Instructions For Form Nyc-3a - Combined General Corporation Tax Return - 2000 Page 2

ADVERTISEMENT

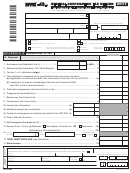

Instructions for Form NYC-3A - 2000

Page 2

possessions tax credit) with respect to a particular

LINE 9 - UBT PAID CREDIT

all of the corporations included in the combined

Enter on line 9 the credit against the General Cor-

federal tax year is not required or permitted to be

report were treated as a single corporation. If the

poration Tax for unincorporated business tax paid

included in a combined report with respect to the

corporation included in a combined report properly

by partnerships from which any corporation includ-

same taxable year (or part thereof).

makes an election to use a double-weighted

ed in this return receives a distributive share or

receipts factor, each of the other corporations in

No taxpayer may file a report on a combined basis

guaranteed payment that is included in calculating

the combined group will be treated as having made

covering any other corporation where the taxpayer

General Corporation Tax liability on either the

a proper election to use a double-weighted receipts

or the other corporation allocates in accordance

entire net income or income plus compensation

factor. If each member of a combined report is

with the special allocation provisions applicable to

base. Attach Form(s) NYC-9.7 (UBT Paid Credit).

treated as having elected to use a double-weighted

aviation corporations or corporations principally

receipts factor, enter on line 7 the amount from line

engaged in the operation of vessels and the taxpay-

LINES 14a, 14b & 16

6. If you make an election, add the percentages in

er or other corporation does not allocate using the

column C and divide the sum by 4 and enter the

Prepayment Credits / Other Credits

special allocation provisions.

result on line 12. If one or more of the other factors

is missing, add the remaining percentage(s) and

LINE 14a

OTHER FORMS AND

divide by the number of percentages so added. If

Attach copy of Form(s) NYC-9.5 and/or NYC-9.6

MINIMUM TAX

you do not wish to make the election, do not enter

(Claim for Credit Applied to General Corporation

Every corporation included in this combined return

an amount on line 7.

Tax).

is required to file a separate return on Form NYC-

3L. Schedules B through H on the separate returns

SCHEDULE K - LINE 3

LINE 14b

(Form NYC-3L) must be completed and the appro-

Enter in Column C, page 3, the amount from line 1

Attach Form(s) NYC-ECS (Energy Cost Savings

priate information transferred to Schedules I

divided by the amount from line 2, rounded to the

Credit). If the total available credit from the

through M on Form NYC-3A to compute the com-

nearest one hundredth of a percentage point.

form(s) exceeds the total tax shown on line 13

bined tax. If any member of the combined group

reduced by the 25% first installment entered on line

has elected to use optional depreciation, it must

SCHEDULE M

11a or 11b and the credits taken on line 14a, enter

complete and attach a Form NYC-324 to its Form

Summary

only that portion of the allowable credit that

The amount of unused optional depreciation that

NYC-3L.

reduces the balance to zero. Any excess credit

may be carried over is determined by limiting the

must be carried forward to future years.

Payment must include the combined tax plus the

combined taxable New York City income to zero.

minimum tax of $300 for each corporation included

LINE 16

in the combined report with the exception of any

SCHEDULE M - LINE 12

Enter the sum of all estimated payments made for

corporation not otherwise subject to the tax. The

this tax period, the payment made with the exten-

Enter on line 12 and on Schedule A, line 24, the

remittance must be payable in U.S. dollars drawn

sion request, if any, and both the carryover credit

amount from line 10 plus the amount from line 11

on a U.S. bank. Checks drawn on foreign banks

and the first installment recorded on the prior tax

will be rejected and returned.

divided by the amount from Schedule I, line 6, Col-

period’s return.

umn C, rounded to the nearest one hundredth of a

Each General Corporation Tax Return (NYC-3L)

percentage point.

attached to this return must be signed by a duly

LINE 23

authorized officer of the corporation.

If the amount on line 21 is not greater than zero,

COMBINED GROUP

enter on line 23 the sum of line 17 and the amount

INFORMATION SCHEDULE

by which line 20 exceeds the amount on line 18, if

BUSINESS AND INVESTMENT

All of the information required on this Schedule

any.

ALLOCATIONS

must be submitted for this return to be considered

Corporations that allocate must complete Sched-

complete. Failure to provide any information

ules D and H of Form NYC-3L.

SCHEDULE J

requested will result in correspondence and may

Business allocation from Form NYC-3L

result in the filing on a combined basis by this

group of corporations being revised or disallowed.

The amount entered on line 12, column C, should

SP E C I F I C IN S T R U C T I O N S

be rounded to the nearest one hundredth of a per-

AF F I L I A T I O N S SC H E D U L E

centage point.

SCHEDULE A

For taxable years beginning after 6/30/96, a manu-

Computation of Tax

List names of all affiliated corporations, including

facturing business may elect to use a double-

those not included in this combined report, their

weighted receipts factor. An election must be

federal Employer Identification Number, if any, and

LINE A - PAYMENT

After completing this form, enter the amount of

made on a timely filed original return. For purpos-

principal business activity. In addition, list the enti-

your payment. Your payment should be the full

es of this election, a corporation is engaged in a

ty that directly owns the corporation, the Employee

amount as shown on line 23.

manufacturing business if it is primarily engaged in

Identification Number and the number of shares of

the manufacturing and sale of tangible personal

voting capital stock owned and outstanding at the

property. Manufacturing includes assembly, work-

beginning of the year. An affiliated corporation for

LINE 2 - ALLOCATED CAPITAL

The tax based on allocated combined capital is lim-

ing raw materials into wares, and giving new

purposes of completing the schedule is a corpora-

ited to $350,000. Multiply the amount from Sched-

shapes, qualities or combinations to matter that has

tion that satisfies the stock ownership or control

ule M, line 10 by the applicable percentage, but do

already gone through some artificial process,

requirements set forth in Section A, “Stock Owner-

not enter more than $350,000 in the right-hand col-

through the use of machinery, tools, appliances or

ship or Control,” on page 1 of these instructions,

umn on line 2, Schedule A.

other similar equipment. A corporation is primarily

without regard to any limitation that may otherwise

engaged in manufacturing if more than 50% of its

exclude the corporation from the combined report.

gross receipts for the year are attributable to manu-

LINE 7 - MINIMUM TAX

Each corporation included in the combined return,

facturing. If a corporation that is otherwise eligible

You may attach a completed federal Form 851 for

other than the corporation paying the combined tax

to elect to use a double-weighted receipts factor is

any domestic corporations that would otherwise be

and any corporation included in the combined

permitted or required to file on a combined basis

included on the Affiliations Schedule.

return that would not be subject to the General Cor-

with one or more corporations, the corporation may

poration Tax if filing on a separate company basis,

elect to use a double-weighted receipts factor only

is required to pay the $300 minimum tax.

if the requirements for the election would be met if

NYC-3A INSTR. 2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3