Form K-Cns 011 - Status Report - Kansas Department Of Labor Page 2

ADVERTISEMENT

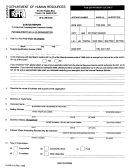

11. Identification of Officers

SOCIAL SECURITY

DATE OF

NUMBER

LAST NAME

FIRST NAME

MIDDLE INITIAL

TITLE

BIRTH

RESIDENCE ADDRESS

12. Record by Week the Number of Persons Performing Services IN KANSAS for Current and Preceding Calendar Year.

Year

January

February

March

April

May

June

Year

July

August

September

October

November

December

13. a. Did you acquire ALL or PART of an existing business?

Yes

No

b. If YES, the date acquired. MM-DD-YYYY __ __ - __ __ - __ __ __ __

All

Part

c. Has the previous owner continued in business in KANSAS?

Yes

No

d. Do you want the previous owner's experience rating factors?

Yes

No

e. Name of previous owner: _ ______________________________

f. Previous account number:____________________________

g. Previous trade name: _________________________________

h. Previous owner's current phone number:__________________

AREA CODE

TELEPHONE

I. Previous owner's current address:______________________________________________________________________________

STREET

CITY

STATE

ZIP

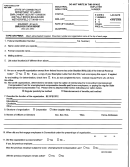

K.S.A. 44-710a(b)(2) allows a successor defined in K.S.A. 44-703(h)(4) and K.S.A. 44-703 (dd), the choice to acquire the experience ratings

factors of the predecessor employer. The request for transfer must be made in writing within 120 days of the acquisition. The experience rating

factors are all of the unemployment taxes paid, annual payrolls and benefit charges of the predecessor employer. These factors are used to

compute your unemployment tax rate for subsequent years. Alternately, successor employers may elect to be assigned their industry tax rate.

14. If no liability is indicated, do you want to elect to extend unemployment insurance coverage to your employees?

Yes

No

Beginning January 1 of the current year or at the commencement of employment and continuing for not less than two calendar years,

on behalf of the employing unit, I voluntarily elect to:

Become an employer described in K.S.A. 44-703 (h), the same as other employers since no mandatory coverage is indicated.

Extend coverage to all workers performing services that are excluded from coverage by the employment security law.

15. Select a Financing Option.

If you are subject to the employment security law by having four or more employees in 20 weeks as indicated in line 12, or by voluntarily

electing coverage in line 14, you have two options of financing the payment of unemployment taxes.

REIMBURSING: Reimbursing employers are

CONTRIBUTING: For up to four years, your contribution rate will be the

industry rate assigned to new employers. After this initial coverage period,

required to reimburse the fund for any benefit

you will become eligible for a computed rate based on your own experience

charges. They are assigned a tax rate of zero.

of contributions paid, annual payrolls and benefit charges. If, in line 13, you

Reimbursing employers must file quarterly wage

reports. This option is for a minimum period of

elected to acquire your successor employer's experience rating factors, you

four calendar years.

will receive the previous employer's tax rate.

16. Would you like a field representative to contact you and provide a more complete explanation of the financing options applicable to a

501 (c) (3) organization prior to establishment of your account?

Yes

No

17. I hereby certify that this organization has made its election as set forth above,

and that I am authorized to sign this form on the organization's behalf.

Return the completed Status Report to:

Signature_________________________________________________________

Liability Determinations

Title_____________________________________________________________

Kansas Department of Labor

401 S.W. Topeka Boulevard

Topeka, KS 66603-3182

Date____________________ Telephone______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2