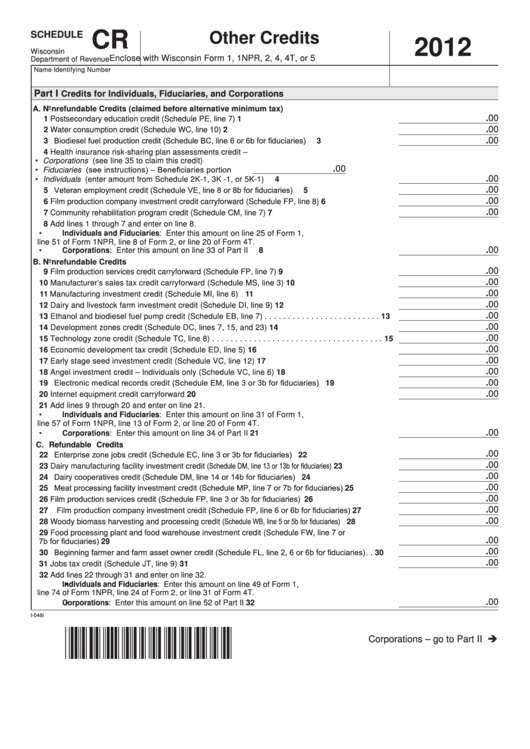

CR

SCHEDULE

Other Credits

2012

Wisconsin

Enclose with Wisconsin Form 1, 1NPR, 2, 4, 4T, or 5

Department of Revenue

Name

Identifying Number

Part I

Credits for Individuals, Fiduciaries, and Corporations

A. Nonrefundable Credits (claimed before alternative minimum tax)

.00

1 Postsecondary education credit (Schedule PE, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

.00

2 Water consumption credit (Schedule WC, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Biodiesel fuel production credit (Schedule BC, line 6 or 6b for fiduciaries) . . . . . . . . . . . . . . . . .

.00

3

4 Health insurance risk-sharing plan assessments credit –

• Corporations (see line 35 to claim this credit)

• Fiduciaries (see instructions) – Beneficiaries portion

.00

• Individuals (enter amount from Schedule 2K-1, 3K -1, or 5K-1) . . . . . . . . . . . . . . . . . . . . .

.00

4

5 Veteran employment credit (Schedule VE, line 8 or 8b for fiduciaries) . . . . . . . . . . . . . . . . . . . .

.00

5

.00

6 Film production company investment credit carryforward (Schedule FP, line 8) . . . . . . . . . . . . .

6

.00

7 Community rehabilitation program credit (Schedule CM, line 7) . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Add lines 1 through 7 and enter on line 8 .

• Individuals and Fiduciaries: Enter this amount on line 25 of Form 1,

line 51 of Form 1NPR, line 8 of Form 2, or line 20 of Form 4T .

• Corporations: Enter this amount on line 33 of Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

8

B. Nonrefundable Credits

.00

9 Film production services credit carryforward (Schedule FP, line 7) . . . . . . . . . . . . . . . . . . . . .

9

.00

10 Manufacturer’s sales tax credit carryforward (Schedule MS, line 3) . . . . . . . . . . . . . . . . . . . . 10

.00

11 Manufacturing investment credit (Schedule MI, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

12 Dairy and livestock farm investment credit (Schedule DI, line 9) . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Ethanol and biodiesel fuel pump credit (Schedule EB, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . 13

.00

14 Development zones credit (Schedule DC, lines 7, 15, and 23) . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

15 Technology zone credit (Schedule TC, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Economic development tax credit (Schedule ED, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.00

17 Early stage seed investment credit (Schedule VC, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . 17

.00

18 Angel investment credit – Individuals only (Schedule VC, line 6) . . . . . . . . . . . . . . . . . . . . . . 18

19 Electronic medical records credit (Schedule EM, line 3 or 3b for fiduciaries) . . . . . . . . . . . . . 19

.00

.00

20 Internet equipment credit carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Add lines 9 through 20 and enter on line 21 .

• Individuals and Fiduciaries: Enter this amount on line 31 of Form 1,

line 57 of Form 1NPR, line 13 of Form 2, or line 20 of Form 4T .

• Corporations: Enter this amount on line 34 of Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

.00

C. Refundable Credits

22 Enterprise zone jobs credit (Schedule EC, line 3 or 3b for fiduciaries) . . . . . . . . . . . . . . . . . . . . 22

.00

23 Dairy manufacturing facility investment credit (Schedule DM, line 13 or 13b for fiduciaries) . . . . . . . . . . 23

.00

24 Dairy cooperatives credit (Schedule DM, line 14 or 14b for fiduciaries) . . . . . . . . . . . . . . . . . . . 24

.00

25 Meat processing facility investment credit (Schedule MP, line 7 or 7b for fiduciaries) . . . . . . . . . 25

.00

26 Film production services credit (Schedule FP, line 3 or 3b for fiduciaries) . . . . . . . . . . . . . . . . . 26

.00

27 Film production company investment credit (Schedule FP, line 6 or 6b for fiduciaries) . . . . . . . . 27

.00

28 Woody biomass harvesting and processing credit (Schedule WB, line 5 or 5b for fiduciaries) . . . . . . . . 28

.00

29 Food processing plant and food warehouse investment credit (Schedule FW, line 7 or

7b for fiduciaries) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

.00

30 Beginning farmer and farm asset owner credit (Schedule FL, line 2, 6 or 6b for fiduciaries) . . 30

.00

.00

31 Jobs tax credit (Schedule JT, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Add lines 22 through 31 and enter on line 32 .

• Individuals and Fiduciaries: Enter this amount on line 49 of Form 1,

line 74 of Form 1NPR, line 24 of Form 2, or line 31 of Form 4T .

• Corporations: Enter this amount on line 52 of Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

.00

I-048i

Corporations – go to Part II

1

1 2

2