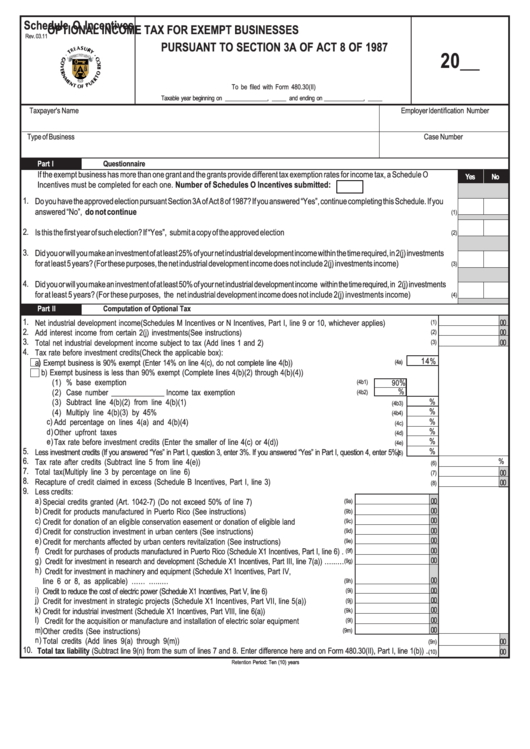

Schedule O Incentives - Optional Income Tax Form For Exempt Businesses Pursuant To Section 3a Of Act 8 Of 1987 - 2011

ADVERTISEMENT

Schedule O Incentives

OPTIONAL INCOME TAX FOR EXEMPT BUSINESSES

Rev. 03.11

PURSUANT TO SECTION 3A OF ACT 8 OF 1987

20__

To be filed with Form 480.30(II)

Taxable year beginning on _______________, _____ and ending on ______________, _____

Taxpayer's Name

Employer Identification Number

Type of Business

Case Number

Part I

Questionnaire

If the exempt business has more than one grant and the grants provide different tax exemption rates for income tax, a Schedule O

Yes

No

Incentives must be completed for each one . Number of Schedules O Incentives submitted:

1.

Do you have the approved election pursuant Section 3A of Act 8 of 1987? If you answered “Yes”, continue completing this Schedule. If you

answered “No”, do not continue ............................................................................................................................................................

(1)

2.

Is this the first year of such election? If “Yes”, submit a copy of the approved election .................................................................................

(2)

3.

Did you or will you make an investment of at least 25% of your net industrial development income within the time required, in 2(j) investments

for at least 5 years? (For these purposes, the net industrial development income does not include 2(j) investments income) .....................

(3)

4.

Did you or will you make an investment of at least 50% of your net industrial development income within the time required, in 2(j) investments

for at least 5 years? (For these purposes, the net industrial development income does not include 2(j) investments income) ................

(4)

Part II

Computation of Optional Tax

1.

Net industrial development income (Schedules M Incentives or N Incentives, Part I, line 9 or 10, whichever applies) .....................

00

(1)

2.

Add interest income from certain 2(j) investments (See instructions) .................................................................................................

00

(2)

3.

Total net industrial development income subject to tax (Add lines 1 and 2) .......................................................................................

00

(3)

4.

Tax rate before investment credits (Check the applicable box):

14

%

a) Exempt business is 90% exempt (Enter 14% on line 4(c), do not complete line 4(b)) ....................................................

(4a)

b) Exempt business is less than 90% exempt (Complete lines 4(b)(2) through 4(b)(4))

(1)

% base exemption ....................................................................................................................

90

%

(4b1)

%

(2)

Case number ______________ Income tax exemption ...........................................................

(4b2)

%

(3)

Subtract line 4(b)(2) from line 4(b)(1) ...........................................................................................................

(4b3)

%

(4)

Multiply line 4(b)(3) by 45% .........................................................................................................................

(4b4)

%

c)

Add percentage on lines 4(a) and 4(b)(4) ..........................................................................................................

(4c)

%

d)

Other upfront taxes .............................................................................................................................................

(4d)

%

e)

Tax rate before investment credits (Enter the smaller of line 4(c) or 4(d)) ...........................................................

(4e)

5.

%

Less investment credits (If you answered “Yes” in Part I, question 3, enter 3%. If you answered “Yes” in Part I, question 4, enter 5%)

(5)

6.

%

Tax rate after credits (Subtract line 5 from line 4(e)) .........................................................................................................................

(6)

7.

Total tax (Multiply line 3 by percentage on line 6) ............................................................................................................................

00

(7)

8.

Recapture of credit claimed in excess (Schedule B Incentives, Part I, line 3) ...................................................................................

00

(8)

9.

Less credits:

a)

00

Special credits granted (Art. 1042-7) (Do not exceed 50% of line 7) ..............................................

(9a)

b)

00

Credit for products manufactured in Puerto Rico (See instructions) .................................................

(9b)

c)

00

Credit for donation of an eligible conservation easement or donation of eligible land .......................

(9c)

d)

00

Credit for construction investment in urban centers (See instructions) .............................................

(9d)

e)

00

Credit for merchants affected by urban centers revitalization (See instructions) ...............................

(9e)

f)

00

Credit for purchases of products manufactured in Puerto Rico (Schedule X1 Incentives, Part I, line 6) .

(9f)

g)

00

Credit for investment in research and development (Schedule X1 Incentives, Part III, line 7(a)) …...…

(9g)

h)

Credit for investment in machinery and equipment (Schedule X1 Incentives, Part IV,

00

line 6 or 8, as applicable) ……..........................................................................................…...…

(9h)

i)

00

Credit to reduce the cost of electric power (Schedule X1 Incentives, Part V, line 6) ..............................................

(9i)

j)

00

Credit for investment in strategic projects (Schedule X1 Incentives, Part VII, line 5(a)) .................

(9j)

k)

00

Credit for industrial investment (Schedule X1 Incentives, Part VIII, line 6(a)) .........................................

(9k)

l)

00

Credit for the acquisition or manufacture and installation of electric solar equipment ..........................

(9l)

m)

00

Other credits (See instructions) ......................................................................................................

(9m)

n)

Total credits (Add lines 9(a) through 9(m)) .................................................................................................................................

00

(9n)

10.

Total tax liability (Subtract line 9(n) from the sum of lines 7 and 8. Enter difference here and on Form 480.30(II), Part I, line 1(b)) ..

00

(10)

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1