Instructions For 2005 Municipal Ir Ez Form

ADVERTISEMENT

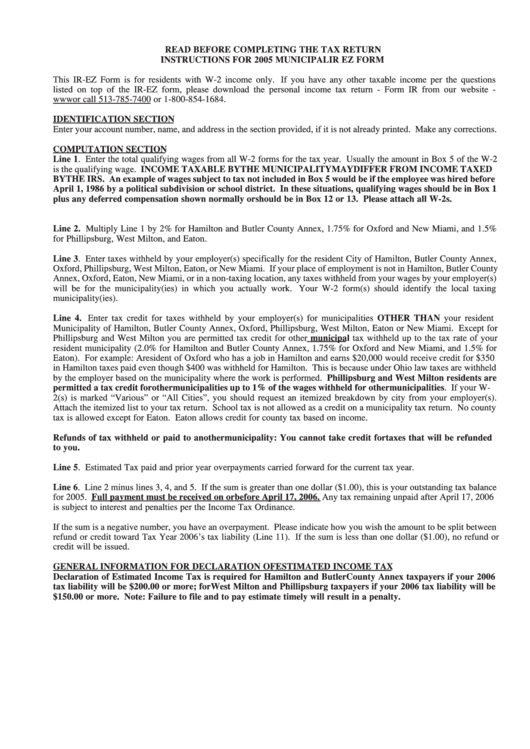

READ BEFORE COMPLETING THE TAX RETURN

INSTRUCTIONS FOR 2005 MUNICIPAL IR EZ FORM

This IR-EZ Form is for residents with W-2 income only. If you have any other taxable income per the questions

listed on top of the IR-EZ form, please download the personal income tax return - Form IR from our website -

or call 513-785-7400 or 1-800-854-1684.

IDENTIFICATION SECTION

Enter your account number, name, and address in the section provided, if it is not already printed. Make any corrections.

COMPUTATION SECTION

Line 1. Enter the total qualifying wages from all W-2 forms for the tax year. Usually the amount in Box 5 of the W-2

is the qualifying wage. INCOME TAXABLE BY THE MUNICIPALITY MAY DIFFER FROM INCOME TAXED

BY THE IRS. An example of wages subject to tax not included in Box 5 would be if the employee was hired before

April 1, 1986 by a political subdivision or school district. In these situations, qualifying wages should be in Box 1

plus any deferred compensation shown normally or should be in Box 12 or 13. Please attach all W-2s.

Line 2. Multiply Line 1 by 2% for Hamilton and Butler County Annex, 1.75% for Oxford and New Miami, and 1.5%

for Phillipsburg, West Milton, and Eaton.

Line 3. Enter taxes withheld by your employer(s) specifically for the resident City of Hamilton, Butler County Annex,

Oxford, Phillipsburg, West Milton, Eaton, or New Miami. If your place of employment is not in Hamilton, Butler County

Annex, Oxford, Eaton, New Miami, or in a non-taxing location, any taxes withheld from your wages by your employer(s)

will be for the municipality(ies) in which you actually work. Your W-2 form(s) should identify the local taxing

municipality(ies).

Line 4. Enter tax credit for taxes withheld by your employer(s) for municipalities OTHER THAN your resident

Municipality of Hamilton, Butler County Annex, Oxford, Phillipsburg, West Milton, Eaton or New Miami. Except for

Phillipsburg and West Milton you are permitted tax credit for other municipal tax withheld up to the tax rate of your

resident municipality (2.0% for Hamilton and Butler County Annex, 1.75% for Oxford and New Miami, and 1.5% for

Eaton). For example: A resident of Oxford who has a job in Hamilton and earns $20,000 would receive credit for $350

in Hamilton taxes paid even though $400 was withheld for Hamilton. This is because under Ohio law taxes are withheld

by the employer based on the municipality where the work is performed. Phillipsburg and West Milton residents are

permitted a tax credit for other municipalities up to 1% of the wages withheld for other municipalities. If your W-

2(s) is marked “Various” or “All Cities”, you should request an itemized breakdown by city from your employer(s).

Attach the itemized list to your tax return. School tax is not allowed as a credit on a municipality tax return. No county

tax is allowed except for Eaton. Eaton allows credit for county tax based on income.

Refunds of tax withheld or paid to another municipality: You cannot take credit for taxes that will be refunded

to you.

Line 5. Estimated Tax paid and prior year overpayments carried forward for the current tax year.

Line 6. Line 2 minus lines 3, 4, and 5. If the sum is greater than one dollar ($1.00), this is your outstanding tax balance

for 2005. Full payment must be received on or before April 17, 2006. Any tax remaining unpaid after April 17, 2006

is subject to interest and penalties per the Income Tax Ordinance.

If the sum is a negative number, you have an overpayment. Please indicate how you wish the amount to be split between

refund or credit toward Tax Year 2006’s tax liability (Line 11). If the sum is less than one dollar ($1.00), no refund or

credit will be issued.

GENERAL INFORMATION FOR DECLARATION OF ESTIMATED INCOME TAX

Declaration of Estimated Income Tax is required for Hamilton and Butler County Annex taxpayers if your 2006

tax liability will be $200.00 or more; for West Milton and Phillipsburg taxpayers if your 2006 tax liability will be

$150.00 or more. Note: Failure to file and to pay estimate timely will result in a penalty.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2